XRP rallies to the Sec Catalyst Window, Resistance Cement at $ 2.93

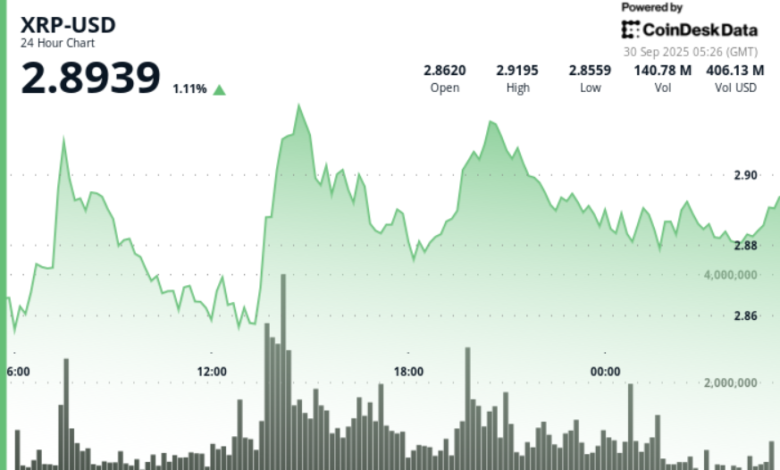

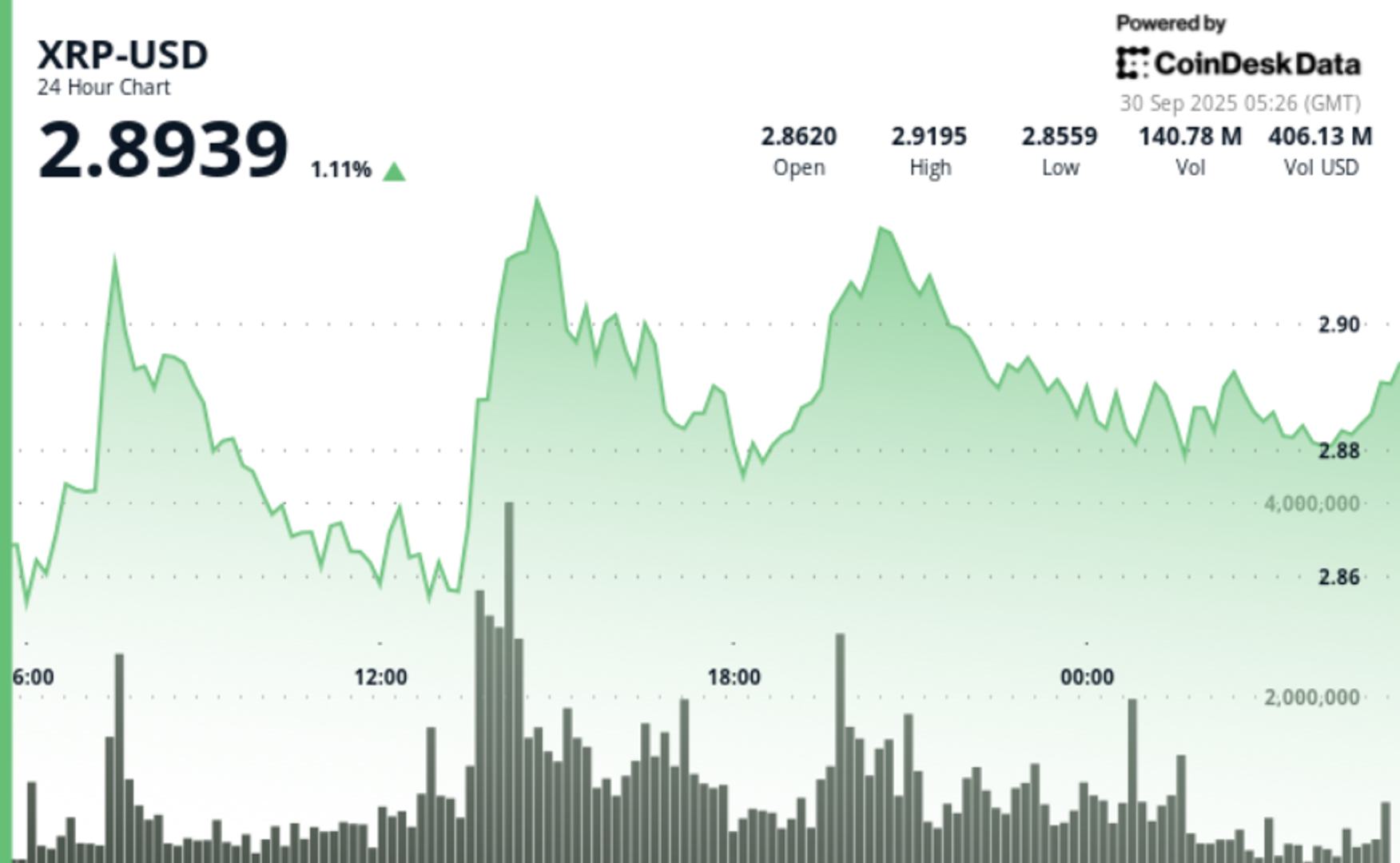

XRP gained 2.1% during the 24-hour trading session from September 28 to 21:00 to September 29 at 20:00, climbing from $ 2.84 to $ 2.90 while moving within a $ 0.10 range that represents 3.47% of the opening price.

News background

• Large institutional addresses that hold between 10-100 million XRP tokens accumulated more than 120 million coins in the last 72 hours.

• Seven applications of XRP spot ETF remain pending before the US Securities and Exchange Commission. Grayscale’s submission was scheduled for October 18, with others lining up until November 14, creating a concentrated window of catalysts regulations that could reshape near the flows.

• The sentiment in the market is that it is being hoped by increasing exposure to the corporate portfolio. Analysts approved the ETF as a structural driver that could accelerate XRP adoption within institutional allocation techniques.

Summary of price action

• Exchanged by XRP within a $ 0.10 corridor, which changes between a low $ 2.84 and a high $ 2.93, reflecting 3.5% volatility during. The price is up close to $ 2.93 where the sale pressure intensifies, especially during the September 29th session 14:00.

• The most significant upward motion arrived at 02:00 and 07:00 GMT on September 29, where the volume reached more than 97 million units. These significantly release a sun -average of 57.4 million, proving the institution’s participation in the rally stages.

