Market in the sea of red, Bitcoin prices have seen dive at $ 80k

By Omkar Godbole (at all times and unless indicated otherwise)

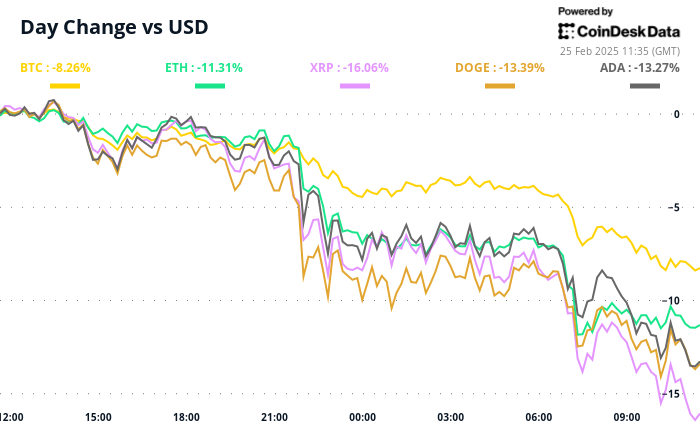

The crypto market is a sea of red, with bitcoin trading in three months lows under $ 88,000 and CoinDesk 20’s index drops more than 10% to 24 hours. There are many catalysts for Swoon, including sentimental at risk in the traditional market and influence from memecoins, especially recent trading in Trump and Libra.

Like us discussed Monday.

Another factor is President Donald Trump’s dislike. Although he has made significant lead-up promises in the election, concrete action is scarce. The expected strategic BTC reserve remains absent, and even state -level reserves prove to be challenged to implement.

“The industry is still waiting to show it in a tangible way in the form of steps like a mooted Bitcoin strategic reserve,” Petr Kozyakov, co-founder and CEO at Mercuryo in CoinDesk said. “Meanwhile, the emotion was hit by the biggest hack in the Bybit Exchange, which leaked 401,000 ETH, and a Memecoin sector struck by high-profile pumps and dump schemes.”

Finally, the revised concerns about the US economy are the demand for riskier assets.

“There have also been some concerns about slowing US growth since the release of US services of PMI last week, the lowest of 22 months and consistent with monitoring GDP growth at just 0.6%,” said the chief analyst of the Nansen’s research Aurelie Barthere. “Our Nansen Risk barometer is also risk-off from neutral today.”

Together, they sent BTC diving out of the two-month-old range playing between $ 90,000 and $ 110,000. The technical analysis theory suggests that it can drop to $ 70,000, although the maximum open interest in BTC placing options listed in the derivit is sitting in $ 80,000 strikes, indicating that this level can provide some support.

What could stabilize prices? Perhaps an announcement from Trump regarding a strategic reserve or a sharp reflection of NASDAQ 100. However, the index falls under the 50-day SMA, while the yen, a signal-preventive signal, continues which boosts against G7 currencies, including dollars.

The next major catalyst for risk assets were Nvidia’s revenues on February 26 and PCE’s main inflation on Feb. 28. Stay alert!

What to watch

- Crypto:

- Macro

- Feb. 25, 10:00 AM: The Conference Board (CB) released the February Consumer confidence index.

- CB Consumer Confidence EST. 102.5 compared to prev. 104.1

- Feb. 25, 1:00 pm: Richmond Fed President Tom Barkin delivers a speech Entitled “Inflation then and now.”

- Feb. 25, 7:30 pm: The Australian Bureau of Statistics releases the January Consumer price index.

- Monthly CPI indicator est. 2.6% compared to prev. 2.5%

- Feb. 26, 10:00 am: The US Census Bureau has released a new January resident sale report.

- New Home Sales EST. 0.68m compared to Prev. 0.698m

- New Home Sales Mom Prev. 3.6%

- Feb. 26-27: 2025’s First G20 Finance Minister and Central Bank Governors Meeting (Cape Town).

- Feb. 25, 10:00 AM: The Conference Board (CB) released the February Consumer confidence index.

