Corporate Bitcoin (BTC) Treasury can raise credit risks, says MorningStar DBRS

Corporation use of cryptocurrencies is emerging beyond payments, with a number of businesses that adopt bitcoin and other digital assets as the main reserve of Treasury. A report Thursday from the MorningStar DBR rating company has been cautious that this approach can increase credit risk profiles.

According to Bitcointreasuries.netapproximately 3.68 million btc (costs about $ 428 billion to August 19) will be held in companies, funds exchanged by the exchange (ETFS)governments, decentralized finances (Defi) Protocols and custodians. It is about 18% of the supply of circulating -transfer of bitcoin.

Funds are dominant with 40% of handles, followed by public companies at 27%. That exposure remains completely concentrated. A firm, approach (Mstr).

The MorningStar DBRS has highlights a set of weaknesses in corporate crypto treasury techniques, including uncertainty of regulation, liquidity challenges during periods of volatility and exposure to substitutes.

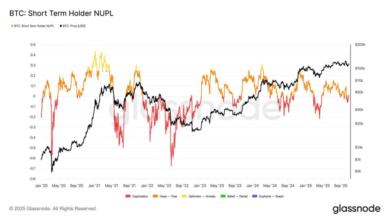

Heavy hopes of bitcoin reserves can aggravate liquidity management, while the sharp price of asset swings increases additional risk.

The firm also noted that various tokens bring unique technological and management issues, and caution, if handled if at home or by third parties, remain a critical security concern.

Corporation adoption of Crypto Treasury techniques is expected to grow, led by companies such as Strategy and Mara Holdings (Mara). The Morningstar DBR has warned that concentration, volatility, and regulation complexity means that techniques can be able to recharge how credit market markets can assess corporate risk.

Read more: Bitcoin Treasury Firm Semler Scientific still has 3x Upside: Benchmark