5% while Bitcoin fell below $93,000

XRP retreated sharply from the $2.30 ceiling on Tuesday as profit taking overbought interest, with an influx in institutional volume confirming that resistance remains structurally intact.

News background

The broader crypto markets remain under pressure as risk sentiments soften and technical signals lead short-term trading behavior across the majors. According to FXPro’s Alex Kuptsikevich, crypto conditions still resemble “a short-term rebound within a larger decline,” with market structure pointing toward a deeper retracement unless Momentum re-accelerates.

ETF flows have been mixed: Canary Capital’s XRPC—the first US XRP ETF—posted $58.6m in opening-day volume on November 13, exceeding expectations but failing to generate sustained upside in market areas. Meanwhile, derivatives data shows $28M in XRP divestments in the last 24 hours, with long positions accounting for nearly $25m of the total, featuring aggressive divestment during declining resistance.

Sentiment across altcoins remains fragile as institutional traders rotate capital selectively, prioritizing assets that show stronger breakouts while trimming exposure to overhead supply zones like XRP’s $2.28-$2.30 band.

Summary of Price Action

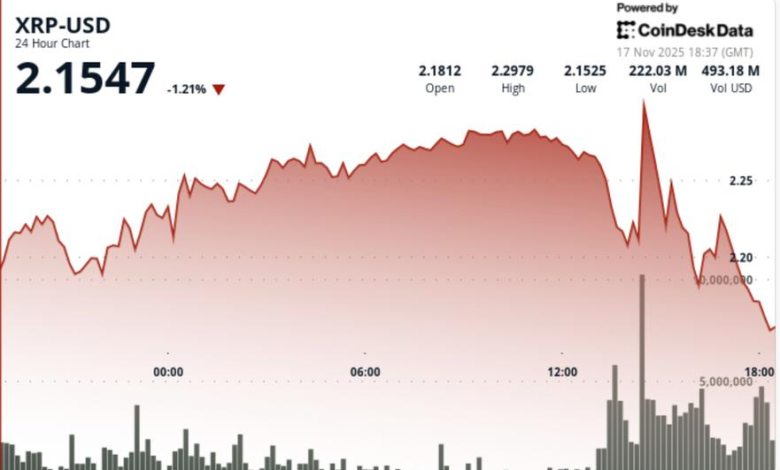

XRP fell 4.58% to $2.18 in the 24-hour session, reversing sharply after a failed breakout attempt at $2.30. The decline triggered heavy selling waves, with a 342% volume spike at 14:00 UTC – 237m tokens traded – marking the session’s inflection point.

The token carved out volatile swings between $2.27 and $2.18 while sellers aggressively defended $2.30. Attempts to consolidate above $2.22 were met with renewed pressure. Late-session trading delivered extended flat-volume periods after 17:21 UTC, suggesting institutional flows paused until clearer confirmation emerged around the $2.20 floor.

Despite the decline, XRP briefly rallied from $2.20 to $2.27 at 16:50–17:00 UTC, but Momentum failed as resistance remained firm.

What entrepreneurs should watch

- $2.20 is the battleground. A hold sets up another attempt towards $2.30-$2.40.

- Failure below $2.18 exposes a quick fall towards $2.02-$1.98.

- Confirmation of volume will dictate direction – Increase in buying volume at $2.20 signals accumulation; Low-volume bounces will remain weak.

- ETF flows remain a key short-term catalyst. The sustained influx of XRPC will boost liquidity in the area.

- The broader sentiment remains fragile; XRP will be highly sensitive to any renewed risk-off move in the majors.