Blog

Dogecoin jumped in 21-cent despite the $ 200m moving whale to Binance

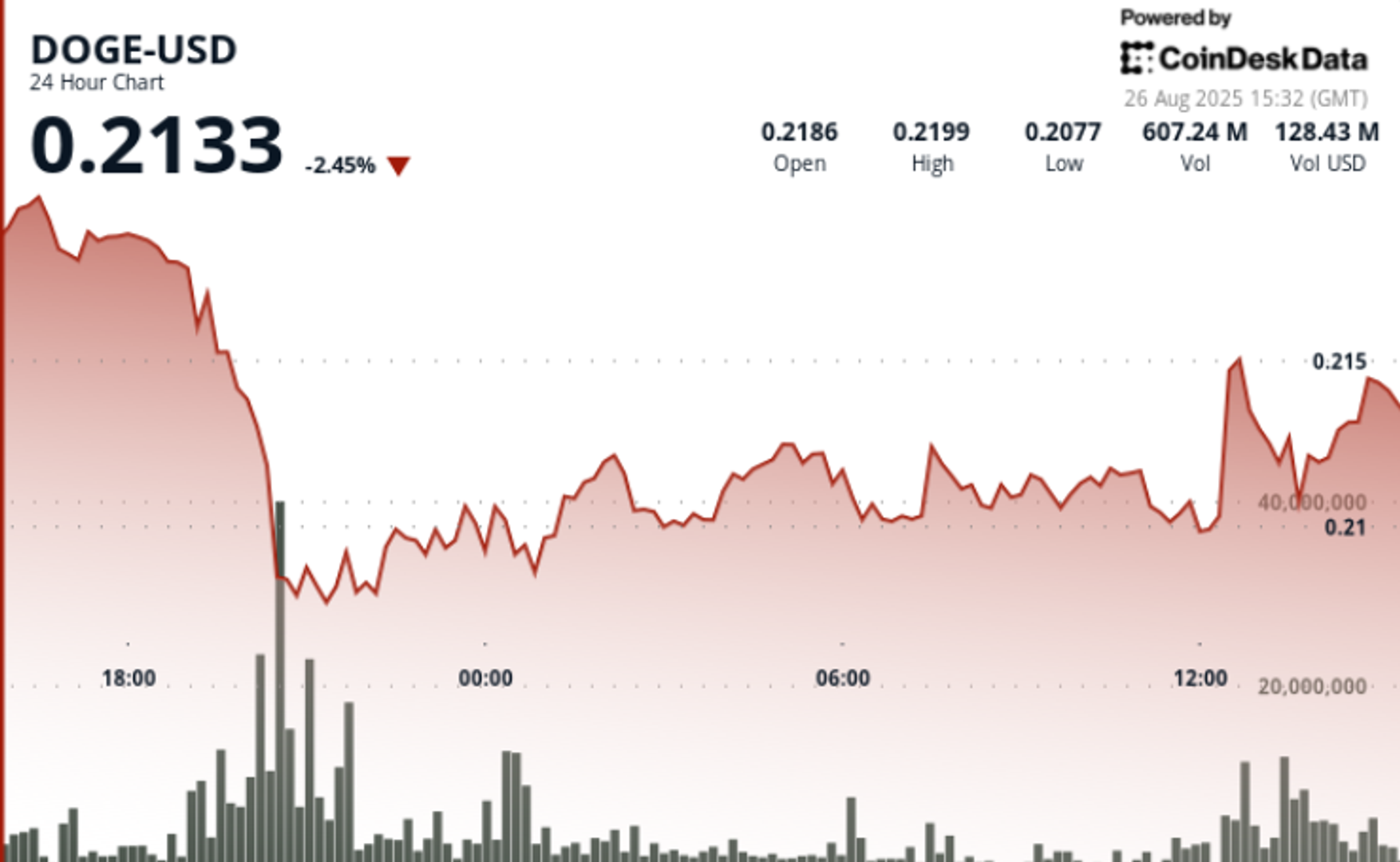

Dogecoin exchanged heavy volatility in the August 24-26 window, which was swinging for a $ 0.013 range before combining close to $ 0.21. A sharp collapse from $ 0.218 to $ 0.208 on August 25 came in the middle of a massive 1.57 billion volume, while the broader pressure was tied to a 900 million DOGE moving to Binance without failing entrepreneurs.

Despite close precautions, whales continue to accumulate, leaving a sentiment between breakdown risks and purchase optimization.

News background

- Whale transfers add fuel to volatility: between August 24-25, a single 900 million doge ($ 200+ million) has been moved to Binance from a long-term holding purse.

- The sentiment on the market is sour in the fear of a seller-off, with an open interest in Doge’s futures dropping 8% as speculative merchants who are Pared Exposure.

- Despite the outflow, on-chain data shows whales that have accumulated more than 680 million dogs in August, counting retail distribution.

- Fed Powell’s Jackson Hole comments sparked a 12% meme coin sector rally, which aligned with Doge with a greater risk-at momentum.

Summary of price action

- DOGE posted a 6.06% spread in a 23-hour session ending August 26th at 12:00, trade between $ 0.221 and $ 0.208.

- The sharp move arrived at the period 19: 00–20: 00 GMT on August 25, when DOGE fell from $ 0.218 to $ 0.208 to 1.57 billion quantities.

- The price is also whipsawed after the whale transfer, swing from a $ 0.25 high to test $ 0.23 support before stabilizing.

- A rebound raised Doge from $ 0.210 session lows up to $ 0.211- $ 0.212 in 11: 27–12: 26 GMT window on August 26th, assisted by a 17.85 million spike volume at 11:58.

Technical analysis

- The support established at $ 0.208 following a high volume collapse.

- The resistance holds at $ 0.218- $ 0.221, capping rallies.

- Current integration – including between $ 0.210- $ 0.212 suggests accumulation.

- The RSI recovered from oversold levels near 42 to mid 50s, showing the stabilized momentum.

- The MacD histogram narrows towards the bullish crossover, which signed a potential reversed upside down.

- Open the fall of interest by 8% points to reduce imaginary action, limiting volatility but also dampening near the term upside down.

- The sustainable trade above $ 0.21 with elevated volumes (+16% compared to 30-day averages) adopted the bullish case.

What do entrepreneurs watch

- Bulls target a breakout towards $ 0.23- $ 0.24 if the integration is upward and the whale purchase continues.

- The Bears featured $ 0.208 as key downside trigger, with the risk of opening the break to $ 0.200.

- The tug-of-war between exchange inflows (distribution risk) and whale accumulation (support demand) remains decisive factor for the next leg.