Doge hits multi-month lows as flows turn bullish for first time in 6 months

Key support at $0.155 has crumbled under heavy selling pressure, but improving exchange flows and accelerating whale accumulation suggest exhaustion may be near.

News background

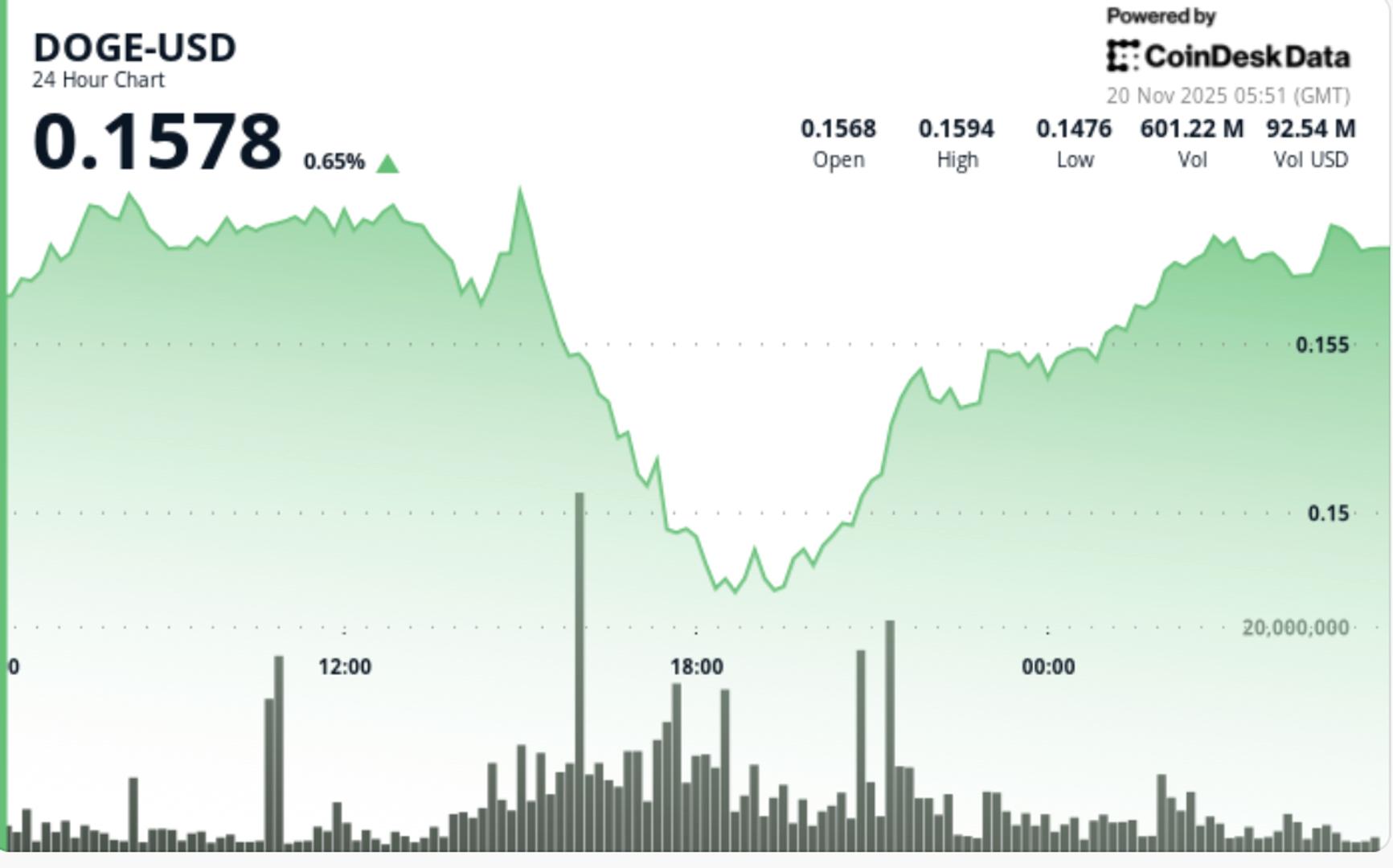

• Doge dropped from $0.160 to $0.149, breaking key support at $0.155

• Exchange net inflows turned positive for the first time in months – a historic precursor to the relief rally

• Analysts have flagged a potential DOGE ETF approval window under Section 8 (a) within the next seven days

• whale accumulation totals 4.72B Doge ($770m) in two weeks despite falling prices

• The broader crypto market remains in deep fear, with sentiment at its lowest since April

Crypto markets continue to deteriorate as Bitcoin’s “death cross” and risk conditions pressure altcoins. However, Doge’s Exchange Flow Dynamics has flipped positive – a structural shift that has historically appeared near market bottoms. Analyst Ali Martinez notes similar inflection points that preceded reversible capitulation phases in previous cycles.

Summary of Price Action

Dogecoin fell 7.42% during the 24-hour session, collapsing from $0.160 to $0.149 in a breakdown that broke free of the critical $0.155 support that anchored the previous consolidation range. Volume jumped 18.39% above weekly averages, confirming institutional participation rather than retail panic.

The sell-off marked a clean breach of the 0.5 Fibonacci retracement from the previous bull cycle and drove the price directly into the lower boundary of the Doge’s year-long descending triangle. The decline extended through several intraday floors before stabilizing near $0.149-$0.151. Oversold conditions emerged as RSI built bullish divergence against fresh price lows, while MACD’s short-lived death cross crossed exhaustion on downward momentum.

Technical Analysis

Dogecoin now sits at a high-stakes intersection of breakdown confirmation versus reversal potential. The fall below $0.155 completed the descending-Triangle resolution, traditionally projecting a continuation up to the $0.145-$0.140 zone. However, counter-signals are building.

The whale hoarding intensified materially, with high-value wallets absorbing more than 4.7B doge as prices fell—a sign of strong hands moving against weak retail flows. At the same time, exchange net inflows flipped positive for the first time in months, a structural shift that preceded tradable bottoms.

Momentum indicators support this divergence: RSI continues to push higher even as prices print lower lows, and MACD’s Bearish signals are fading fast. This creates a mixed but increasingly interesting setup where technical breakdowns clash with early reversal signals rooted in on-chain behavior.

Doge price will likely remain compressed between $0.149 support and $0.158 resistance until ETF catalysts or macro sentiment provide a decisive push.

What entrepreneurs should watch

Traders face a binary setup shaped by both regulatory catalysts and technical inflections:

• Monday of Section 8 (a) DOGE ETF Deadline – A surprise approval can trigger immediate regret

• Recovery of $ 0.155-Important for neglecting the breakdown and reopening the path at $ 0.162-$ 0.165

• Failure at $0.150-Exposed rapid continuation towards $0.115-$0.085 Demand Zones

• Exchange flow direction – Continued positive net inflows will strengthen the thesis return

• Macro Sentiment – Extreme fear across BTC and altcoins can produce sharp relief moves, but also increases the risk of a breakdown

The risk/reward setup becomes highly favorable for trader traders as DOGE approaches the top of a multi-year structure as ETF catalysts interact with on-chain accumulation dynamics.