The first United States Solana Stoke Etf starts with $ 12 million flows

The first trade fund in the United States in the United States (ETF) has finished trading day for the first time with $ 12 million in flows-a positive sign of investment funds circulating in the investment funds supported by the bladder.

And Rex -Sprey Solana Staking Etf First On the CBOE BZX Stock Exchange on Wednesday, it recorded $ 33 million in trading volume and $ 12 million in flows, According to For Bloomberg analyst ETF Eric Balunas.

the financeTrading under SSK, gives investors direct exposure to Solana Solana (Teller) Along with Stokeing Revenue, which makes it the first encryption of the investment funds circulating in America.

James Sevart, an “Bloomberg analyst Ishnal analyst, who was” a healthy beginning for circulation “said Note It has seen $ 8 million in trading volume in the first 20 minutes.

Sonas also Stuck On the sizes of the impressive day on the first day, it states that it is “blowing” in ETF and XRP FUTURE SOLANA FUTEREBTC) And the fragrance (EthMoney when launch.

The investment funds circulated in Bitcoin, listed in the United States, recorded a $ 4.6 billion share on its first day in January 2024.

“The launch of the Crypto Staking investment funds is a crucial moment for digital assets and an important step forward in full access to the ecosystem for encryption,” He said The co-founder of Anchorage Digital Nathan McCauley, his company is the restricted and one partner in Rex-SPREY ETF.

Organizational obstacles

The Rex -Sprey Fund faced organizational obstacles with the Securities and Stock Exchange Committee, which it objected to in late May after the initial registration.

The case was whether the product was eligible as an “investment company” under the laws of securities, but the company managed to circumvent this by investing at least 40 % of its assets in the other ETPS, most of which are from its home outside the United States.

More eyes on Solana Etf, Altcoin Etf Summer

Unlike Solana ETFS still requires approval from SEC, ETF was organized by Rex-Solana Solana ETF under the 1940 Investment Company Law, which avoids the 19B-4 standard deposit.

In May, the head of the Novadius Nate Geraci was described as a “organizational end”. However, some Discuss Whether the box should be considered a traditional spot Solana ETF.

Meanwhile, the last ETF performance can highlight the institutional demand for immediate Solana ETF, which may be launched this year.

Sevart and Al -Shunas Recently linking 95 % chance The investment funds circulating in Solana Solana will be approved by the end of the year.

“We expect a wave of investment funds circulating in the second half of 2025,” said Sevart earlier this week.LtcThe products will be green by the Supreme Education Council before the end of the year.

Related to: Analysts raise an opportunity to agree to Sol, XRP and LTC ETF to 95 %

On Tuesday, organizer consent A gray application to convert its large digital fund into circulating investment funds. The fund includes a basket of the five best digital assets depending on the market value.

A simple reaction to Sol prices

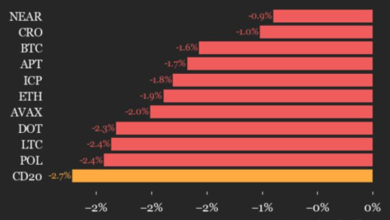

There was no specialty reaction In Solana prices, which have gained 3.6 % over the past 24 hours, less than most other high tons.

The original was trading about $ 153 at the time of writing this report, and it was about 5 % during the past week, but it still decreased by 48 % of its peak in January.

However, Solana CME FUTERES “The Standard demand, indicating the increase in the institutional interest” as the open interest reached 167 million dollars after the launch of ETF, I mentioned Solanafloor.

magazine: Bitcoin ‘Bull Pennant’ $ 165K $, POMPS Scoops Up 386M BTC: Hodler’s Digest

publish_date