Blog

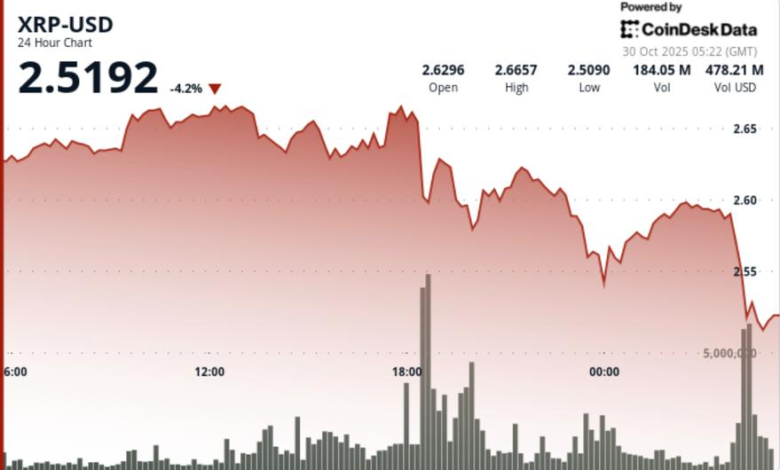

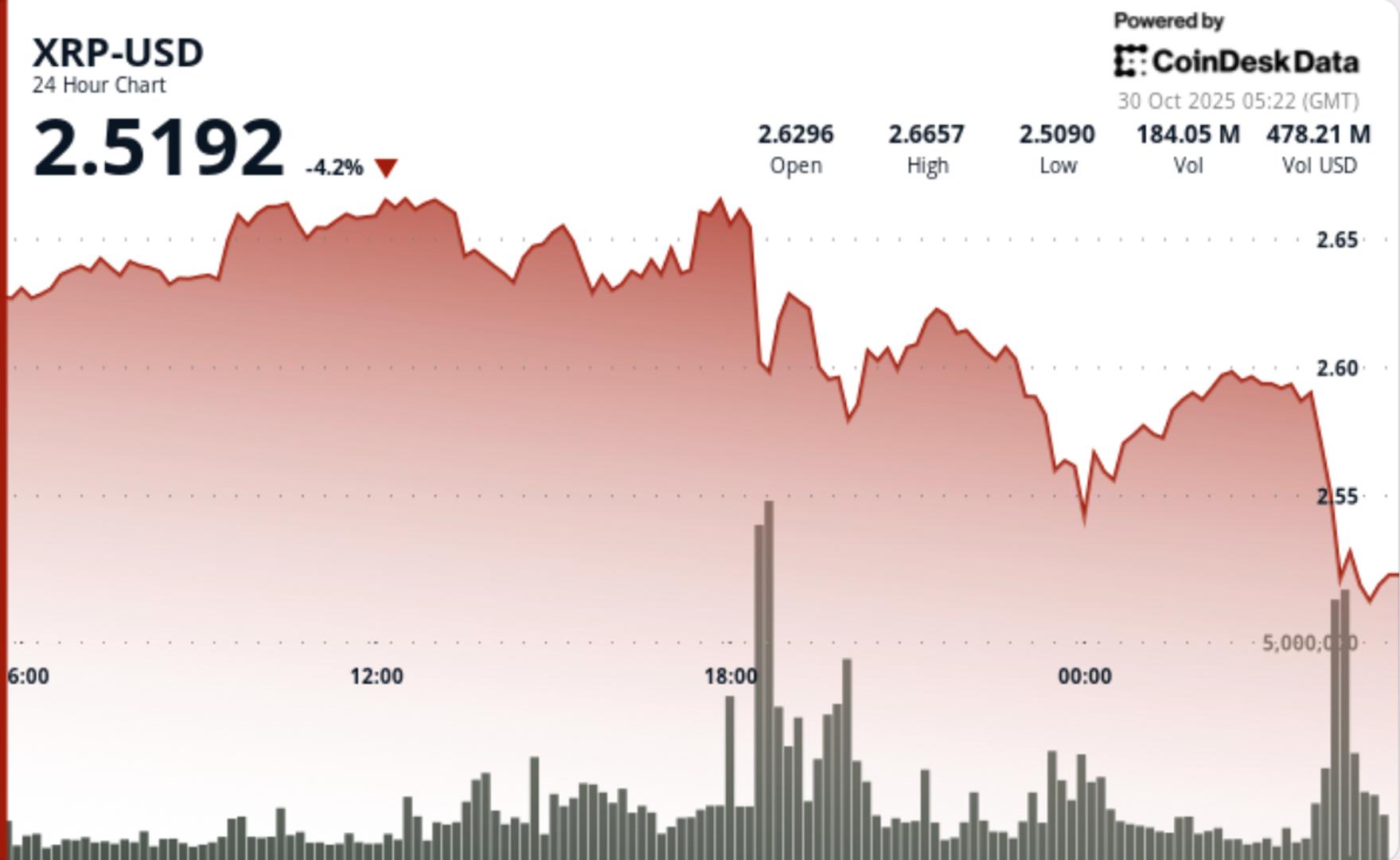

Ripple at risk of deeper pullback as Fed cuts cause bitcoin slide

The $2.67-$2.69 zone now stands as critical supply overhead. Meanwhile the support in the $2.580 area and the 200-day EMA near ~$2.61 act as anchors.

News background

- XRP slipped from $2.63 to $2.59 after a failed breakout above the $2.67 zone, with trading volume flowing to nearly 392.6 million tokens – about 658% over its recent average – on the decline.

- This move coincides with elevated open interest in XRP futures near early-2025 highs (~$2.9 billion).

- Meanwhile, on-chain data suggests major wallets have offloaded significant amounts of XRP, raising concerns over profit-taking even amid broader institutional interest.

Summary of Price Action

- Over the 24-hour window, XRP moved from ~$2.63 to ~$2.59 while carving out a $0.12 trading band. The decisive cap occurred at the ~$2.67 resistance, where volume exploded and price weakened.

- A late-session drop from ~$2.590 to ~$2.579 around 04:04-04:05 UTC occurred with ~2.18 million token volume—≈355% above the hourly average—before a brief freeze between 04:08-04:10 at near-zero volume.

- The breakdown breached the support cluster near $2.580, establishing fresh lower lows below consolidation levels.

Technical Analysis

- Declining resistance confirms the short-term bearish pivot: While the long-term structure still shows accumulation, the immediate risk has shifted back to the downside.

- Futures open interest remains elevated, but whale wallet sales data suggests distribution—not accumulation—is currently dominant.

- RSI/MACD momentum indicators show divergence (higher price highs, lower momentum highs), further warning of potential correction.

What entrepreneurs should know

- Traders should treat the current levels as a high-risk / high-reward pivot zone. A bounce from $2.58-$2.60 on updated volume could reset the momentum and target $2.70-$3.00.

- But a clear break below $2.58 would open the downside towards ~$2.53 and perhaps $2.50, especially if whale outflows continue and open interest drops.

- Monitoring large wallet flows, futures oi dynamics and volume spikes will be key to judge whether this is just consolidation or the start of a deeper correction.