Pepe faces a 15% risk of falling while trading volumes and on-chain activity have dropped

Meme-inspired cryptocurrency Pepe is under pressure after slipping below a major support level, sparking Warnings of a possible 15% collapse.

Moving arrived as trading volumes fell to $ 980 million and the open interest contracted 4% to $ 535 million based on Coinglass Data, signing a waning conviction to entrepreneurs.

Derivatives data show a long liquid that hit $ 326,000, which is far over $ 9,900 in shorts, based on the same data source, featuring an imbalance that can accelerate the downward momentum.

Meanwhile, the activity on the Pepe Network collapsed to fewer than 3,000 -day -day active address, Glass node Data displays. That was a sharp fall from late 2024, when a peak of 27,500 addresses were active at a major price rally.

According to the Trader Alpha Crypto signal, the price of Pepe can detect a major deterioration and slow to $ 0.0000085 to $ 0.0000080 area as it comes from a symmetrical triangle.

Meanwhile, meanwhile Nansen Data for the past week shows the top 100 Pepe addresses in the Ethereum blockchain only increases 0.2% to their holdings, while Pepe on Exchanges increases by 1.13%.

Overall -analysis of technical analysis

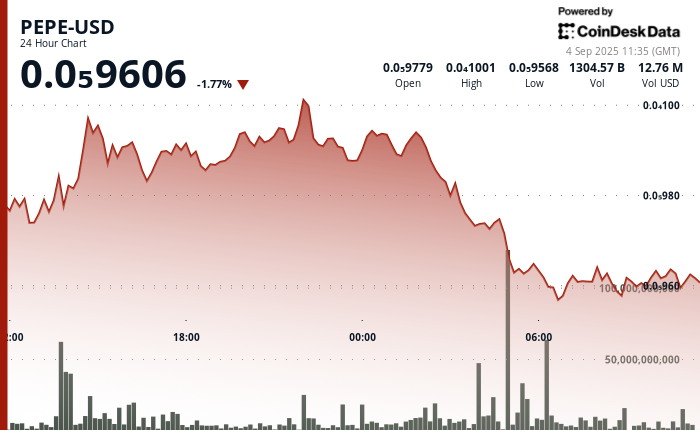

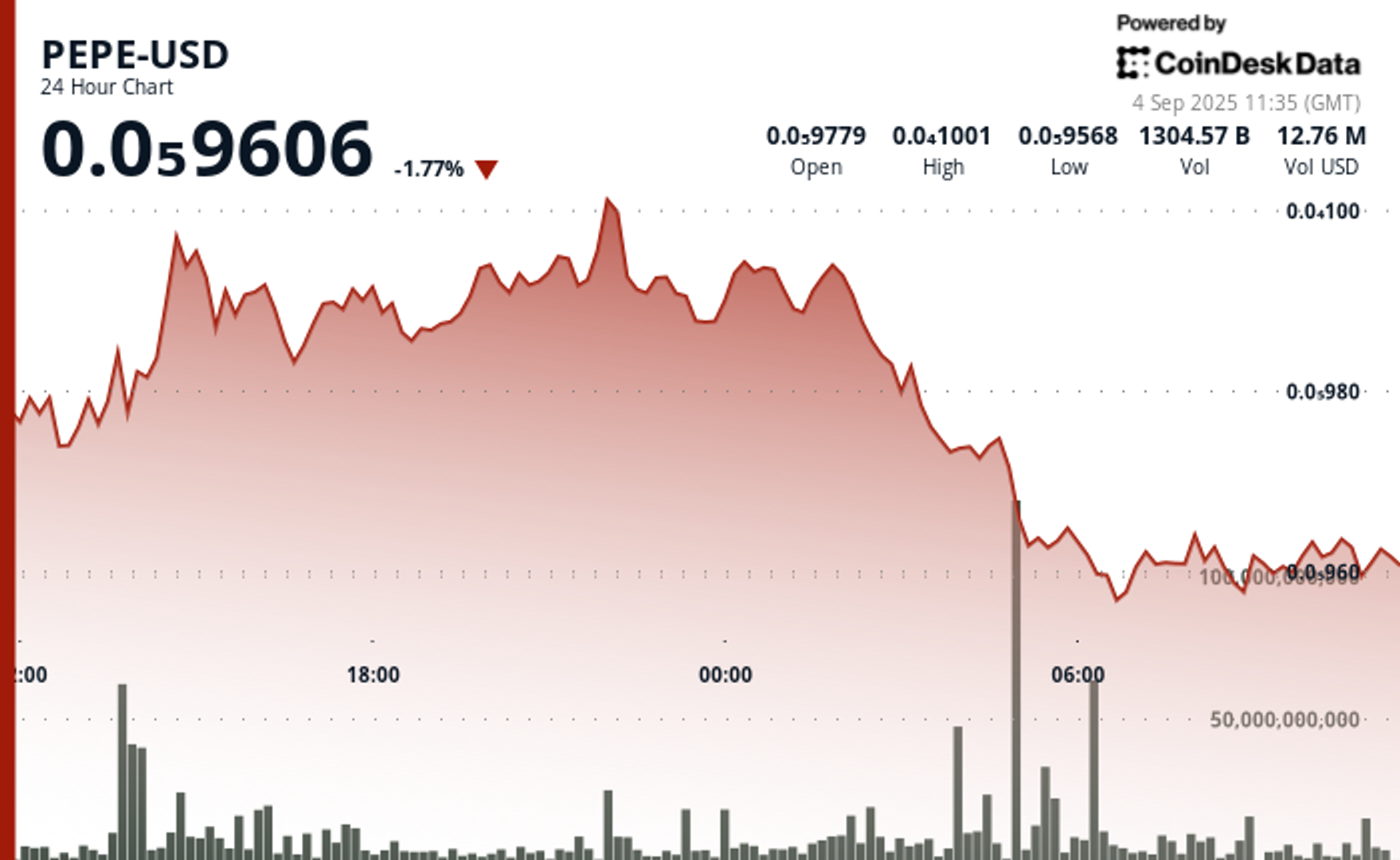

Pepe showed volatility during the latest trade cycle, with a 5% range between $ 0.000010028 at high and $ 0.000009567 to low, according to the technical review model of CoinDesk Research’s technical research research.

A rally earlier in the week briefly pushed prices to the $ 0.000010000 Mark in the volume of 2.6 trillion tokens, but the move was stuck and the seller was regulated.

Since then, the token has been lower, testing $ 0.000009610, a 4% pullback from recent highs. Time -rus trading also showed resistance that forms near $ 0.000009640 despite the sharp volume of spikes above 89 billion, suggesting distribution rather than accumulation.