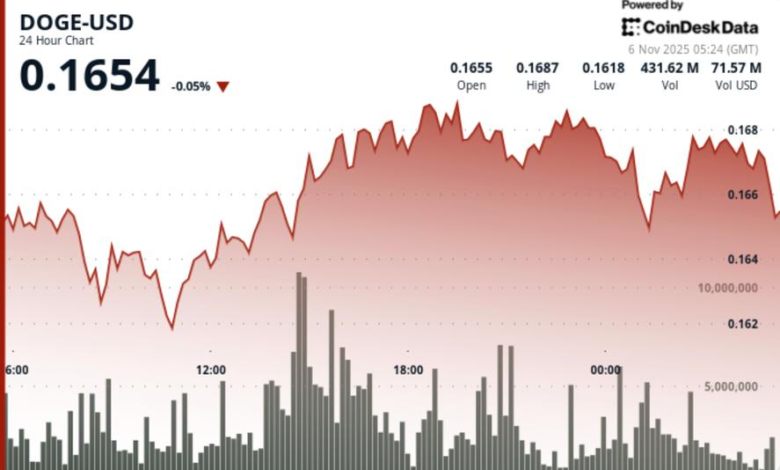

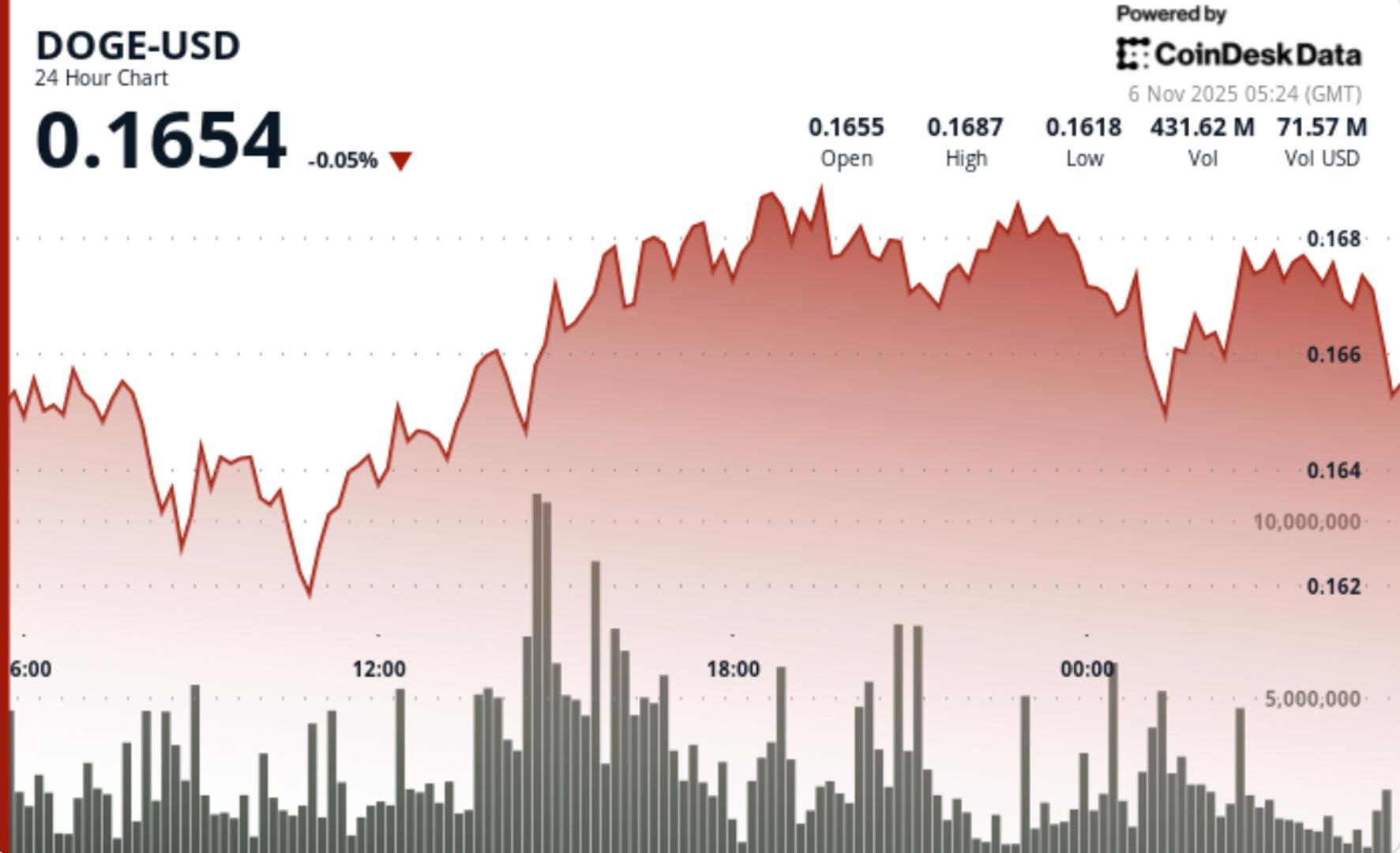

$0.16 support holds as profit-taking breakout

Dogecoin gave up 0.5% lower at $0.1657 in Wednesday’s session as institutional flows hovered near resistance following a 104% volume spike above daily averages. The token defended the ascending channel structure despite the distribution pressure on the upper border, maintaining the short-term neutral-to-bullish bias above $0.16.

News background

- Institutional positioning continues to define Doge’s intraday structure. Large-cap holders accumulated near $0.1620 early in the week, then trimmed exposure as bids thin near $0.1670.

- Tuesday’s breakout attempt at 774m volume marked the session’s pivot—proving that smart money participation, not retail noise, drove the move.

- Broader sentiment across the meme-coin complex remained muted, though derivative open interest in doge futures rose modestly on binance and bybit, indicating speculative hedging rather than straight risk-taking.

- Analysts said the pair’s firmness above $0.16 reflected disciplined earnings rotation rather than trend fatigue.

Summary of Price Action

• DOGE advanced from $0.1646 to $0.1665 before a mild pullback to $0.1657

• Support held at $0.1617–$0.1620 across four consecutive hourly tests

• Volume concentrated at $ 0.1665 highs (8.9m during 02:10–02:11) showing institutional distribution

• The channel structure remains constructive with higher lows, suggesting the potential for renewed breakout attempts above $0.16.

Technical Analysis

• Trend: Sideways-to-bullish within an ascending channel

• Support: $ 0.1620 Main; $ 0.1617 second buffer

• Resistance: $0.1665–$0.1670 zone that has been rejected repeatedly on high volume

• Volume: 774M Turnover (+104% vs. SMA) Institutional participation confirmed

• Structure: Channel intact, volatility 4.2% – phase of compression before the next direction of movement.

What traders are watching

• Ability of bulls to defend $0.1620 on volume decline – key for structural integrity

• Confirmation of breakout above $0.1670 for continuation towards $0.17-$0.175

• Any intraday close below $0.1615 Signing Structural Failure and Downside Expansion

• Cross-asset flow from BTC or sol rotation as a broader market gauge for risk