Uniswap Hype upgrading failed to stop the UNI slide while traders pay for more volatility

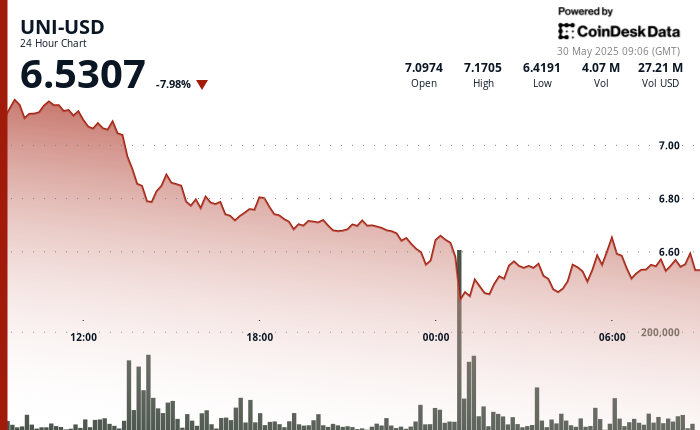

In the past 24 hours, Uniswap’s native token Uni has experienced a marked decline due to the change of market conditions. Price movement from $ 7.119 to $ 6.532 indicates a huge downward pressure, which is strengthened by macroeconomic factors such as general market trends and investment sentiment.

At the same time, microeconomic elements, including the latest promotions of uniswap protocol and strategic interest from crypto whales, provide supporting points in support, which potentially eliminate further price decline. Despite sinking, long-term confidence can develop as uniswap gets traction with the latest innovations, suggesting strategic considerations with the investor.

Technical assessments

- UNI price dropped from $ 7.119 to $ 6.532 to 24 hours.

- Intermediate support was found at $ 6.40, which is a significant trade volume, according to the technical evaluation model of CoinDesk Research’s technical review.

- Price tried the recovery to reach a high $ 6.595 but stabilized at $ 6.522 by 08pm.

- Pare -like lower highs mentioned throughout the session, suggesting ongoing emotion.

External reference

- “Uni Eyes $ 10 As Uniswapx Launch Trigger Inverse H&S Breakout“, Crypto.News, published May 29, 2025.

- “Uniswap Price Prediction: Is UNI set for a bullish breakout?“, Coinpedia, published May 29, 2025.

- “UNI price prediction for May 30th: Momentum slows down near $ 7.25 after major breakout“, Coin Edition, published May 29, 2025.

- “What’s next for this famous Defi token? Is Uniswap (UNI) march above $ 10 this coming month?“, Coinpedia, published May 29, 2025.