7% Swing on Buying Digital Treasury Asset, Grayscale ETF plans

The native token of the chainlink Stopped on Wednesday after a strong start to Sunday, returning some of the news news about asset manager Grayscale File To convert its closed-end fund to a funds exchanged by the exchange (ETF).

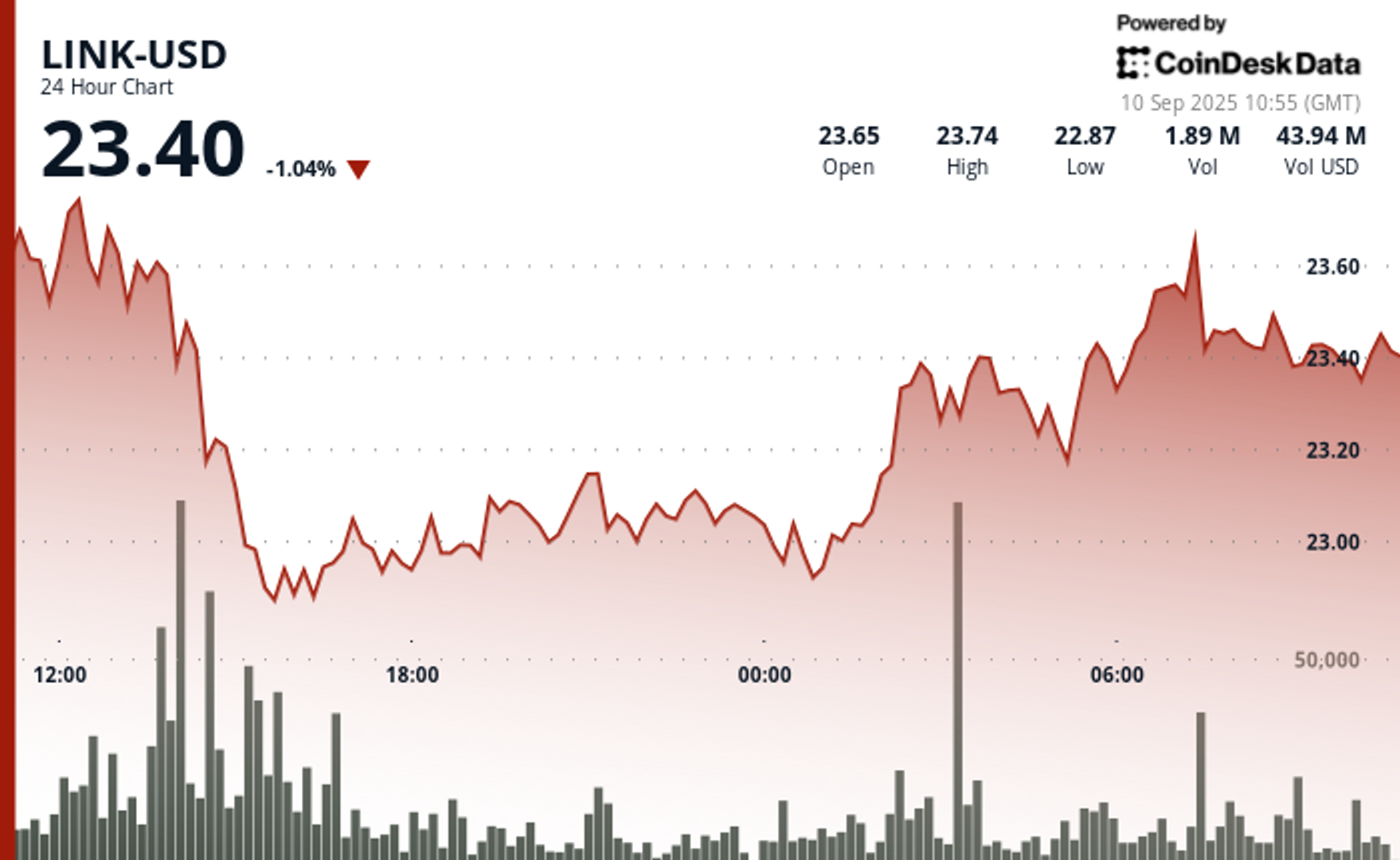

The token dropped nearly 1% in the past 24 hours in a session -changing session, experiencing a 7% swing swing, each technical research technical review of CoinDesk Research research.

Price action followed Arizona -based in real estate and asset manager Caliber’s (CWD) This Tuesday announced completed Its first purchase of link tokens, which marked the start of the Digital Asset Streasury approach.

Its stock skyrocks nearly 2,000% on Tuesday before returning a large portion of the gains, down another 20% on Wednesday pre-market. The firm did not disclose the amount of tokens purchased.

The move makes the first firm listed in the NASDAQ to adopt a Treasury reserve policy dedicated to the link. The company aims to accumulate link over time using existing credit lines, cash reserves and equity-based security, with plans to stake tokens to produce yield.

Technical analysis

- Trading Performance: The link posted a moderate 1% decline within a 24-hour period, experiencing a volatile intraday swings of 7% between $ 22.84 and $ 24.46, the technical model of CoinDesk Review Review showed CoinDesk Research.

- Volume indicators: Trade activity reached 3.78 million units at 14pm at September 9:00 UTC, which exceeded the 24 -hour average and establishing support near the $ 23 price level.

- Resistance Test: The intraday high of $ 23.49 encounters a sale pressure before refusing through minor support levels, indicating activity that earns revenue and potential preparation for further discovering the price of downside.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.