Stellar Lumens hold the firm as a network growth stage for breakout

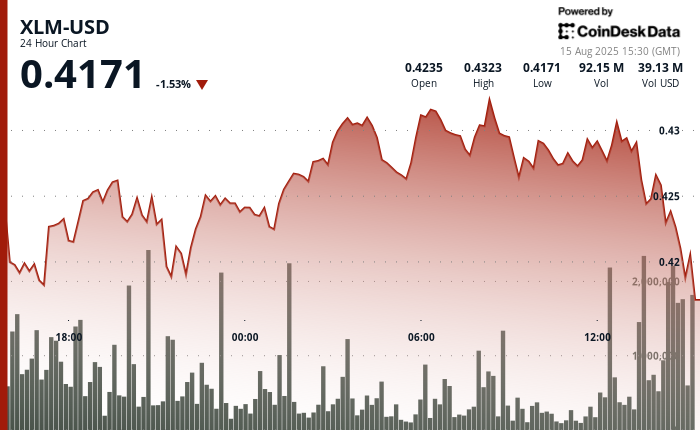

Stellar Lumens (XLM) Exchanged with a tight range in the past 24 hours, holding between $ 0.42 and $ 0.43 from August 14 and 15:00 UTC to August 15 and 14:00 UTC.

The token measured the measured gains before the income income session pushed prices 1% less than $ 0.43 to the last time of the trade. The CoinDesk’s technical data technical evaluation model suggests that XLM approaches a major resistance level at $ 0.50, with a breakout that potentially targets $ 0.60- $ 0.77, supported by strengthening the network fundamentals and growing institutional participation.

On-chain metrics continue to paint a bullish picture. Stellar’s active enterprise wallets hit a full time of 9.69 million, with 5,000-6,000 new institutional addresses added daily.

The total amount locked in the network jumped by 80% to $ 150 million, reflecting a corporate adoption. Entrepreneurs are closely watching the $ 0.47- $ 0.50 zone, a potential point of triggering for short institution cover that may have the next leg higher.

Despite the early pressure that drives XLM up to $ 0.42 during the first six hours of the session, consumers continue to appear at that level, signing strong institutional support.

Overnight, the token performed a stable recovery, rerefined $ 0.43 before integrating. In the final 60 minutes, the heavy sale of short moments returns prices back to $ 0.42, but a fast rebound and lighter volume suggests the sale of pressure can be used, leaving the room for a revised reverse momentum.

Corporate Technical Indicators Signal Consolidation Phase

- Stellar established stable institutional support in the $ 0.42 zone with the consumer’s consumer’s emergence during the session.

- Cryptocurrency tried to resist near $ 0.43 during overnight institutional trading before integrating -with the upper price range.

- The trading volume dropped to 71.43 million during the initial six -hour decline, indicating the institution’s significant participation and interests.

- The technical development approaches critical resistance to the level of $ 0.50, which represents major institutional breakout thresholds.

- Corporate momentum indicators suggest potential advances towards $ 0.60- $ 0.77 institutional price target price zones.

- Reducing the amount of trade at the final time of signals that have exhausted the institutional sale of pressure and potential market stabilization.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.