• The final trading time has expanded the advance, as the price moved from $ 2.88 to $ 2.90 for a 0.7% late gain. Breaking the $ 2.90 psychological barrier was confirmed by a 4.8 million volume of unit explosion, taking the session to the highs before repairing around $ 2.9045.

Technical analysis

• The resistance is clustered between $ 2.92 and $ 2.93, where the price is repeated in a higher volume. This zone marked the next drawback for continuity, with a breakout confirmation that would probably require a close more than $ 2.93 in expanding participation.

• Support is combined between $ 2.85 and $ 2.86, where consumers continue to defend the bids during the period. Multiple successful retests of this band throughout the session will highlight its importance as an accumulation zone.

• The $ 2.90 psychological level moved to a near term pivot. The price of the late session will be able to reclaim, and traders will monitor if it can be handled in support of heading on the weekend.

• Volatility in the 24 -hour window reaches 3.47%, corresponding to raised institutional repositions around the major catalysts of regulation.

What do entrepreneurs watch

• If the XRP can maintain a closing above $ 2.90 and it will be in support, which will prove continuing attempts towards $ 3.00 and more.

• The October Analysis window -November ETF of the SEC, with the date of October 18 of Grayscale seen as the first major catalyst structure for institutional flow.

• Wallet activity activity, with 120 million tokens accumulated within three days suggesting further upside down if this speed continues.

• Wider macro conditions, with volatility of treasury produce and Fed policy signals that influence appetite in risk in both equality and digital assets.