AAVE Aced Market Stress Test with $ 200m in liquidations and no new bad debt

Decentralized lending protocol Aave processed by millions of liquids Monday without compiling any new bad debt, showing its stability during market volatility, Data from Chaos Labs Shut up.

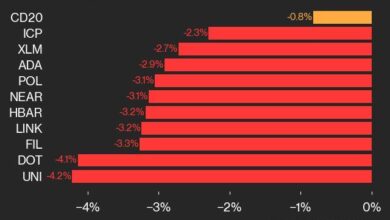

The crypto market is missing early Monday, with the price of bitcoin (Btc) Falling nearly $ 91,000 from $ 100,000 as concerns of a modified trade war between the US and the leading partners in Canada, Mexico and China sent shockwaves through financial markets. The slide returned later the day after President Donald Trump’s tariffs in Mexico were silent for 30 days.

Solid two-way price actions have led to margin deficiencies, resulting in massive prevention, forced closing positions in centralized and decentralized trading avenues. One alone has processed $ 210 million in liquids, the highest single day tally since the August 5 crash, the data shows. More importantly, the protocol avoids getting new bad debts.

The protocol gets a bad debt when the borrowers are unable to repay their loans and the collateral provided is not enough to cover the remaining amounts. The risk was higher during the PABAGU -change of market conditions, such as on Monday, when the sharp price refused and low demand hindered effective collateral destroying.

“Liquids are carried well throughout the protocol, most of which are carried out in the essential example of Ethereum. The stable risk mechanisms within the Aave ensure that collateralized positions are fixed as intended , which reduces protocol losses, “Chaos Labs told X.

AAVE is essentially ACED to test the stress of the market, showing the efficiency of risk control steps and destruction mechanisms. Its existing bad debt refused even 2.7% due to the fall of the amount of debt assets.

Pseudonymous Defi Leo’s observer Hailed aave’s performance As evidence of the strong foundation of decentralized finances, which includes “strict collateral selection and management through management, excellent protocol design for fluids, thick pools of ecosystem pools in the ecosystem.”

The upcoming upgrades such as AAVE V3.3, V4 and umbrellas updates indicate a promise future for the Defi industry, Leo said.

Version 3.3, announced in December. The version also helps control the build-up of so-called dust debt, which is a small amount of debt that is difficult to clear or liquid because of their neglected amount.