BTC ignores the threat of the new Trump tariff with the passage of the deadline in July

The encryption markets witnessed a relatively quiet day on Friday, despite the renovation of the threats of definitions.

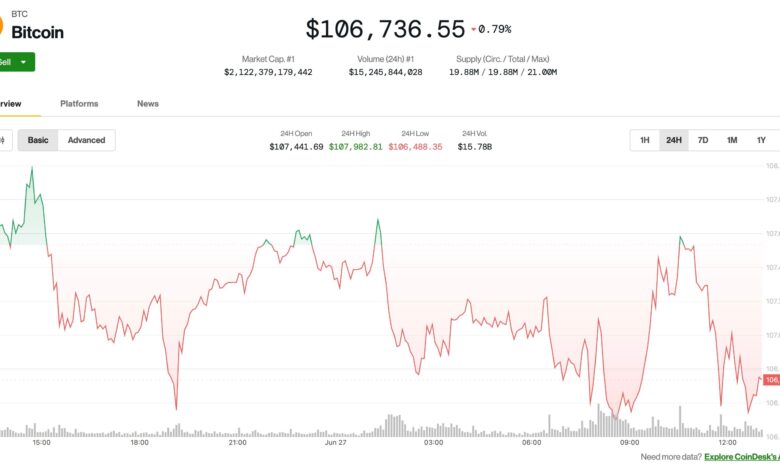

Bitcoin

It has decreased by 0.7 % in the past 24 hours, and is now trading by $ 106,700, According to Coindsk Market data.

The performance of the orange currency was widely in line with Coindesk 20’s – An indicator of the best 20 encrypted currencies by market value, with the exception of Stablecoins, Memecoins, and the exchange of coins – which decreased by 0.7 % in the same time period. but

Was the index code that witnessed the largest price change in both cases, and only 3.3 % rose.

Crypting stocks have witnessed more important moves, with coinbase (currency) And a circle (CRCL) Loss of 6 % and 16 %, respectively. Stablecoin Source shares fell 40 % since it reached nearly $ 300 on Monday.

Bitcoin miners have been relatively flat per day, including Core Scientific (Corses)Which rose more than 30 % on Thursday from a report An artificial intelligence was looking at Coreweave to get the company, despite the 8 hut (hut) 6.5 % decreased.

The moderate price procedure contrasts with the possibility that the White House tariff strategy will reach the high equipment again. US President Donald Trump announced that his administration will end all employment discussions with Canada in light of the country’s digital services tax in the country the goal To impose American technology companies.

“We will tell Canada with the knowledge of the tariff you will push to work with the United States of America during the next seven period,” Trump to publish.

The temporary suspension of the mutual tariff is scheduled to end on July 9, but traditional markets or encryption do not seem particularly concerned, and Coinbase’s analysts male In my research report.

“[Markets] Analysts wrote: “They greatly ignored the potential economic risks caused by this situation … Partially because this has not necessarily reflected in economic data,” the analysts wrote.

They said that satisfaction with the definitions about the definitions will probably continue, because it is unlikely to be inflated as expected previously.

publish_date