Another piece of Michael Saylor’s BTC strategy starting to fall into place?

Another piece of strategy (MSTR) executive chairman Michael Saylor’s Playbook looks set to develop after the Company’s Perpetual Preferred Share, Stretch (Strc), press a Record high of $100.10 with trading volume reaching 1 million shares.

The milestone is significant because it allows the strategy, the largest holder of bitcoin to use the at-the-market (ATM) offering against STRC to buy more of the largest cryptocurrency. STRC, described by the company As a short duration, high-yield credit instrument, currently offering an annual 10.5% return, paid monthly in cash.

ATM, which was established on July 31, was held because the instrument was not trading at par. The company raised STRC’s dividend rate, initially to 9%, to help push the trading price toward the $100 par value. According to the latest 8-K Filingthe company has $4.2 billion in available capacity for share issuance.

The strategy used ATM sales of Perpetual’s other three preferred products –Strk, STFR and STRD — as well as its common stock to fund bitcoin purchases.

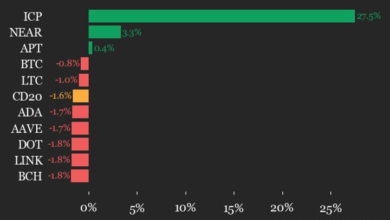

MSTR common shares have fallen 15% this year to around $253. With a multiple to net asset value (MNAV) running near 1.3, Saylor’s ability to issue Perpetual preferred stock successfully will be key to continuing the company’s bitcoin accumulation in a non-dilutive manner.

STRC was up 0.5% in pre-market trading at $100.50 per share, while MSTR was down 1%.