BTC hashrate hits all the time high analyst hopes

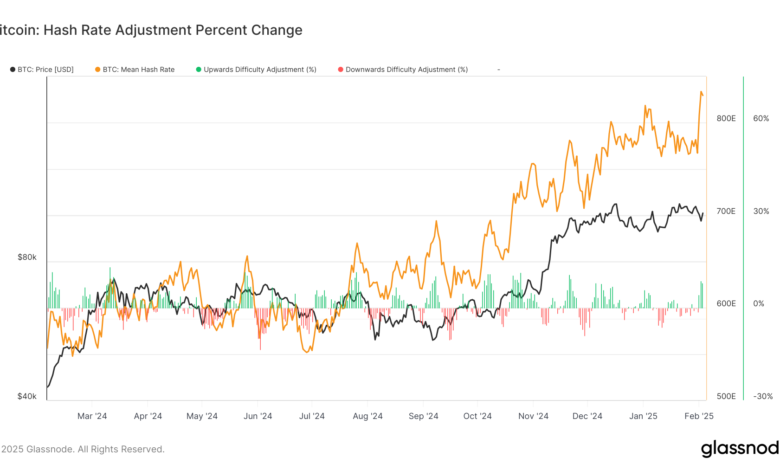

The hashrate of Bitcoin (BTC) reaches another high time, with a seven -day moving average jump at 833 exahashes per second (eh/s), according to glassnode data. This represents a 9% increase from 767 eh/s in recent days.

According to Miner Mag, pre-orders for hardware mining began to refuse following the pre-halving surge. Many mining companies have been to the equipment in this event, ensuring that their operations have remained competitive; However, analysts are now expecting a slowing down hashrate.

The hashrate measured the computational power used to secure the Bitcoin network through mining, and a higher hashrate indicates more network security.

According to Miner magThe network has seen a significant increase in the hashrate over the last 18 months, driven by more through institutional investment in mining infrastructure.

The climb preceded the stop of April 2024 of Bitcoin, which has been around for almost four years and reduces the block reward by 50%. Due to the division, the hashrate increased by more than 40%, indicating continuous expansion in mining operations.

The hashrate increases in conjunction with the mining profitability that has been relatively flat in recent months. One major reason for this is low history transaction fees, which reduced miner’s revenues.

In Bitcoin Mempool, a high priority transaction costs only 5 SAT/VB ($ 0.69)-one of the lowest levels of charge in recent years. With fewer transactions generating fees, miners earn less from transaction fees, making it harder to offsetting operating costs.

The long-term model of the economic Bitcoin network depends on transaction fees that gradually replace the block subsidy as the main source of miner’s income, but the current dynamic markets bring challenges to this model.

At the forefront, the next difficulty repair is scheduled for four days and is expected to increase by more than 6%, take it to a full time and put additional pressure on the miners.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.