The BTC price continues to track the previous session despite the low prices, the tariff war: Van Strawn

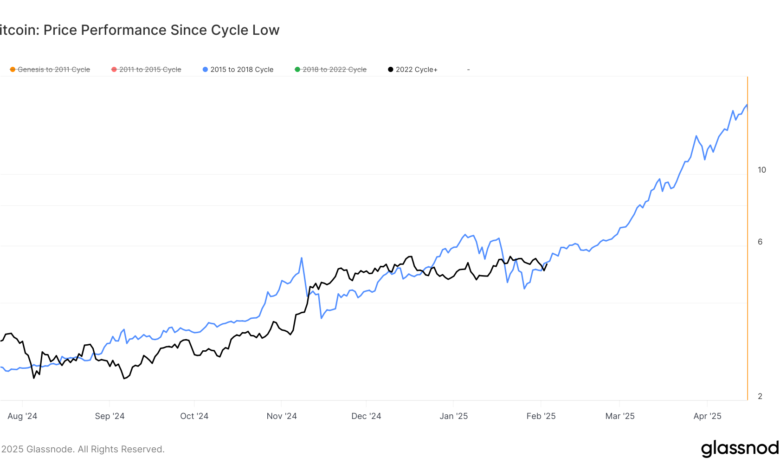

Bitcoin (BTC) continues to follow up path From the 2017 session. Despite the disturbances in the last market, driven b Escalation tariff Tensions between the United States and neighboring countries, as well as China.

Bitcoin still rises about 525 % of its decrease during the FTX collapse in November 2022. Relatively, at the same stage in the 2017 cycle, Bitcoin rose by 533 %.

Whereas, there is another way to evaluate the periodic Bitcoin behavior, which is the measuring returns from its highest previous levels ever. The peak of the market occurred in the last round in April 2021 at about $ 64,000, although the highest level in Bitcoin was $ 69,000 in November 2021.

However, many indicators indicate the series that April 2021 indicates the top of the real cycle. Despite the ongoing geopolitical tensions, Bitcoin showed a remarkable consistency in tracking previous sessions.

In addition, Bitcoin (BTC) has been in the range in the range of $ 90,000 to $ 109,000 during the last 2.5 months channel, even amid the growing market fluctuations. Bitcoin continues to test both the upper and lower boundaries of the current trading channel.

At the same time, the previous one Coindsk Research Select $ 91,000 as a local bitcoin.

publish_date