US regulator pursuing the pilot of tokenization to tap stablecoins as collateral

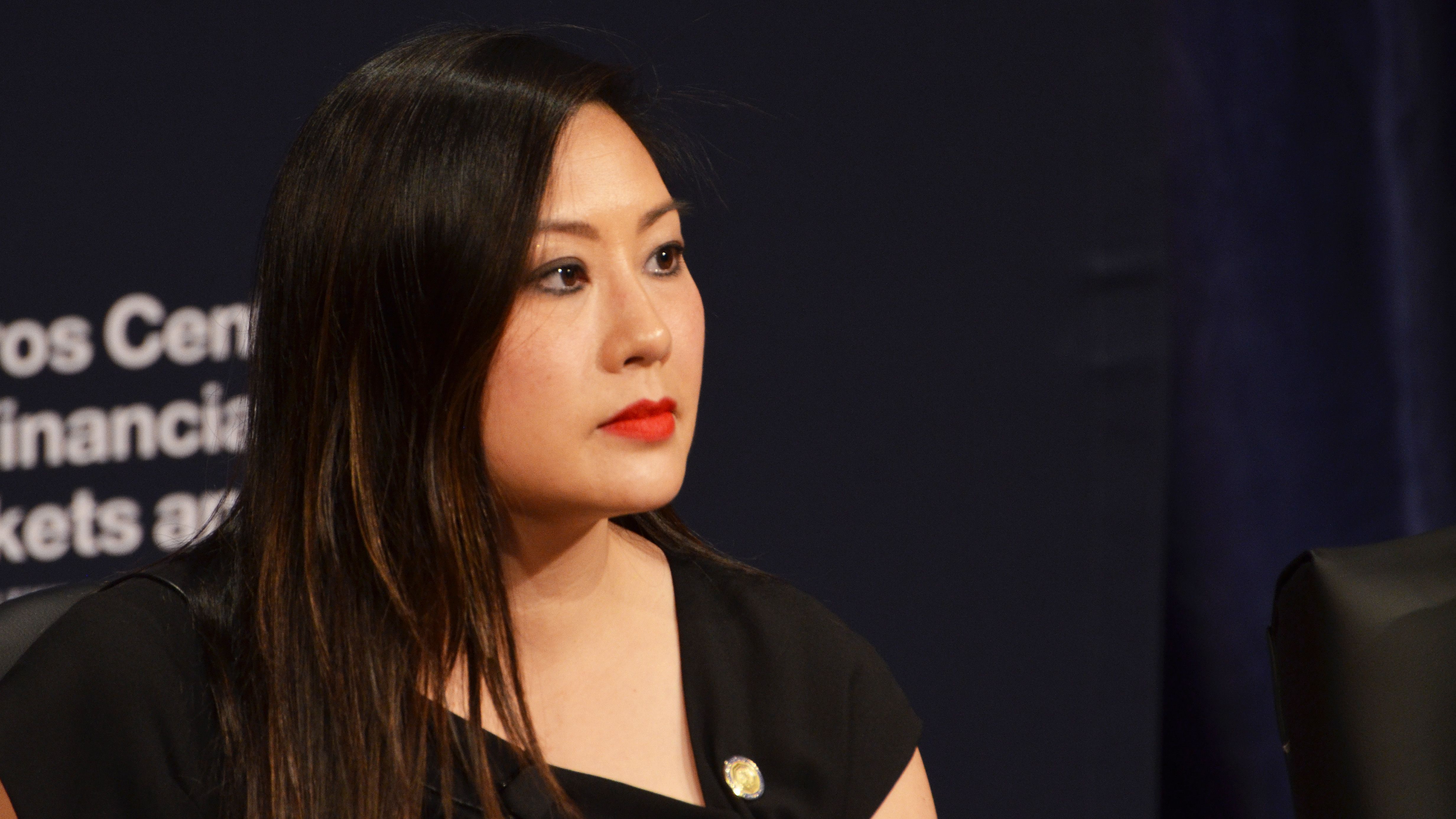

Caroline Pham, who operates the US Commodity Futures Trading Commission on a basis of action, is pursuing a Stablecoin tokenization tokenization program, and an upcoming summit will include leaders of Coinbase, Ripple, Circle, Crypto.com and Other digital assets firms.

Pham had The idea was suggested For a so -called regulatory sandbox in tokenization through its counseling committee, the Global Markets Advisory Committee, in the past but did not embrace the agency’s previous leadership.

“I’m glad to announce this groundbreaking initiative for US digital assets markets,” Acting Chairman Pham said in a statement Friday. “I hope to participate with market participants to deliver the Trump administration’s promise to ensure that America is leading the economic opportunity.”

The idea, based on the so-called pham “responsible change,” will be pushed to use non-cash collateral “through the shared ledger technology,” according to the agency.

A date and additional details for the CEO digital assets forum has not been set.

Number Acting ChairmanRepublican Commissioner Pham has made some dramatic changes to the US Derivatives Watchdog in just a few weeks after he began standing for previous chairman Rostin Behnam, a Democrat nominated by former President Joe Biden. Those changes incorporate a widespread replacement of older agency officials, and a personnel involving a former man-resource leader caused the unusual open and detailed response on Thursday from the CFTC. The speaker for the regulator argued that “false accusation” has been made Against the pham by “disgruntled individuals” the agency linked to internal investigation into misconduct.

Read more: Trump’s CFTC pick is removing the leading rank of key US crypto regulator