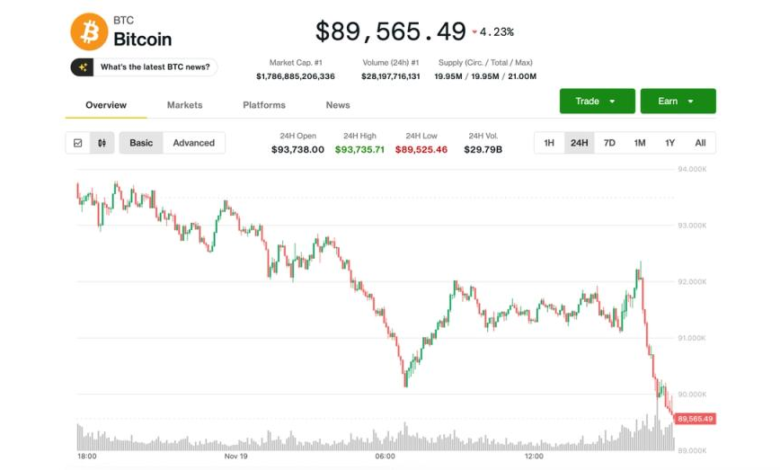

Back below $90k as crypto correction ranks at worst

The Big news Tuesday is that the crypto not only posted gains, but also rose even as US stocks sold off. That outperformance has been rare for what seems like months, with Bitcoin and other cryptocurrencies watching from the sideways as major stock market averages hit new record highs on a regular basis.

Sadly for the Bulls, though, normalcy returned just 24 hours later, with Bitcoin falling 4% back below $90,000 even as US stocks managed gains. Ethereum’s ether Slid 6.5% to below $3,000.

Crypto-related equities broadly mirrored the price action. Bitcoin Treasury Firm Strategy (MSTR) fell 8% to a more than one-year low, while StableCoin Issuer Circle (CRCL), ether Treasury firm Bitmine (BMNR), miners bitfarm (Bitf) and Hive Digital (HIVE) saw similar declines.

Although the session ended well, the Nasdaq remained up 0.2% after noon on the East Coast.

After relentless downward pressure on prices since BTC’s record highs, crypto investors remain deeply risk-averse. The crypto fear and greed indexa popular emotion gauge, remained pinned in “Extreme Fear” territory.

Vetle Lunde, Head of Research at K33, mentioned that current drawdown – nearly 30% in 43 days – ranks among the worst compared to the seven corrections that have lasted more than 50 days since March 2017.

Steady outflows from ETFs also added fuel to the selloff, Lunde said. Investors have withdrawn nearly $2.3 billion from the U.S. listed area over the past five consecutive sessions, Farside Investor The data is displayed.

“BTC swept lows below the average cost basis of the US BTC ETF, and if the current drawdown mirrors the two deepest drawdowns of the past two years, a bottom could be formed between $84,000 and $86,000,” he said. “If not, a revisit to the April Low and the MSTR entry average of $74,433 could be a natural leg lower.”