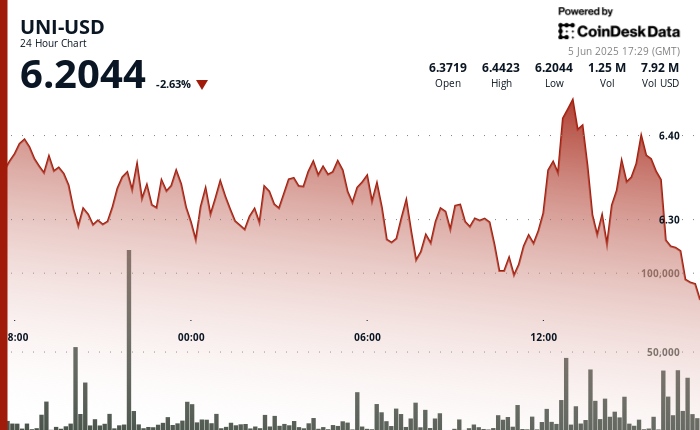

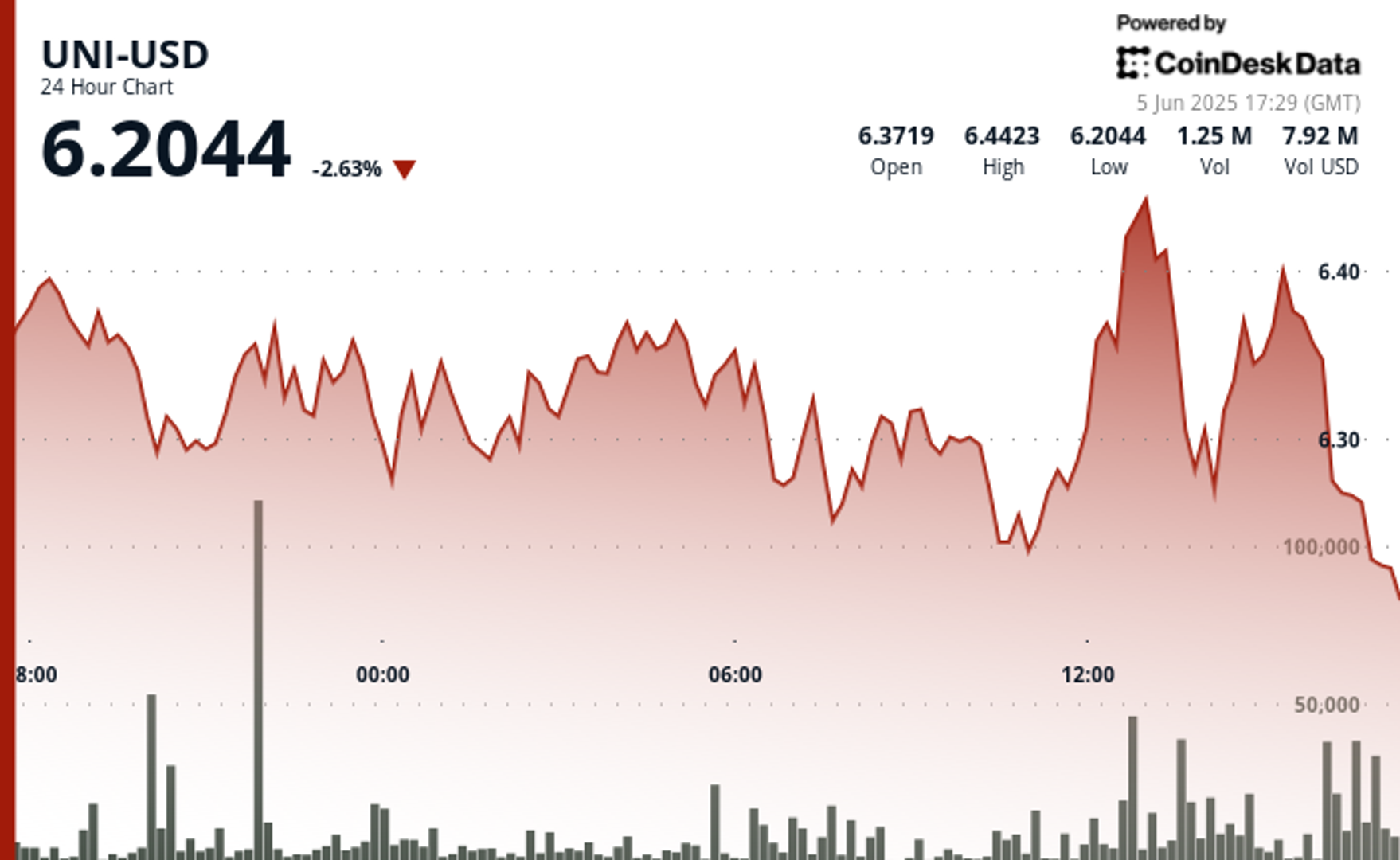

Uni slumps below $ 6.21 as a denial of $ 6.44 triggered fresh seller-off

Uniswap’s Uni Token underwent with -updated pressure while earlier obtained were not formed, sending prices below the critical $ 6.22 support to the zone.

The day began with a sharp rally that pushed the UNI to a high $ 6.44 intraday, but strong sale appeared shortly after, removing the advance.

The transition to market structure comes amid greater uncertainty tied to macroeconomic events, including financial policy signals and ongoing trade tensions.

While the UNI has shown signs of elastic earlier on the week, the return now indicates an increase in risk of avoiding entrepreneurs.

Analysts now viewed $ 6.20 as the final defense line before the potential more.

Technical assessments

- UNI has exchanged a PABAGU -CHANGE OF $ 0.22 range between $ 6.22 and $ 6.44.

- A 3.1% rally that sank to $ 6.44 before the trend reversed.

- Heavy sale at 13:45 led a price collapse to $ 6.31 to 244,581 quantities.

- Multiple recovery attempts failed, forming lower highs at $ 6.31, $ 6.30, and $ 6.29.

- Last time Uni saw a fall at $ 6.20, with a lot of accelerating nearby.

- The $ 6.22– $ 6.25 support in the zone remains key, but now under the direct threat.

- The general momentum has been negative in the bearish confirmation at $ 6.35.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.