Metaplanet Gains 620 Bitcoin as Ripple Token Leads Market Decline

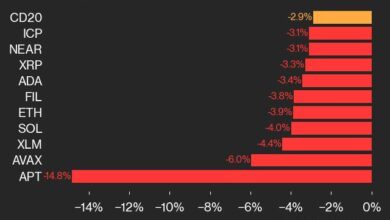

XRP fell 3% in the past 24 hours, leading losses among the major tokens as bitcoin (BTC) started the festive week in the red and Japanese bitcoin accumulator Metaplanet (3350) announced its biggest buy.

The Tokyo-listed company said it bought a record 619.70 BTC for 9.5 billion yen ($61 million) in a move that increased its BTC holdings by 54%.

BTC is still down 1.5% in 24 hours, CoinGecko data shows, with ether (ETH), Cardano’s ADA, Solana’s SOL and dogecoin (DOGE) all down as much as 2%. Chainlink’s LINK and Tron’s TRX have gained, while the broad base CoinDesk 20 (CD20) index down 1.39%.

Metaplanet has now acquired 1,762 BTC for 20.87 billion yen ($133.2 million), with an average purchase price of 11.85 million yen. Between Oct. 1 and Dec. 23, the company achieved a BTC yield of 309.82%, up from 41.7% for July 1-Sep. 30.

Metaplanet has been experimenting with new ways of financing its bitcoin purchases since it first started the strategy in April. On December 20, the company issued a $5.0 billion yen 5th Series of Ordinary Bonds to EVO FUND, a zero-coupon bond maturing on June 16, 2025 with possible early redemption related to the 12 series stock acquisition rights.

In total, the company has made 19 separate bitcoin purchases using capital market activities and operating income. Shares are up 2,100% this year, and the company has become the 15th largest public holder of bitcoin.

Meanwhile, market watchers are cautious ahead of the holiday period with a short-term bearish bias.

“Markets continue to dig the Fed’s tighter tone, fueled by the pent-up urge to lock in earnings after a strong year,” Alex Kuptsikevich, FxPro’s chief market analyst, told CoinDesk in an email. “Bitcoin is trading around $95.5K, receiving support near the 50-day moving average on Friday and Monday. While we expect to see the market decline here, it is too early to say that this is the end of the correction.

“Further declines in the stock market, where Bitcoin and Ethereum abound, could trigger institutional investors, launching a deeper pullback. Reduced holiday liquidity has the potential to amplify this amplitude with a potential dip into the $70K area,” Kuptsikevich said, adding that the $90,000 level could present an “attractive level” for to consumers to stop selling.