Why is Pepe coming down now? Price dropped by 2.6% amid the wider memecoin sector

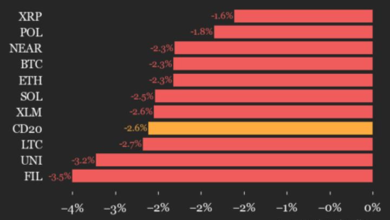

Meme-inspired cryptocurrency Pepe fell 2.6% in the past 24 hours to trade near $ 0.0000915, which significantly underperforming the broader crypto market as CoinDesk 20 (CD20) The index drops 1.4% at the same time.

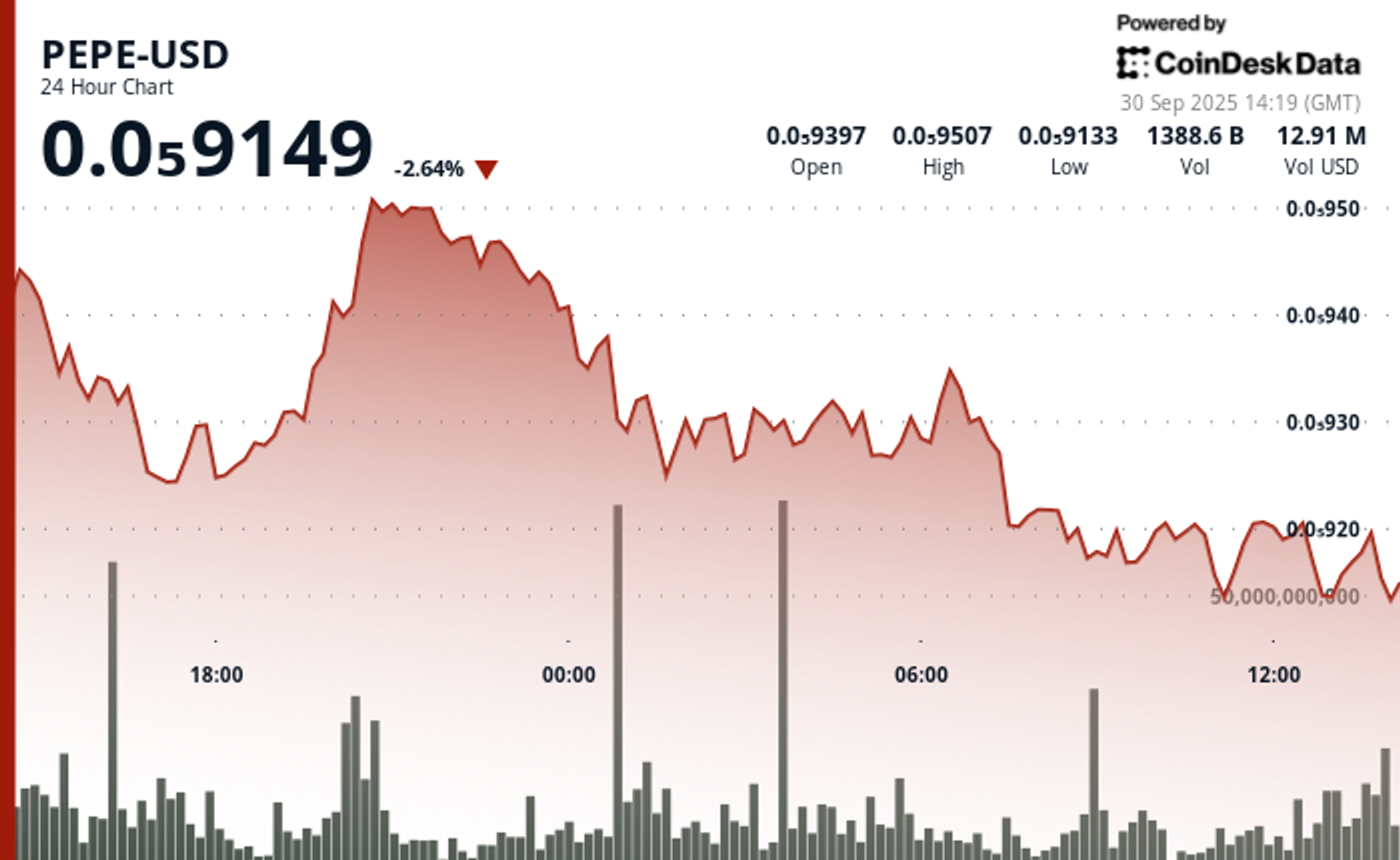

The token was exchanged to a range between $ 0.0000913 and $ 0.0000951, with a brief attempt at a rally stalling near the fight before giving way to a slow denial, according to the CoinDesk Research’s technical research review model.

The session was opened near $ 0.0000939 and sank early around $ 0.000095 before the sale of pressure weighed to the token. Pepe’s price continues to refuse throughout the night and morning time, brief integration -including near $ 0.000092 before sliding down.

Despite the collapse, activity in the derivatives markets continues to build and Pepe has managed to release the Memecoin sector, measured by the coindesk memecoin index (CDMEME) has dropped 3% in the past 24 hours.

Open interest in Pepe Futures reached $ 560 million according to Coinglass The data, while the total trading volume rises to $ 1.2 billion.

So far, market observers are focused on whether Pepe can maintain a foothold above $ 0.000091 zone support or risks slipped towards lower ranges.

A break above $ 0.000095 may change emotions, but any such transition needs to be supported by stronger volume and confirmation from greater market conditions.

Overall -analysis of technical analysis

The 24 -hour Pepe trade covers a $ 0.0000034 spread, about 4% between highs and session lows. Sellers continue to appear near $ 0.000095, making it a clear level of resistance so far.

Support near the $ 0.000092 held during the early and mid -session period but weakened at the last time. The token showed signs of a higher low formation earlier in the session, a structure often associated with bullish accumulation.

However, the decline of the volume in the near paint of a picture of reluctance, non-belief.Temporary Surge on trading activity suggests some positioning during short-term breakout attempts, but efforts that have lost the steam as the volume has dropped.

Unless consumers return to strength, a recent incorporation attempt can give way to a broader presence.