Bitcoin (BTC) Price News: Surging towards $ 110k

Bitcoin

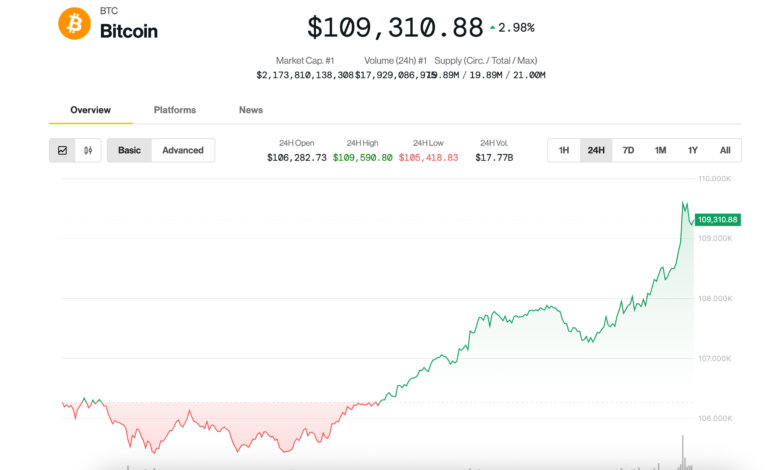

was bouncing hard to $ 110,000 on Wednesday, which retreated to the short risk off wave of Tuesday dragging the price below $ 106,000.

Recently, the largest crypto has been exchanged at the strongest prices since June 11, around $ 109,500, up to 3.5% in the last 24 hours.

The action arrived as Donald Trump announced a trade deal with Vietnam, which contributed to the risk of risk throughout the board. NASDAQ at noon was ahead of 0.8%.

Under the deal, the US will impose a 20% tariff on goods from Vietnam and a 40% seating of transships -productivity who has been raised by Vietnam on their journey to USUS exports, will not deal with tariffs when entering the Vietnamese market.

Trace in the Crypto sentiment can be a debut of rex-osprey solana + staking etf (SSK)The first such as the Crypto Staking product available in the US

“Volume at $ SSK today at $ 20M, which is really strong, top 1% for a new launch,” Bloomberg’s analyst Eric Balchunas writes A short time ago. Balchunas noted that Solz-a futures based on Sol ETF who opened for business in March-made only $ 1 million in the first day of trade.

July can be large (in either direction)

July is shaping up to be a potential moon -changing Moon for Bitcoin, driven by the policies of the Trump administration, according to Vetle Lunde, head of research in K33.

Trump is expected to sign a controversial expansion of the budget budget called the “Big Beautiful Bill” on Friday. The bill, which could expand US deficiency by $ 3.3 trillion, has been seen by some as bullish for deficiencies of properties such as BTC, Lunde said.

Another major date of the dating is the July 9 tariff deadline, which may see a more aggressive trade posting from Trump.

Third, July 22 is the final deadline for action in the long-awaited crypto executive order, with potential updates to the US strategic bitcoin reserve.

“July is tight in Trump’s natural volatility,” Lunde said. However, crypto markets are quite calm without much froth, he said.

“There are several reasons to expect a massive extensive deleveraging of the crypto market, as crypto-leverages remain enclosed,” he said. “This favors maintains exposure to the area and staying patients as we progress at a time known for the time -consuming.”