How a businessman became shocked with $ 192m profit

How an anonymous wallet benefited from the crypto frenzy

An anonymous wallet (0xB317) on the Hyperliquid Derivatives Exchange reportedly made a $192-million profit in just a few hours during a period of sharp market volatility.

As bitcoin (BTC) and ether (Eth) Prices fell sharply, many traders were hit with liquidity that removed more than $ 1 billion in leveraged positions. During the sale, an entrepreneur is managed at time a short That pays off in a big way. Whether it was luck, timing or experience is unclear.

The WalletThe timing, minutes before a US tariff announcement triggered a market plunge, fueled speculation about insider knowledge or market manipulation. The incident highlights the significant influence of high-leverage trading on decentralized finance (defi). It also revealed the complex reality of modern crypto markets, where anonymous traders can move billions and shape market sentiment with a single trade.

How the US trade war news triggered massive liquidity in the crypto market

The market meltdown began shortly after the US administration unexpectedly announced it would impose 100% tariffs on Chinese imports, catching investors off guard. The news sent shockwaves through global markets.

The announcement of the tariff caused stock prices to fall sharp swings in derivatives and pushed cryptocurrencies into a steep decline. Within hours, the value of Bitcoin fell sharply, prompting widespread liquidations across the board exchange. However, weaknesses in the crypto market were well established before the Tariff News broke.

The Perpetual futures The market is already overloaded with open interest and excessive leverage, creating a delicate situation where even a small shock can trigger a wave of margin call.

In this context, hyperliquid, a decentralized derivatives platform, stands out. Unlike centralized exchanges (CEX) which have lighter controls, The open structure of Hyperliquid This made it a preferred place for bold, high-stakes trading by major traders.

do you know Some traders short crypto to hedge their long-term holdings. By betting against price dips, they can protect profits during volatile weather. It’s like getting insurance on their portfolio, allowing them to stay invested even when the markets shake.

Fall of $ 190-million revenue of onchain

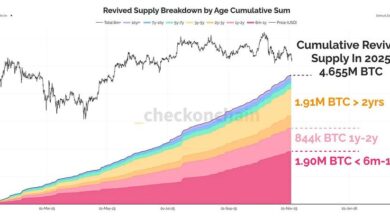

Blockchain data tracking popular wallet trade “0xb317,” which opened a massive short position before the US tariff announcement reportedly sent crypto markets crashing.

In hyperliquid, the trader placed A $208-million cross-margin perpetual short with 20x leverage. The position was entered around $116,800, with a liquidation level near $121,000. As the price of Bitcoin fell, the trader’s unrealized profit topped $190 million – one of the most successful Onchain short trades on record.

However, trade has wider consequences. More than 6,300 accounts lost, more than 1,000 wallets Absolutely liquid, and total losses exceeded $ 1.23 billion. Hyperliquid’s automatic elimination mechanism reinforced the decline, adding to the selling pressure.

Within hours, the trader’s wallet position is deep in profit. It remains unclear whether the position is fully closed or partially maintained, leaving followers guessing about the trader’s timing and strategy.

do you know A large short position can intensify selling pressure, triggering a cascade of liquidations when prices decline. This creates a domino effect where each wave of liquidations drives prices even lower.

Wallet “0xB317” launches a new $163-million short against Bitcoin

Just days after reportedly earning $192 million, Wallet “0xB317” entered another major short trade. On October 12, 2025, the trader opened a $ 163-million leveraged position, betting against the price of Bitcoin.

The businessman used almost 10x leveragewith an entry price close to $117,369 and a liquidation level at $123,510. The position leaves only a small margin, only a few thousand dollars above entry, before hitting the risk of liquidation, which reflects both confidence and strategic risk management.

Implementation suggests a deep understanding of market timing and liquidity dynamics. The trader appears to have a strong insight into market movements and economic events, which allows them to consistently achieve volatility with the right timing and scale.

Success, systematic risk and the risks of decentralized action

The crypto community is divided over Wallet 0xB317’s $192-million short trade. Some see this as an amazing display of market skill, while others believe it is simply luck.

A section of the crypto community believes that the success of the anonymous trader comes from the skillful reading of onchain data, derivatives positions and market sentiment. Others, however, attribute the outcome to luck, arguing that random events can occasionally align with major global developments.

The timing of the trade, just minutes before the US tariff announcement, sparked speculation about insider knowledge or running in front. Verification of such activity in the decentralized market is almost impossible. Some also argued that large short positions could deepen the market crash by triggering a wave of liquidations that intensified the selling.

Despite the trader’s success, significant risks remain in short trading. A sudden market rebound can trigger margin calls, Slippage or liquidation, showing how quickly fortunes can change in the high-stakes, leveraged world of crypto trading.

do you know Short traders often use leverage, which means borrowing funds to boost returns. While a 20x short can boost profits, it also magnifies losses. A small 5% move against the trader can wipe out the entire position, showing that the action is both exciting and risky.

Accountability to anonymity: The legal and ethical challenges of the $192-million short

The $192-million short trade sparked renewed discussions about the integrity of the largely unregulated cryptocurrency market. It also highlighted the wide gap between anonymous traders, or “whales,” and smaller retail participants.

The $192-million short trade not only marked a major gain but also sparked widespread discussion about the need for stronger oversight, transparency and accountability in the increasingly unregulated cryptocurrency markets. In traditional finance, compliance with insider laws and market abuse laws are standard, but such checks are still emerging in the crypto space.

For smaller traders, the event serves as a reminder of how high leverage and limited capital can lead to serious losses during volatile times.

The incident also raised concerns about decentralized derivatives platforms and their ability to handle large commodities without causing market instability. This shows that even with protections such as auto-diseverage systems and insurance funds, these platforms can still struggle under extreme conditions.

The trade also prompted both ethical and legal questions. If market manipulation occurs, who can be held accountable in an anonymous market? Regulators may need to monitor trader activity more closely, especially with whales. Developing stronger risk management tools can also help reduce the risks associated with such situations.