Hbar slides 0.5% to $0.146 as technical supports crumble

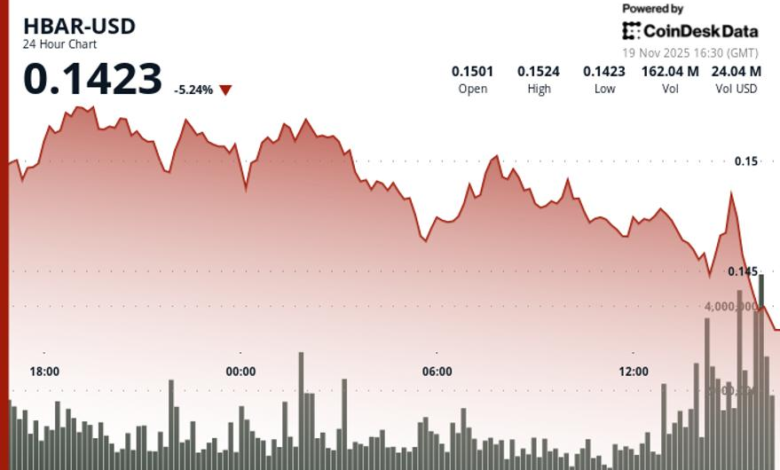

Hedera’s HBAR slipped below key technical support levels on Tuesday, extending a 24-hour decline from around $0.1459 to $0.1451. The token carved several lower highs within a tight $0.0074 range, making a 4.9% intraday swing that highlighted growing structural weakness in the market.

Trading activity increased to 145.7 million tokens on November 18 – about 73% above its moving average – reinforcing strong resistance at $0.1525 and pointing to possible institutional selling. The failure to sustain the rebounds, including a high-volume decline at 14:07, underscored the continuing downward momentum as the HBAR broke firmly below the $0.1458 support level.

With no major catalysts in play, technical factors continue to drive sentiment. The combination of increased volume on breakdowns, repeated failed bounce attempts and the alignment between broader 24-hour softness and shorter-term selling pressure suggests that traders may face additional risks before a significant recovery is formed.

Key technical signal levels extend the weakness for HBAR

- Support/Resistance: Key support sits at $0.1451 with resistance at $0.1525; $0.1458 breakdown opens the path to session lows.

- Quantitative Assessment: Institutional selling dipped to 145.7m tokens during the resistance test; Refusal of follow-through suggests completion of the distribution cycle.

- Chart patterns: Lower forming highs confirm the acceleration of the trend; Bounces failed at 14:07 with a 5.2 million volume spike confirming the breakdown scenario.

- Targets and Risk/Reward: Next downside target at $0.1451 support; The recovery faces resistance at the broken $0.1458 level acting as overhead supply.

Refusal: Parts of this article were generated with help from AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see Coindesk’s full AI policy.