The CAP CAP climbs BTC to $ 1.05 despite the withdrawal of prices

Bitcoin (BTC) Benefiting from the capitalization, the scale on the series that measures the value of the coins that it last dealt with, continued to rise even with the decrease in the immediate price, indicating the investor’s condemnation of the network and a reference to the economic spine of the largest encrypted currency.

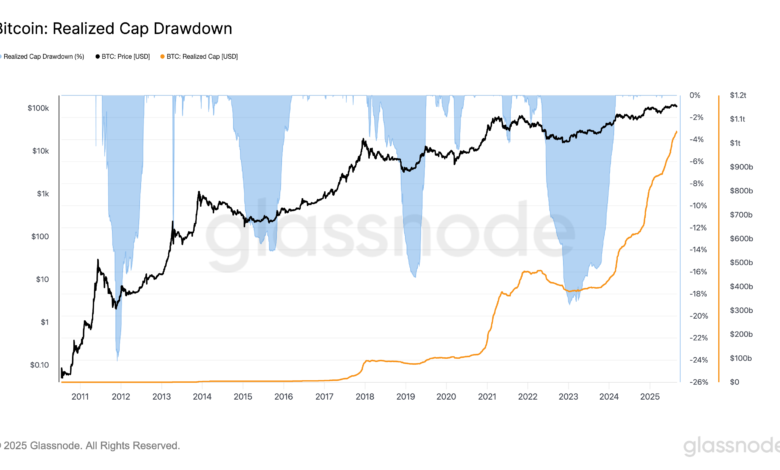

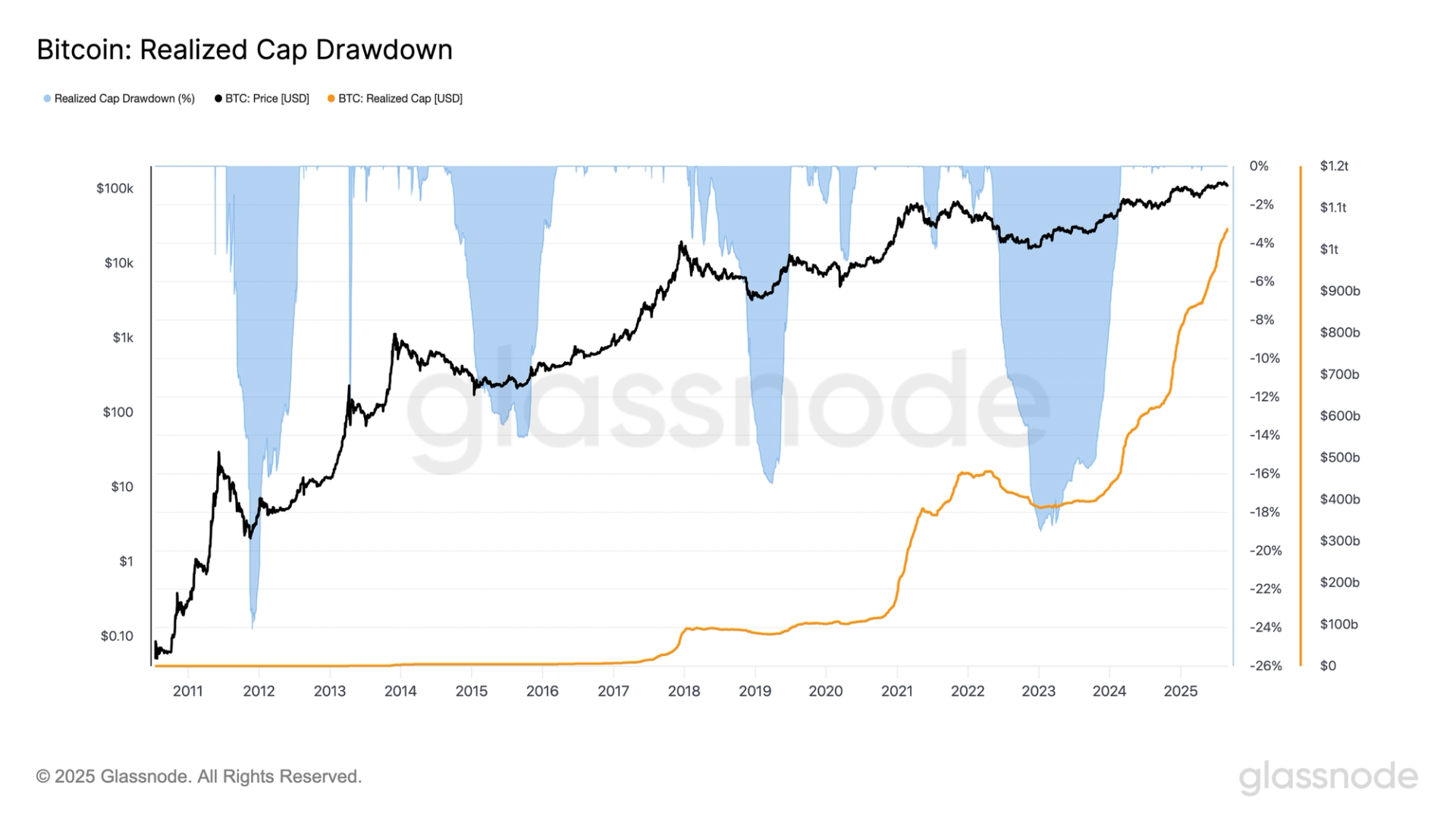

After crossing for the first time a trillion dollars in July, Glassnode data appears that the achieved CAP is now at a record price of $ 1.05 trillion, although the instant price slides about 12 % of its peak at all near $ 124,000. While the market value decreases with the decrease in the immediate price because each currency is at the current level, the achieved CAP is only seized when the coins are spent and reactivated on the chain.

Under the CAP model, the inactive holdings operate, their holders operate in the long run and the lost coins as a stabilization, which prevents large withdrawals even when the short -term procedures turn into negativity. The result is a better procedure that reflects the real investor’s condemnation and depth of capital committed to Blockchain.

In previous sessions, CAP investigators suffered more severe withdrawals. During the 2014-15 and 2018 bear markets, it decreased by up to 20 % as it forced prolonged surrender to large amounts of coins to be reshaped. Even in 2022, the scale witnessed a decrease near 18 %, according to Glassnode data.

This time, on the contrary, the CAP is acquired although the dual -number price correction. This highlights how the current market absorbs volatility with a more flexible basic base.

publish_date