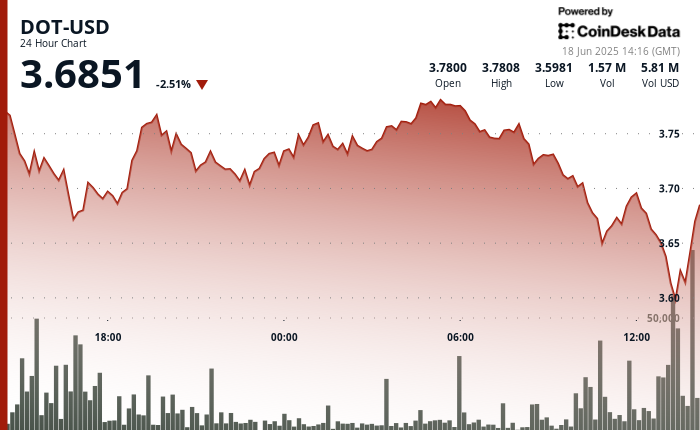

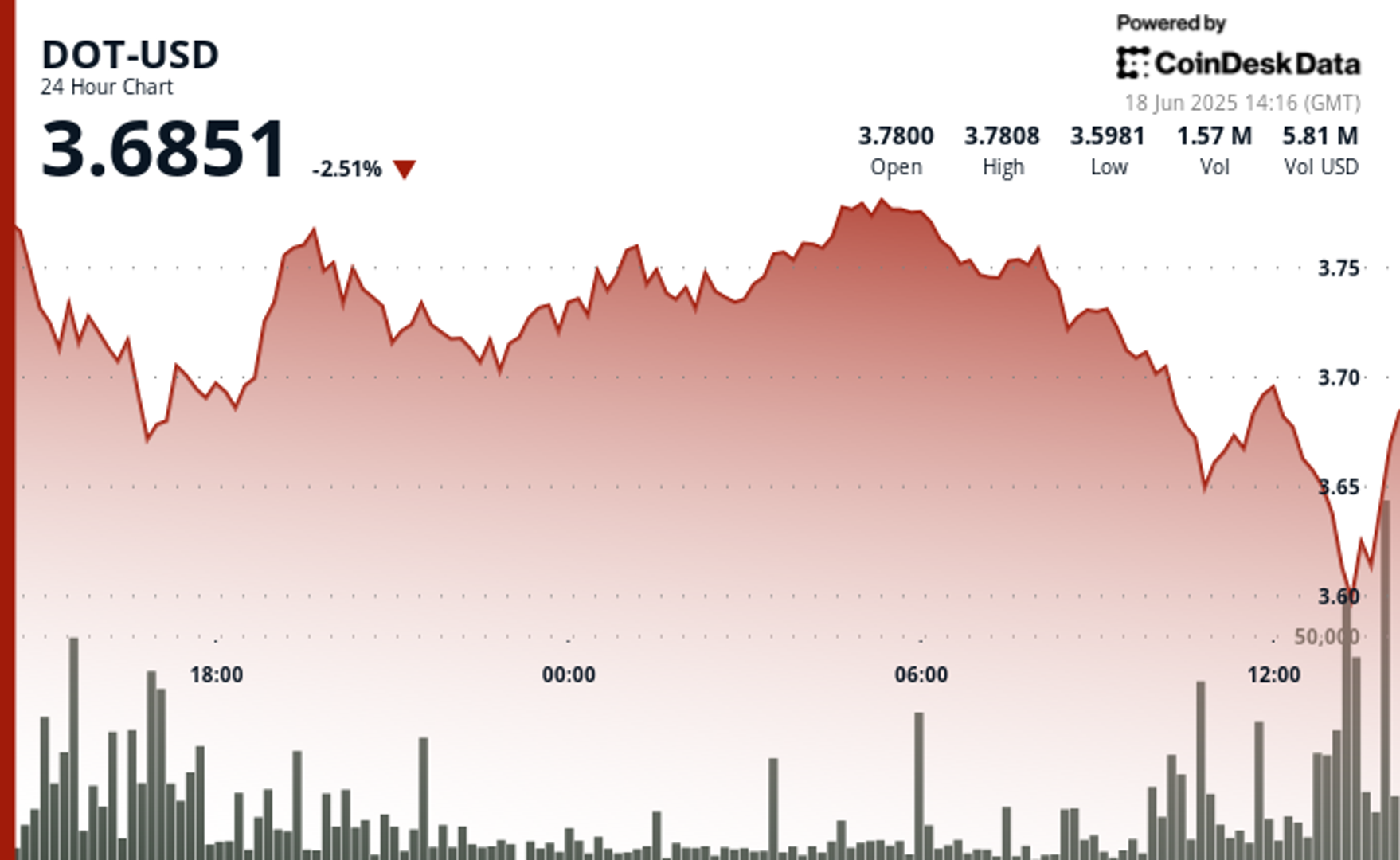

The Polkadot point drops up to 5 % after the failed operators that sell the wave

Dotted

She faced great pressure for sale, decreased to 5 % before recovery, and perhaps a dual -bottom pattern indicating the continuation of the upward movement, according to the technical analysis model of Coindsk Research.

After an attempt to initially create a bullish trend at $ 3.787, DOT faced a strong resistance and formed a declining reflection pattern, according to the model.

In the last trading, DOT was 2.6 % less 24 % less, trading about $ 3.63 after it was found support at $ 3.59. The broader market scale, Coindesk 20, decreased by 0.5 % at the time of publication.

The model showed that the price procedure shows a potential dual -bottom pattern with improving the momentum, indicating more upward trend if it maintains support higher than the price level of $ 3.62.

Technical analysis:

- Dot witnessed a 24 -hour volatile period with a large range of 0.193 (5.1 %), initially in an attempt to create the bullish direction with a peak at $ 3.787 before facing strong resistance.

- The basic procedure formed a declining reflection pattern as DOT failed to stick to a level of $ 3.75, followed by the accelerated sale of a large size during 10:00 and 13:00 when a volume rose to approximately 4 million units-higher higher than average 24 hours.

- Support appeared at $ 3.594, although the current price structure indicates more risks of the downside as Dot closed near its lowest levels at the session with weakening momentum indicators.

- In the last hour, Dot has seen significant fluctuations with a sharp drop from $ 3.643 to a decrease of $ 3.594, followed by a recovery attempt.

- The price found strong support at the level of $ 3.594, which led to a V -shaped recovery, which paid a point up to 1.3 % to $ 3.642.

- The last price movement is a potential dual -bottom pattern with improving the momentum, indicating the possibility of continuing upward movement if DOT can maintain support higher than a level of $ 3.62.

Slip: Parts of this article were created with the help of artificial intelligence tools and reviewed by our editorial team to ensure accuracy and commitment Our standards. For more information, see Coindsk Full Policy Artificial Intelligence.

publish_date