Bitcoin CPI Relief was short-lived after a brief trip to $112,000

Key points:

-

Bitcoin Price action whipsaws around a cooler-than-expected CPI print.

-

Optimizing risk assets is increasing, with the Federal Reserve seeing continued interest rate cuts through 2026.

-

BTC found resistance at $112,000, as key support levels emerged.

Bitcoin (BTC) saw fresh volatility on Friday as US inflation data sent stocks to new all-time highs.

CPI Relief Fuels New Highs for US stocks

Data from Cointelegraph Markets Pro and TradingView BTC price showed gains that touched $112,000 before reversing at the Wall Street Open.

The September print of the Consumer Price Index (CPI) came in below expectations across the board – a major tailwind for cryptos and risk assets.

Both the CPI and Core CPI were 0.1% below their expected levels, hovering around 3%, according to a Official Release from the US Bureau of Labor Statistics (BLS).

Reacting to the news, the Kobeissi letter, a trade source, said that figure “paves the way for another Fed rate cut next week.”

“This report was published as a ‘rare exception’ during the US government,” it mentionedwhile the S&P 500 advanced to fresh record levels.

CME Group’s Fedwatch tool.

“Financial conditions will remain loose overall and receive another boost as the Federal Reserve is expected to cut interest rates at its two remaining meetings this year,” Mosaic assets source wrote. Latest review.

“That should be supportive for the backdrop of economic and corporate earnings, which will be necessary to drive the rally next year.”

BTC price struggles despite CPI relief

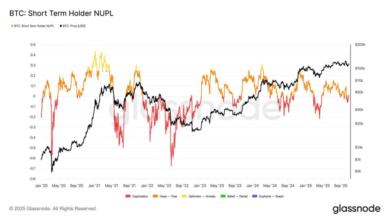

Bitcoin still has to contend with sell-side pressure in the US market open during the day.

Related: Worst Uptober ever? Bitcoin price risks first ‘red’ October in years

Traders stayed on the sidelines, with X Commentator’s exitpump warning that little support was in place below the spot price.

$ Btc Thin bid side in Perps orderbook btw, can dump quickly pic.twitter.com/udwtgvjuqs

– ExitPump (@exitpumpbtc) October 24, 2025

Trader Diego White described Exchange order-book liquidity conditions as “severe,” as data from Coinglass showed the price approaching a new ladder of bids around $ 110,000.

Caleb Franzen, creator of the financial research resource cubic analytics, has flagged three exponential moving averages (EMA) that are now important to capture as support.

“$BTC is returning to the 200-day EMA, so far. But now it needs to break and close above 21/55, which worked as resistance during the retest earlier this week,” He said X Followers.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making decisions.