Federal Reserve US Interest-Rate Cut can spark a resurrection in BTC’s Basto Trade

The big question for bitcoin is if the basis of trade, an attempt to earn from the difference between the price of the futures area and market, will return if the Federal Reserve is cutting interest rates in Sept. 17.

There is a 90% chance that the Federal Open Markets Committee will cut the rate of the target federal fund by 25 points basis from the current 4.25% -4.50% range, according to Tool of CME Fedwatch. A move towards the easier policy can sparkly change demand for seizure, pushing premium futures higher and breathing life back to a trade that has remained covered throughout 2025.

Trade basis involves the purchase of Bitcoin in the market area or by a funds exchanged by the exchange (ETF) While selling futures (or vice versa) to earn from the price difference. The goal is to obtain the spread as it narrows toward expiry, while limiting exposure to volatility of bitcoin prices.

With Fed funds just above 4%, an 8% basis – the annual return on the basis of trade – may not seem to be appealing – until the rate cuts start to accelerate. Investors are likely to want lower rates to be incentive to go to the basic trade rather than just handling cash.

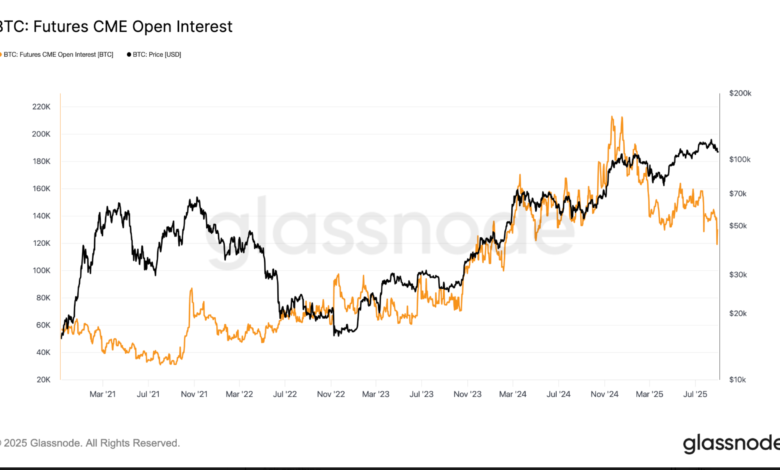

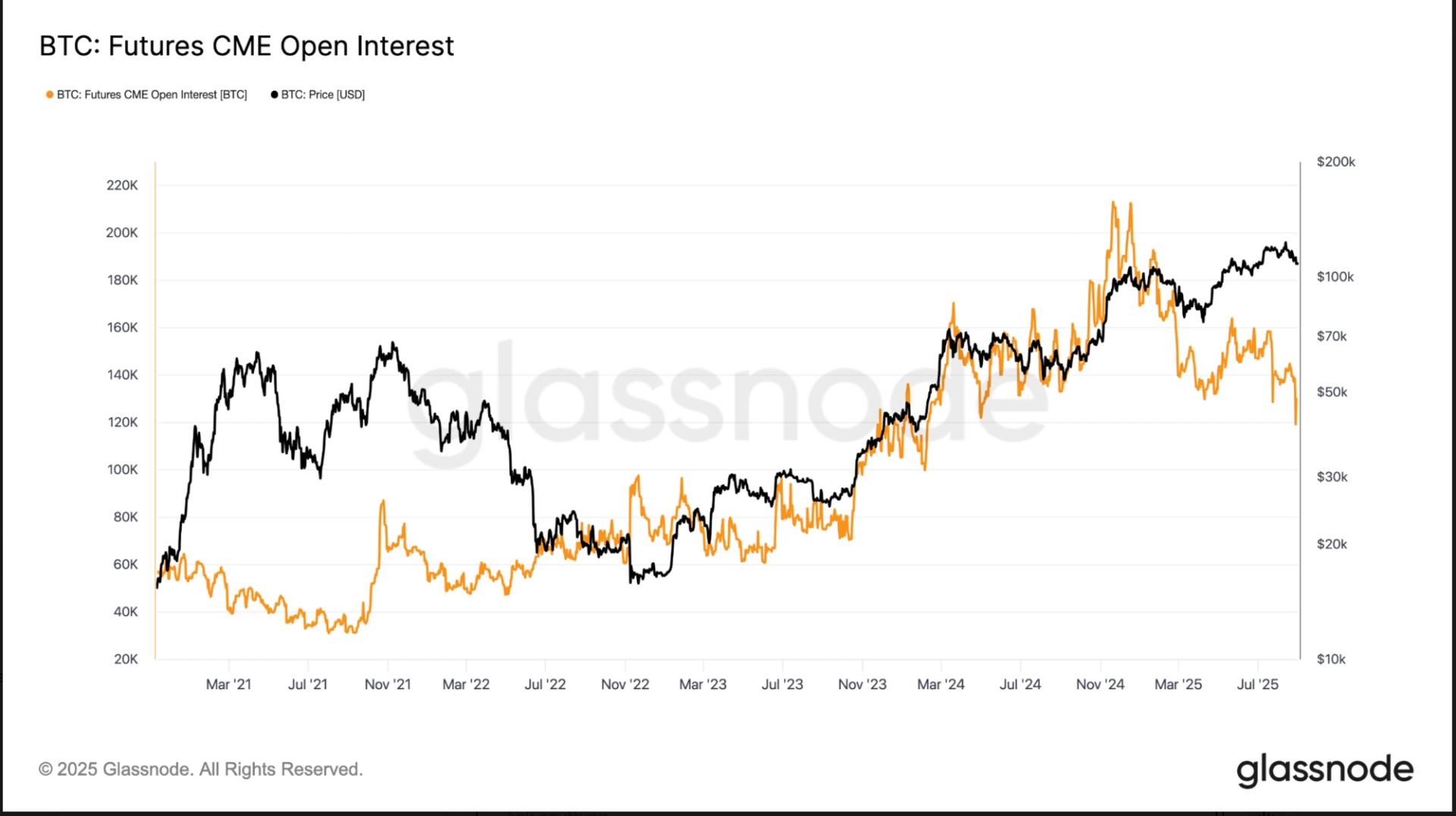

In CME, the Bitcoin Futures Open interest fell from more than 212,000 BTC at the start of the year to nearly 130,000 BTC, according to glassnode data. This is almost the level visible when the Bitcoin ETFS spot launched in January 2024.

The annual basis remained below 10% throughout the year, according to Date of veila noticeable contrast to 20% visible until the end of last year. The weakness reflects both market and macro forces: lighter funding conditions, the ETF flows after the boom of 2024 and a rising appetite outside of Bitcoin.

The compressed scope of bitcoin trading has strengthened the trend. The indicated volatility, a scale of expected price swings, was only 40 after the hit of a record of less than 35 last week, shownode data is displayed. Through volatility restrained and institutional light of leverage, the futures premiums remained on the cap.

If Fed reduction rates, liquidity conditions can be eased, strengthening demand for risk properties. Once again the CME futures can be lifted to open interest and live the basis of the trade after a year of disruption.