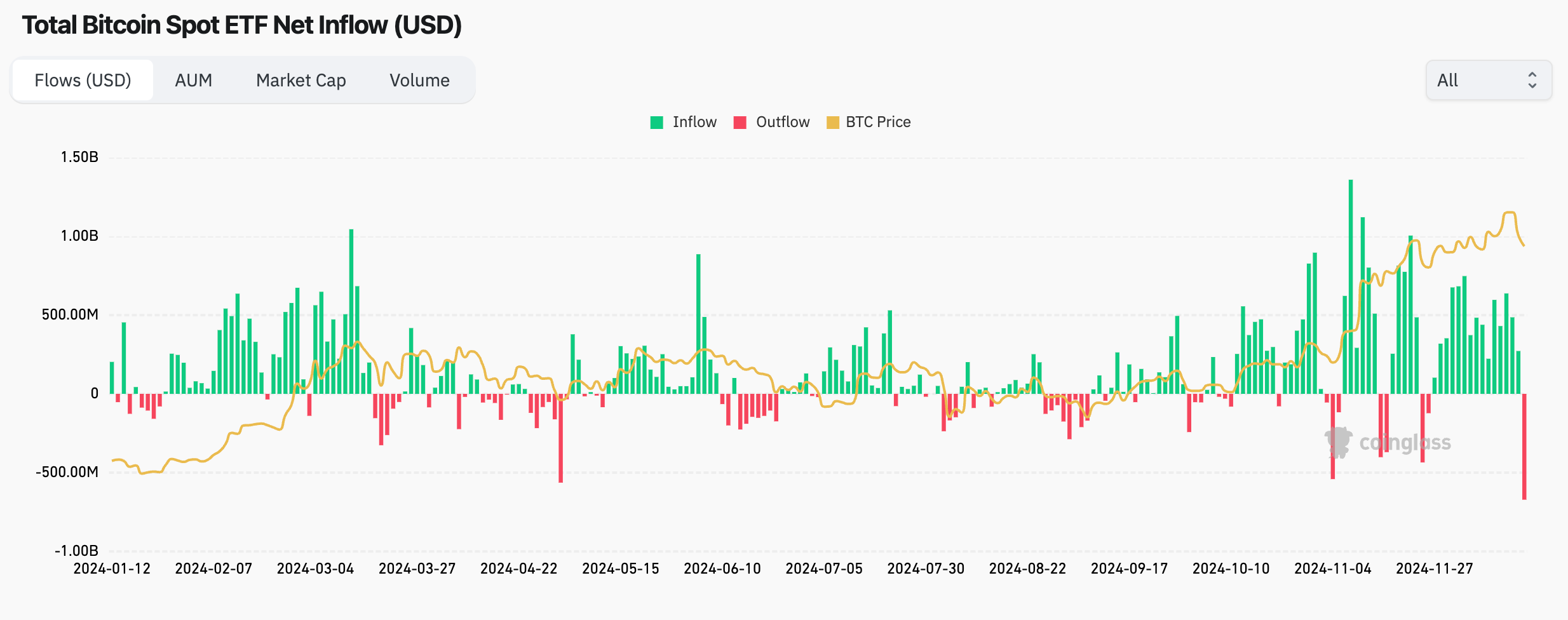

US Spot Bitcoin ETFs Bleed Record $671.9 Million as Prices Drop

US-listed exchange-traded funds (ETFs) posted record outflows on Thursday and the premium for Chicago Mercantile Exchange futures fell to single digits in a sign of weak short-term demand.

Investors ended a 15-day streak of inflows by withdrawing a net $671.9 million from 11 ETFs, the largest single-day tally since their inception on January 11, according to data from Quinglass and Persian investors.

Fidelity’s FBTC and Grayscale’s GBTC led the outflows, losing $208.5 million and $188.6 million, respectively. Other funds recorded outflows as well, with BlackRock’s IBIT fund recording its first zero in several weeks.

Bitcoin has expanded its reach Post-Fed losses On Thursday, it fell to $96,000, down about 10% from the record high of $108,268 seen early this week.

Bearish sentiment was reflected in the derivatives market, as the annual premium in Chicago Mercantile Exchange-regulated one-month bitcoin futures contracts fell to 9.83%, the lowest level in more than a month, according to data source Amberdata.

The decline in the premium means that cash and carry arbitrage bets involving a long position in the ETF and a short position in CME futures are lower than they were earlier. As such, ETFs may continue to see weak demand in the short term.

Ethereum ETFs also recorded a net outflow of $60.5 million. This is the first time since November 21. Ethereum has fallen 20% since levels above $4,100 before the Fed’s decision on Wednesday.

publish_date