Buy the Dip in Bitcoin Miner Hut 8 (hut), says Markmark’s Mark Palmer

Hut 8’s (HUT) Tuesday Third Quarter Earnings Report showed record revenue and solid profitability, but the stock fell nearly 13% after investors were let down by the lack of an announcement by the AI hyperscaler tenant at the River Bend site in Louisiana, Wall Street Broker Benchmark said in a report Wednesday.

The sale was “short-sighted and unpredictable,” wrote analyst Mark Palmer, who argued that it’s not a matter of if a deal happens, but when. He maintains his buy rating and price target of $78.

Tuesday’s plunge into Hut 8 didn’t happen in a vacuum, of course. Crypto markets in general suffered one of their worst declines of the year and traditional markets also sold off, with the NASDAQ shedding 2%. Cube shares, however, are the worst performers in the Bitcoin/ AI infrastructure space.

The cube was up 4% early Wednesday to $50 alongside a modest bounce in markets overall.

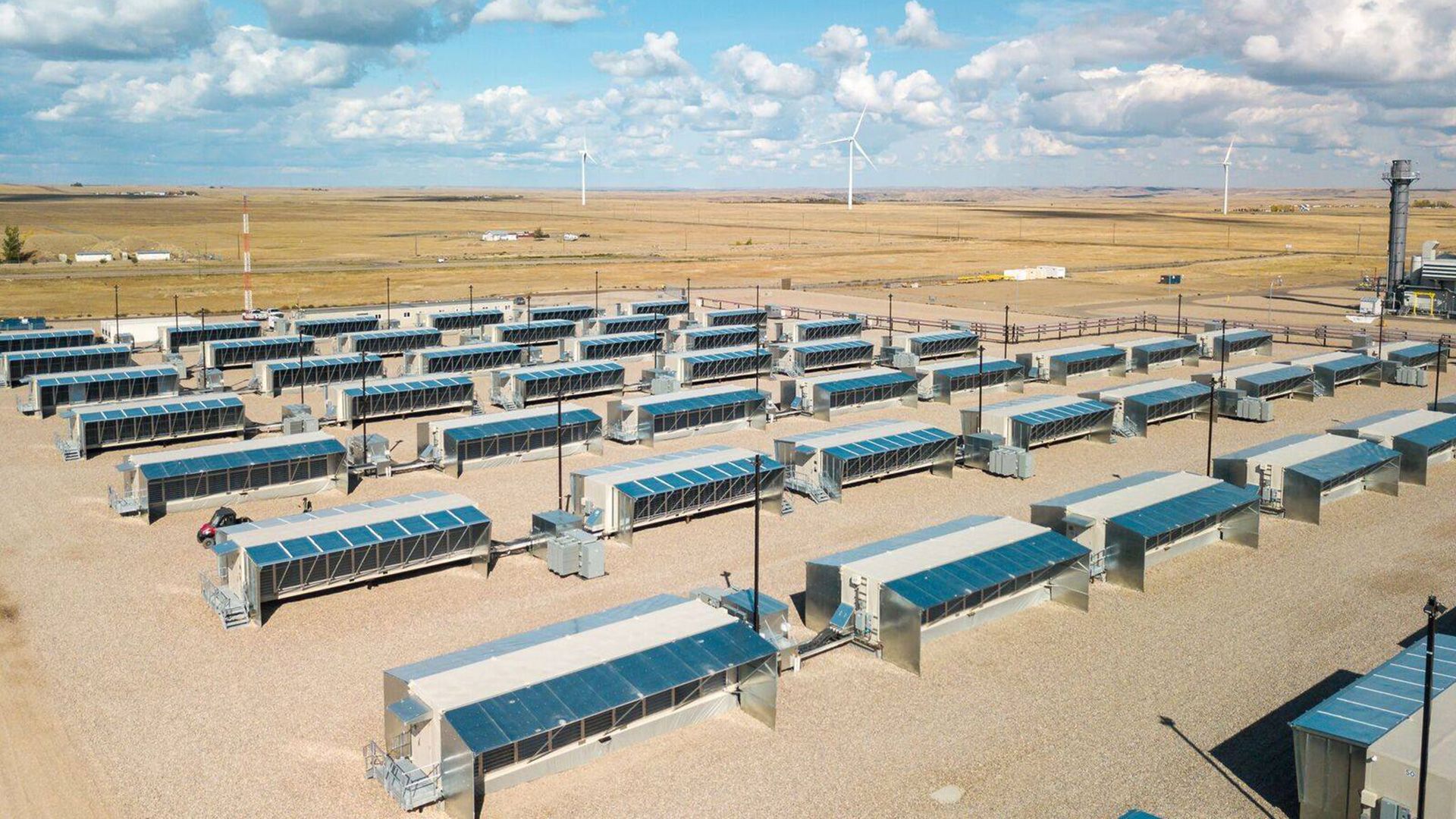

Back to the results and the outlook, Hut 8 CEO Asher Genoot reaffirmed that the 300 Megawatt (MW) Data Center in West Feliciana Parish, which will eventually scale towards 1 Gigawatt (GW), remains on schedule for late 2026, consistent with Palmer’s so-called “methodical” approach.

Palmer says entrepreneurs chasing a quick pop miss the bigger story. Hut 8 is positioning itself for long-term value rather than rushing into a suboptimal deal.

With hyperscalers and cloud providers scrambling for power capacity amid the AI boom, Palmer expects River Bend to find a tenant in due time.

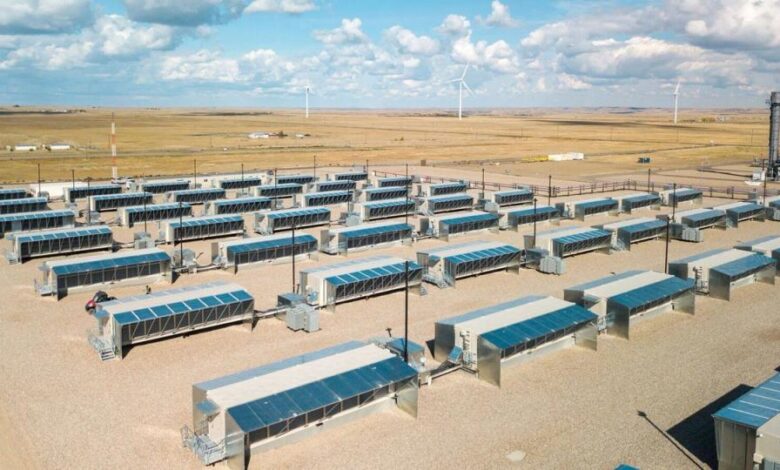

Genoot’s comments on the call underscored a leadership team focused on strategic positioning for the next decade, with Hut 8 sites in Texas, Alberta, and Louisiana forming an integrated platform that can transition between AI, high performance computing, and bitcoin mining as the economy dictates.

Palmer also noted that Genoot discussed the market discount on Hut 8’s 1,530 MW power pipeline, saying investors need to see execution before awarding higher valuations.

Palmer’s buy rating and $78 price target is based on a sum-of-the-parts analysis of that development pipeline, Hut 8’s 64% stake in American Bitcoin (ABTC), and the 10,278 Bitcoin held on September 30.

The valuation does not yet include an additional 1,255 MW under exclusivity or 5,865 MW under diligence, leaving additional upside potential, the report added.

Read more: Benchmark sees Hut 8 as Hybrid AI -Bitcoin Power Play, price target doubles to $78