EU MICA brings benefits to crypto investors

Despite the preliminary concerns about its impact on the European crypto industry, the regulation of crypto-assets (MICA) regulation (MICA) regulation has proven a benefit to crypto customers and exchanges.

The first EU regulation package about cryptocurrencies has been effective for almost 200 days, and since then, a number of known exchanges has set up operations on the continent.

In its first two quarter of operation, MICA has shirked critics of critics to “destroy” the European crypto industry by excessive exchange of regulations and asking users to identify themselves to stay on regulated platforms.

Instead, the regulatory regime is set to combine the European crypto industry and serve as a catalyst for investor adoption.

How crypto companies benefit from Mica

There are challenges of following MICA for cryptocurrency companies. First, MICA is relatively new law, and there is no guide for how to ensure compliance, which could lead to uncertainty during the application process, Bybit EU Managing Director Mazurka Chen said at a conference of July 10.

Second, there is a cost. It takes a significant amount of time, effort and money to ensure compliance, which is a cost that is more easily carried by large, established companies.

Exchanges that are less able to cost or view the MICA ramp-up as a “theater regulation,” each Dante Disparte and Patrick Hansen-according to the mention of the Chief Strategy Officer and Director of EU Strategy and Policy in Circle-may Forced to leave the market.

It could be a windfall for the responsible local actor, according to circle executives. “Mica represents a chance (…) to grow a unique European crypto asset market.”

Related: What are the crypto-assets markets (MICA)?

For Stablecoin readers, this means that products that are not related to the EU will disappear, leave a space and significant need for Mica ready products to close the interval, stable, rather than moist, the local stablecoin ecosystem.

For exchanges, larger fish can break the smaller, increasing the market part. Okx europe CEO erd ghoos before said to the cointelegraph That such a companion will separate the “serious market players from unlicensed actors and (drives) healthy, trust -based competition.”

Another benefit of MICA for crypto companies is the relatively equally legal walking they compare compared to traditional banks and asset trading services such as eores.

According to Georg Hater, the director and head of the Global Following bybit EU, MICA-controlled companies have the same anti-money laundering (AML) standard as major banks, so “there is no reason not to work in the MICA license company.”

How Mica benefits European Crypto investors

This more equally walking in traditional financial institutions also have effects on customers, such as easier bank transfer, broader access to the institution and stronger protection for client assets.

“With the license, we can ride directly, and the client can make deposits and withdraw very easily from their own bank,” Bybit CEO Ben Zhou told cointelegraph. “Therefore, you have family offices, different types of trading institutions that may be aboard us today because before, they are probably concerned about licensing issues.”

Licensing also allows exchanges to expand their offerings. In Mica and the Financial Instruments Directive (MIFID) markets, crypto exchanges can trade in traditional ownership such as stocks and goods, providing more familiar asset offerings for customers.

Many of the provisions outlined in MICA are associated with investor protection and market integrity. The exchanges are subject to strict reporting and consumer protection requirements.

Related: Mica’s licensing of Mica is under a thorough investigation from the EU regulator

While it will undoubtedly increase the regulation of burden on cryptocurrency exchanges, it also provides familiar guards for investors concerned about entering the cryptocurrency space. Hreler said the most important benefit for mica-regulated entities customers is these protections.

This includes “strict care of clients, properties and funds. You can remember FTX and others, where they report that they have billions and billions -billions of clients.

Many more crypto exchanges apply for a MICA license

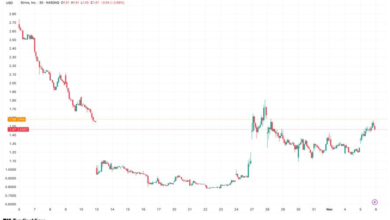

Major American Exchange Coinbase A MICA license has been obtained On June 20, with OKX and BYBIT Accepts them after a week.

Zhou said the increasing number of exchanges on the continent is “a very positive trend.”

MICA also has the potential to influence other regulators. Zhou said, “Many regulators are waiting for Mica. And you see the new outline type of borrowed or copied worldwide.”

As more exchanges enter the European market, the competition is expected to intensify. Other regions have been detected and moved to establish comparable frameworks of crypto regulation, as both customers and service providers have agreed to the constituents with clear regulations of guard.

Magazine: Within 30,000 phone bot farm stole crypto airdrops from real users