The link is up to 18% today; Here are the catalysts and what analysts say

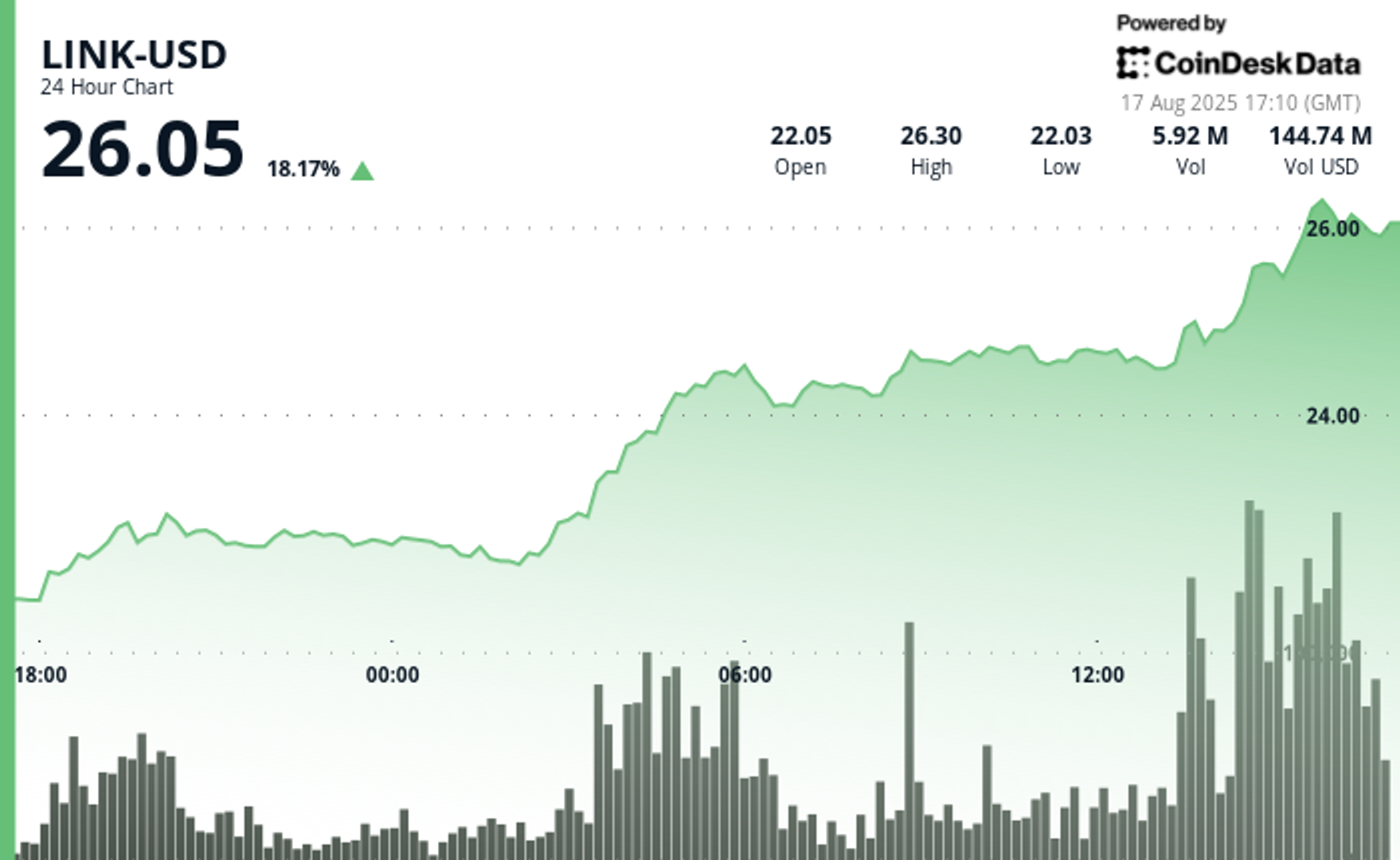

The chainlink link jumped 18% up to $ 26.05 on Sunday, according to CoinDesk data, the placement of the top 50 cryptocurrencies by percentage obtained as analysts and entrepreneurs cited momentum and recent major catalyst.

What do analysts say

Altcoin Sherpa described Link as “one of the best coins today,” pointing to the chart’s strength that could bring $ 30. He explained that circle levels as $ 30 often act as psychological barriers by which sellers take income, so merchants should be careful about chasing the latter.

Zach Humphries, another analyst, Argued That link remains “very -ndervalued” at current prices. He emphasized that the chainlink is subject to most decentralized finances by delivering price feeds and cross-chain services that many protocols depend on. From his point of view, the token should be treated as a stake in critical infrastructure rather than another speculation.

Milk Road Highlighting The strong trading backdrop. The publication mentioned a 66% climb in the 24-hour trading volume and said a clean link of a link of more than $ 24.50 was added to the momentum entrepreneurs. They tied the bullish tone back to two major August developments: the launch of the new Onchain Reserve of Chainlink and its data collaboration with Intercontinental Exchange (Ice).

Chainlink Reserve

On August 7th, chainlink introduced The Chainlink Reservea wise ark of contract designed to continue to accumulate link over time. The mechanism works by converting project revenue – paid to stablecoins, gas tokens, or fiat – at the link and then locked the onchain tokens for years.

The conversion process, called the abstraction of the payment, is automatically the flow of this job. It uses its own chainlink services – Price feeds for fair conversion rates, automation to trigger transactions, and CCIPs to combine fees from different chains – before changing the link through decentralized exchange.

Chainlink said the reserve has accumulated more than $ 1 million worth of link, with no removal planned for many years. These are also earmarks of 50% of fees from staking-secure services such as the Smart Value Recapture to feed the reserve, creating a repeated stream of flows.

The initiative serves two strategic goals.

First, it strengthens the link between adoption and token demand by ensuring use of use directly to the link.

Second, it provides transparency: anyone can view the flows, balances, and the timelock in Reserve.Chain.Link.

The chainlink has framed the reserve as a piece of a broader economic design that includes user growth and cost reduction through the chainlink runime environment. For investors, the practical argument is that network growth can now be translated into stable, programmatic accumulation of links to the open market.

Chainlink’s Dashboard Showing the reserve today holds nearly 109,663 link tokens, with a market value of approximately $ 2.8 million. The data also highlights that the average cost basis for these holders is $ 19.65 per token, emphasizing the approach to early accumulation of the program.

Ice cooperation

On August 11, chainlink announced A Collaboration with Intercontinental Exchange (Ice)The New York Stock Exchange operator. The collaboration includes a combined Ice feed, which provides foreign exchange rates and essential from more than 300 areas, in chainlink data streams.

ICE is one of the many contributing blue chips to these datasets, which the chainlink combines to create a fast, tamper-resistant data feed for use onchain. By incorporating the ICE market range, the chainlink aims to make its feeds more attractive for banks, asset manager, and developers who build tokenized properties or automatic regulating systems.

The chainlink labs described the integration as a moment of water for the institution’s adoption. The mind is that traditional financial players need to be proven, high-quality data to contact blockchain applications, and bringing ice feeds helps meet that standard.

Collaboration marked one of the clearest examples of a major data providers in the Wall Street market that interacts with the blockchain infrastructure. By providing decentralized application directly accessing Ice financial data, it has been positioned a chainlink as a bridge between traditional markets and decentralized finance.

Look forward

Analysts feature a strong link, undervaluation and speedy momentum, suggesting the token is in a position of strength as investors digest chainlink are recently strategically moving.