7 Solana etfs advance; Defi Development Corp prepares to buy more SOL for Treasury

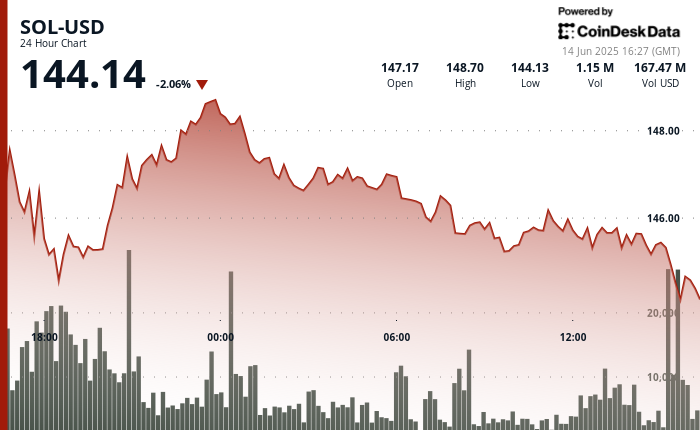

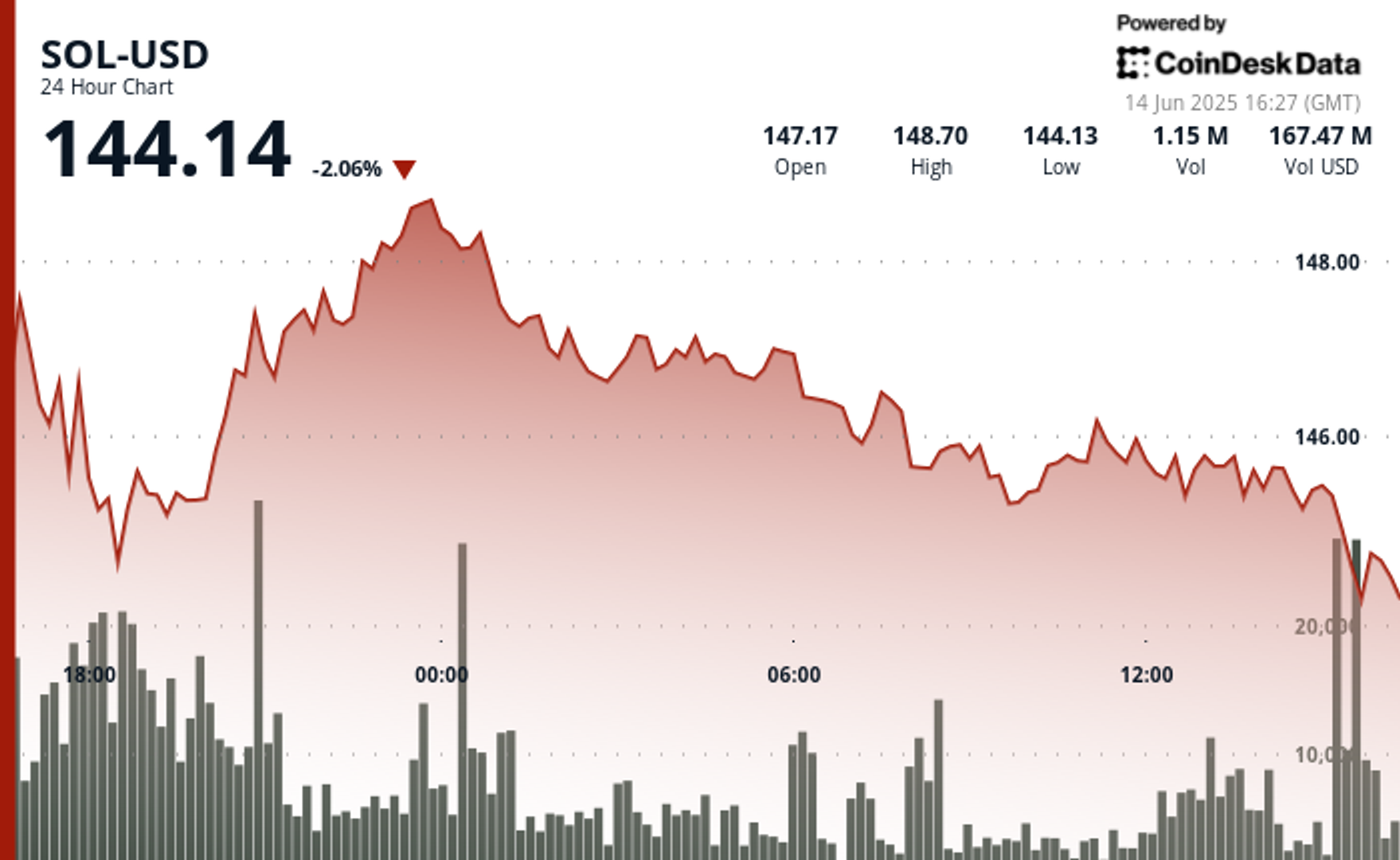

Solana (Sol)

Exchanged for $ 144.14 on June 14, down 2.06% in the past 24 hours, but showed stability as long-term institutional offset-driven weakness. The price action remains pinned near the lower end of the recent $ 145- $ 149 aggregation of the zone, following a broader multi-day correction throughout the crypto markets tied to increasing geopolitical tension.

Despite the recent weakness, the two major institutions of the institution suggest deepening the interaction with the Solana ecosystem.

First, Bloomberg’s James Seyffart confirmed It was Friday this week that all seven seats at Solana ETF mean that including Fidelity, Grayscale, Vaneck, 21shares, Franklin, Bitwise and Canary Marinade-updates S-1 filings on Sec. Each filing today includes staking provisions, making them a structure that aligns with Solana on-chains.

Second, Defi Development Corp, a listed NASDAQ’s Solana Treasury Firm, announced On Thursday it entered a $ 5 billion equity line of credit (ELOC) agreement with RK Capital. The facility allows the Defi Dev Corp to issue shares gradually to fund additional solving SOL, rather than relying on a single, fixed price.

This follows a minor regulatory setback: On Wednesday, the company applied to the SEC for removal of the registration statement in Form S-3. It said it wanted to withdraw an earlier filing of the S-3 due to technical issues with the SEC. The firm said it would file a re -registration of the future statement to raise the capital it needed.

Despite the hiccup filing, the company emphasized its ongoing promise of growing its Sol Treasury, which is currently holding more than 609,190 tokens – worth more than $ 97 million. The CEO Joseph Onorati said on Thursday’s press that the new capital structure offered a “clean, strategic path” to exposure to the scale during the integration of the validator yield.

Sol’s price appears to be stabilizing as these institutional tailwinds strengthen, even though retail activity remains covered.

Technical assessments

- Sol exchanged for a 24 -hour range of $ 4.57 (3.08%), from $ 144.13 to $ 148.70.

- The initial strength faded, with a price drift towards the support level of $ 144.

- The resistance remains stable near $ 149, while short -term rejection struck $ 145.78.

- The sale of high volume took place between 13: 41–13: 47 UTC, with a sharp fall from $ 145.95.

- A spike volume at 13:23 UTC aligned with a failed breakout.

- The whale accumulation continues below $ 146, even though the follow-through remains limited.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.