BTC Removal of Basics on the basis of market optimization basis for market optimism

Record highs – to be $ 20,000 in 2017, $ 69,000 in 2021 and $ 109,000 this year – are great for headlines and quick comparisons, but in reality didn’t do a great job of describing price action.

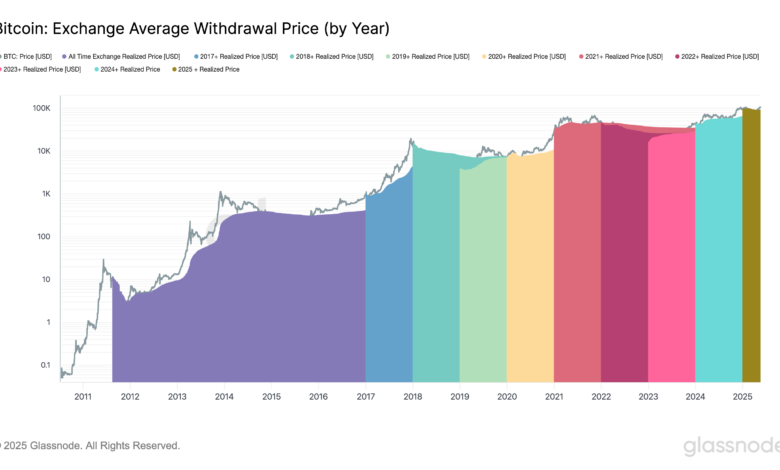

Tracking the “realized price,” or the average price at which bitcoin

has been removed from all exchanges to estimate a basis throughout the market is a more important tool for measuring investor profitability and potential inflection points in market sentiment.

The charts (above and below) describe the average removal prices for various investor cohorts, which are the year -long cohs that they enter the market from January 1 of each year from 2017 to 2025.

The average realized price for 2025 to date is $ 93,266. With the current bitcoin currently trading at $ 105,000, these investors are approximately 12% on average.

When Bitcoin began its denial from a full time of $ 109,000 in late January, it briefly fell under 2025 realized price, a historical capitulation signal. This period of stress lasted until April 22, when the price gained the basis of cohort costs.

Historical Context: Captain Patterns

Historically, when the price drops under the realized price of a cohort, it often marks market capitulation and cycles underneath:

- 2024: After the launch of the ETF in January, Bitcoin sank below the average cost basis before it was revealed. A more significant capitulation followed in Tag -Sun, linked to Yen Carry Trade Unwind when Bitcoin drops to $ 49,000.

- 2023: The price monitored near the average cost of the cost of support levels, only to shortly break down during the Silicon Valley Bank crisis in March.

The data suggests that a capitulation phase has probably occurred, positioning the market for a more constructive stage. Historically, recovery from such events marks transfers to healthier market conditions.

Realized, not a record

When Bitcoin first exceeded $ 20,000 during the 2017 Bull Market, it marked a significant difference between market prices and the realized price of $ 5,149, featuring a stage of massive speculation. Not surprisingly, prices shortly then went on a brutal return.

In contrast, in the depths of the 2018 Bear Market when Bitcoin dropped around $ 3,200, the price at that point converts at all time realized prices, a scale that combines the basis of the cost of all investors throughout the cycles.

The long-term basis of this cost acts as a level of foundation support in the bear markets and gradually rises over time as new capital enters the market. Therefore, just a bitcoin review by comparing cycle peaks, for example, from $ 69,000 in 2021 to just over $ 100,000 to 2025, has not taken the bigger picture.

The more relevant view is that the integrated cost basis of all investors continues to climb, emphasizing the long-term maturation of the property and the increasing depth of the network-oriented capital.