Stablecoins, ETPS and Law The main themes for the return of crypto to Q4

Crypto prices are likely to get rid of the law of the crypto market structure, stablecoins and a flood of exchange-exchanged (ETP) products in the fourth quarter, analysts in cointelegraph, after property tied to digital treasures led in the last quarter.

In a report released on Thursday, the Crypto Asset research team Grayscale Says The law of the crypto market structure in the US, the Law of EnlightenmentRepresents the “comprehensive financial service law,” and can be “a catalyst for a deeper integration in the traditional financial service industry.”

Meanwhile, the Securities and Exchange Commission’s Approval of a common standard on the list For ETPs based on goods can also spark flows as it increases the “number of crypto assets accessible to US investors.”

Researchers also said that “Crypto assets should be expected to benefit from Fed rate cuts,” along with Federal Reserve collapse rates on the first time since last year on September 17, with more possible on the road.

Although JPMorgan CEO Jamie Dimon doubts more rates, and said on Monday that he was thinking of the Fed will have difficulty cutting interest rates unless inflation decreases.

Stablecoin chain may appear as winners in this quarter

Talking to Cointelegraph, Edward Carroll, head of Crypto markets and blockchain investment firm MHC Digital Group, he said he expected Stablecoin growth To be a major driver of return to Q4.

US president Donald Trump Signed the Genius Act in law in July. It aims to establish clear policies for payment stablecoins, but still await final regulation prior to implementation.

“It should be positive medium- up to long-term for any chain used for stalls, Ethereum, Sol, Tron, BNB, Eth Layer 2S, but more start to companies that build and provide products on the market,” Carroll said.

At the same time, he predicts that tokenization institution applications will begin to obtain traction, as larger players begin to pursue more tokenized funds in the money market, bank deposits, and funds exchanged by the exchange (ETF).

Bitcoin and Altcoins can also have a bumper quarter

Pav Hundal, lead analyst at the Australian crypto broker Swyftx, told Cointelegraph that more money flows into crypto through funds and automatic contributions, and a bitcoin (Btc) rally by the end of the year will fuel an altcoin surge in Q4.

A report from the Financial Services Company River Released earlier this month was found Those ETFs spread, on average, 1,755 Bitcoin per day in 2025.

“Unless the market is kneeling something unexpected, Bitcoin is likely to hit new highs before the end of the year, and that will fuel the altcoins,” Hundal said.

“This is a rotational market for all 2025, with ALT coins performing well after an initial Bitcoin rally. I can’t find any reason to change that pattern.

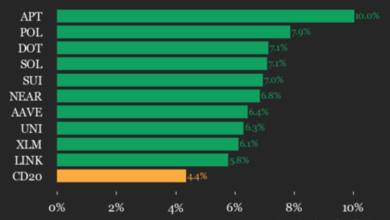

Last quarter, Hundal said the big theme was the companies listed in the US converted to digital asset treasures, with ether (Eth), Solana (Sol) and the hype that is emerging as the leading performer in the last few months.

Related: Crypto Treasury Share Buybacks can signal a ‘breed of credibility’ is in

Defi projects that make up income can also be a winner

Henrik Andersson, chief investment officer of Apollo Crypto, told Cointelegraph that he hoped the Q4 would include the ETF approved in the US, including staked assets, and the Clarity Act to pass.

“On a sector basis, we believe that projects that make up the Defi income will continue to perform well. Stablecoins and RWAs are likely to continue to be the main themes in general.”

However, he also said that “the rate of expectations in the US can fail because the economy and labor market seems to be better than the Fed fears when it lowers rates.”

During the last quarter, Andersson said Hyperliquid and Pump Buybacks made big waves in crypto markets, along with the “proliferation of digital treasure assets.”

Magazine: How do the world’s major religions look at Bitcoin and Cryptocurrency?