A start -up is looking to pay 30% yield by tokenizing AI infrastructure

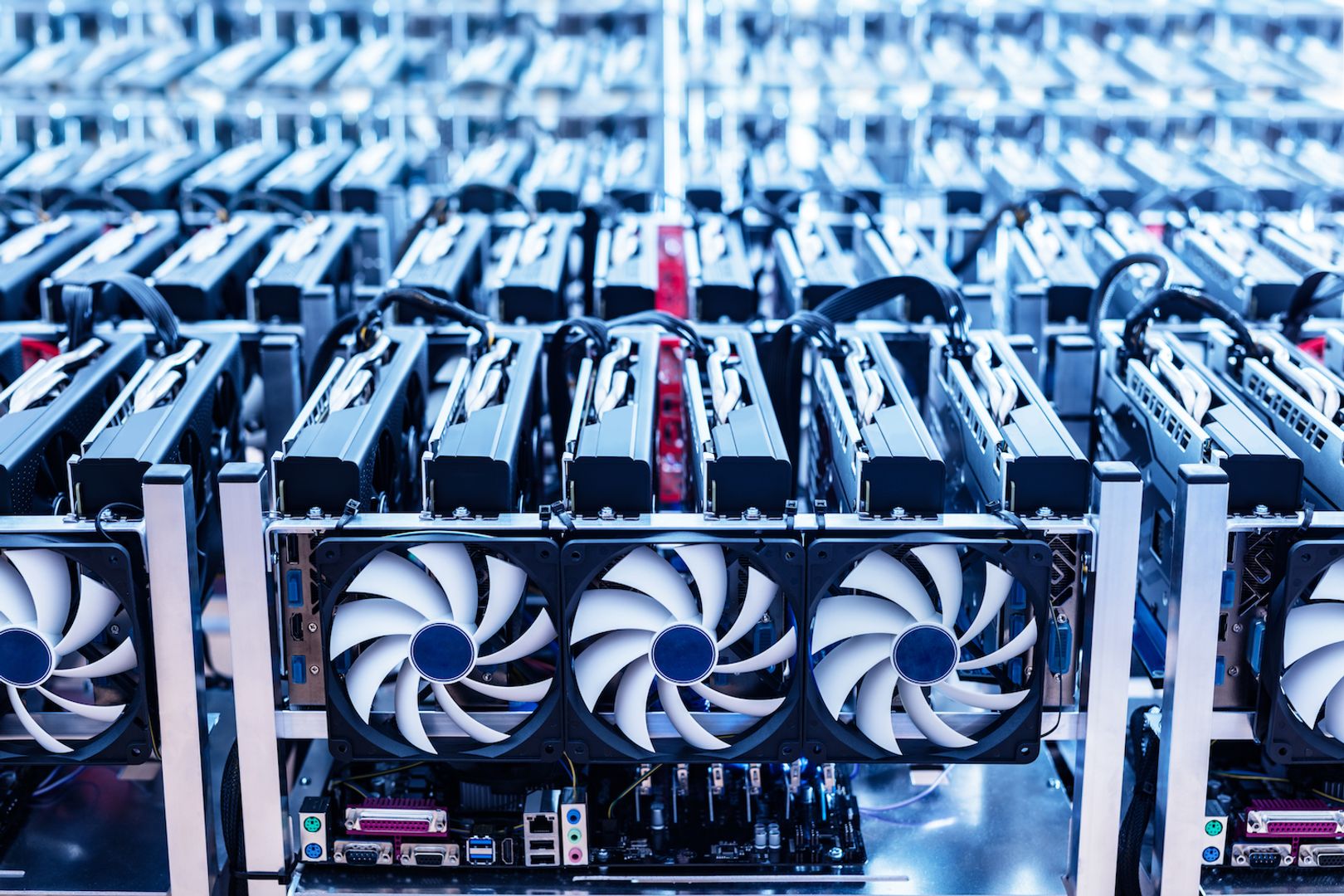

The power and profitability of the AI infrastructure is centralized and generally confined to hyperscalers such as AWS or large venture -supported companies. However, the compute labs are trying to bring token holders to directly access the potential of enterprise hardware such as the NVIDIA H200 GPU, which will sell nearly $ 30,000 for a single unit.

“For investors, this pilot (project) represents the first opportunity to earn stablecoin yield directly from live AI compute without having to manage hardware or rely on the excessive amount of public equities,” the compute labs said in a press release.

Europe Nexgen, which provides access to its customers to AI’s computing power and raised $ 45 million in April, will handle the initial financing by computing the investment investment investment.

How it works

The funds raised will be used by Infrahub to buy GPUs, which will then be fractionalized for investors and customers, according to the press release.

The first “Vault” raised $ 1 million from investors. The initial vault will have the top-of-the-range NVIDIA GPU, which is currently used for “AI training and understanding,” the company said. Companies have been able to produce produce, in the USDC, which may have passed 30% per year based on active GPU rent agreements.

Nikolay Filichkin, Chief Business Officer at Compute Labs, talks to the type of data center operators who can have additional floor space and looking to add excess capacity; The equivalent of the “Mom and Pop Shops” data center, he said in an interview with CoinDesk.

“When the data center uses GPU owned by an investor, manages compute labs through its protocol and sheet balance, and leases GPUs to the data center,” Filichkin said in an interview. “The net income, minus items such as pumping and energy costs, returns to the investor who owns a cut of GPU processing power.”

Companies will tokenize and fractionalize GPUs within vaults, which can be offered to individuals investors in increases of several hundred dollars. NFTs are also used to distinguish between different types of tokenized GPU hardware investment.

Compute labs are supported by protocol labs, OKX ventures, CMS holdings and amber groups, among others. The firm operates a flat 10% fee structure throughout the tokenization, asset management and performance yield.

“This model assigns concrete, tradable value to every GPU cycle, rationalizing the AI market by removing investors, and directly linked to supply, demand, and price,” said Youlian Tzanev, co-founder and chief strategy of the Nexgen Cloud strategy.