XRP rejects $ 3.09 resistance, target the target $ 2.96 demand zone

XRP closed the Monday session under pressure, upside down an earlier rally and ends near the $ 3.00 threshold. A sharp sale at the final trading time saw the asset sink of 1% in the surging volume, suggesting the distribution of the institution and stopping the driving price growth.

Technical analysis shows the mix -all signs

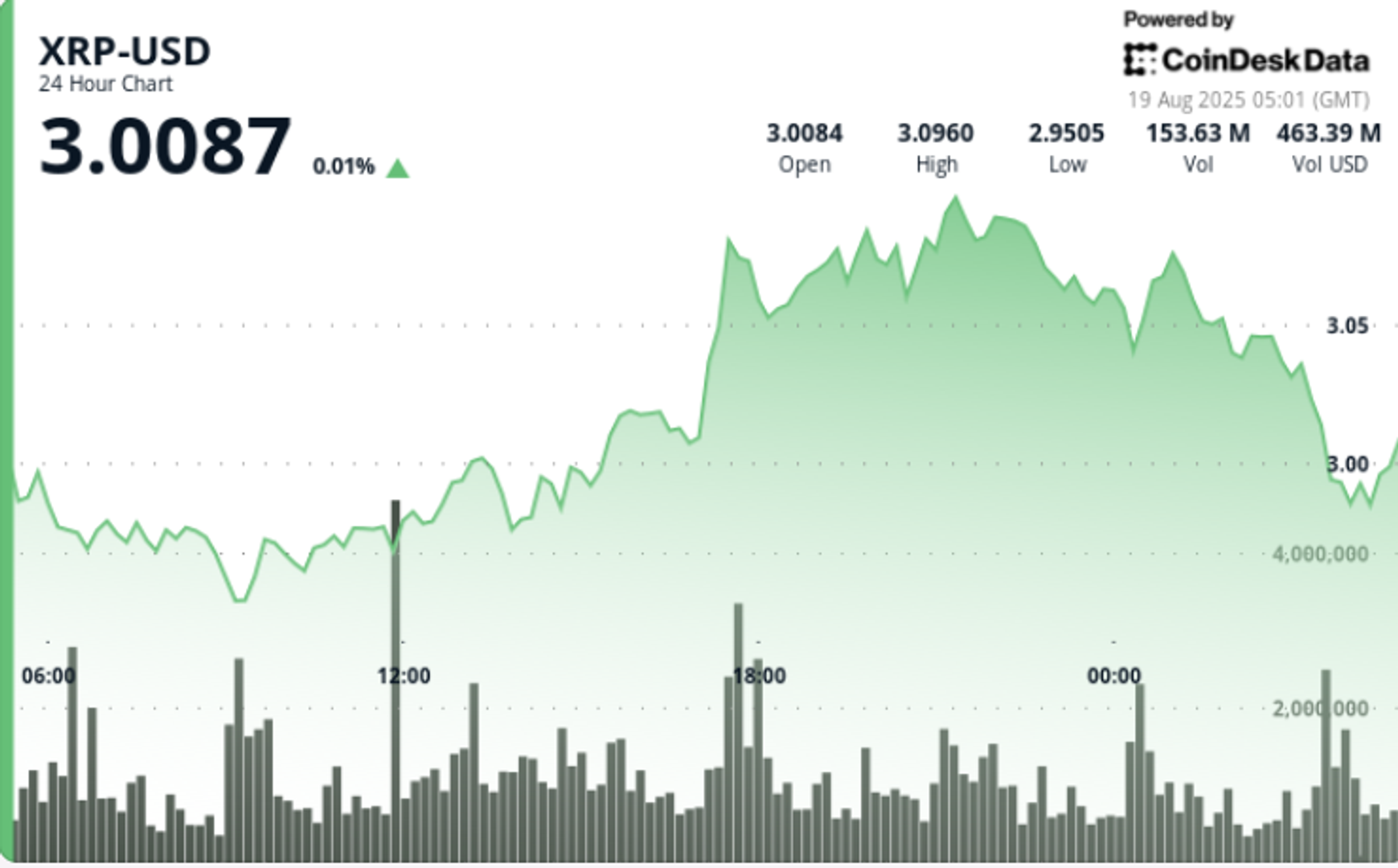

The XRP exchanged within a range of $ 0.11 between $ 2.94 and $ 3.10 throughout the 24 -hour session from August 18 05:00 to August 19 04:00, which represents nearly 4% volatility of intraday. A bullish breakout during the 17:00 hours of trading on August 18 pushed prices from $ 2.97 to $ 3.10, supported by heavy volume of 131 million-duple the 24-hour average of 66.8 million. Short -term support was established near $ 3.00.

Momentum quickly faded, however. The token declined several times at $ 3.09, slipping into integration -including around $ 2.99. An aggressive pullback opened at the time of 03:00 pm on August 19, when the XRP dropped from $ 3.04 to $ 2.99.

Keys to the market movement

• XRP refused 1% to final 60 minutes, slipping from $ 3.03 to $ 2.99 as volumes spiked to 5.26 million – five times in time -oras average

• Pressure distribution accelerates around $ 3.00 psychological threshold, trigger

• A bullish surge earlier in Session (August 18 17:00) raised XRP from $ 2.97 to $ 3.10 to 131 million quantities, which is more than average activity

The Dynamics Dynamics Drive Sharp Reversal

The late session breakdown confirmed the sale of the institutional near $ 3.00, which removed the momentum of the previous breakout. While $ 2.99 provided the stabilization of the intraday, the refusal to support the volume of $ 3.09 highlights of growing resistance pressure.

The XRP is now sitting at a branch: Handling above $ 2.99 may allow the bulls to re -evaluate the $ 3.08- $ 3.09 cluster, while the failure threatens a deeper correction towards the $ 2.96 demand zone.

Technical summary

• Range: $ 0.11 (3.8%) between $ 3.10 climax and $ 2.94 trough

• Resistance: $ 3.09, repeatedly rejected by night sessions

• Support: $ 3.00 psychological levels, tested under high volume distribution

• Risk: Breakdown towards the $ 2.96 demand zone if $ 2.99 failed

• Signal: Bullish Triangle Structure intact, but momentum that fades under income income