- We are

Events with the token

- Votes and Management Calls

- The ampleforth dao voted Reduction of Flash Mint fee to 0.5% And the flash redemption fee to 5% to increase the system’s flexibility.

- Dydx Dao discusses the Establishment of a DYDX Buyback Program. Its initial step is to provide 25% of the DYDX protocol net to buy a token on the back.

- Frax Dao discusses Upgrading the protocol By changing the FXS name to Frax, making it gas token in Fraxtal, Frax North Star Hardfork implementation, and introducing a tail release plan with a gradual reduction of releases, among other enhancements .

- Unlocks

- Feb. 28: Optimism (OP) to unlock 2.32% of the shifting -shifted supply worth $ 30.21 million.

- Mar. 1: DYDX to unlock 1.14% of the circulating -switch supply worth $ 5.36 million.

- Mar. 1: Zetachain (Zeta) to unlock 6.48% of the switch -shifted supply worth $ 11.86 million.

- Mar. 1: Sui (Sui) to unlock 0.74% of the circulating -switch supply worth $ 61.32 million.

- Mar. 7: KASPA (KAS) to lock 0.63% of the circulating -switch supply worth $ 14.02 million.

- Mar. 8: Berachain (Bera) to unlock 9.28% of the shifting -transfer supply worth $ 61.6 million.

- Mar. 12: Aptos (APT) to unlock 1.93% of the circulating -transfer supply worth $ 69.89 million.

- Token lists

- Feb. 25: Zoo (Zoo) listed in Kucoin.

- Feb. 25: Etherna (ENA) listed in Bithumb.

- Feb. 26: Moonwell (Well) listed in Kraken.

- Feb. 27: Venice token (VVV) listed in Kraken.

- Feb. 28: Worldcoin (WLD) listed in Kraken.

Conferences:

Token talk

By Shaurya Malwa

- A token tied to a fake Sam Bankman-Fried account became rug-pull of the day.

- The scam began with the account “Comune Guardiagrele,” a small city of Italy with a verified color -Bo checkmark indicating that it was an official government or organization account, based on web results in verification of identity.

- Scammers probably hijacked or bought an account and changed the name to “@sbf_doge” that mimics the Sam Bankman-Fried (SBF), the disgraced crypto mogul confined for FTX fraud.

- The account then launched a memecoin, likely to be tricking undoubtedly entrepreneurs or bots in thinking it was legitimate because of the verification badge.

- Memecoin’s capital capital increased to $ 10 million before its creators drained liquidity, crashing it into a $ 100,000 capitalization and pocketing fees and proceeds from sale.

Derivatives positioning

- Top 25 cryptocurrencies according to market value, excluding stablecoins, have registered price losses over the past 24 hours. At the same time, most saw an increase in open interest in the eternal futures and negatively combined -with the volume of deltas, indicating a flow of short positions. There may be more pain ahead.

- In the derivit, February’s XRP expiry puts a trade on an 8 vol premium KaMag -child on calls. Talk about the sentiment that is noticeable.

- BTC, ETH options show concerns until the middle of the late march, with the subsequent expiration of maintaining the bias of the bullish call.

Market Movements:

- BTC dropped 6.23% from 4 pm et Monday to $ 88,118.16 (24hrs: -7.7%)

- ETH dropped 9.4% to $ 2,393.03 (24hrs: -10.6%)

- CoinDesk 20 dropped 9.19% to 2,750.01 (24hrs: -11.61%)

- Ether Cesr Composite Staking Rate does not change to 2.99%

- BTC funding rate is at 0.0008% (0.84% annual) in Binance

- DXY does not change to 106.7

- Gold drops 0.28% to $ 2,937.90/oz

- Silver dropped 0.43% to $ 32.14/oz

- Nikkei 225 closed -1.39% to 38,237.79

- Closed by Hang Seng -1.32% to 23,034.02

- FTSE reached 0.34% to 8,688.48

- Euro Stoxx 50 does not change to 5,449.69

- Djia closed on Monday without changing 43,461.21

- S&P 500 closed -0.5% out of 5,983.25

- NASDAQ closed -1.21% to 19,286.93

- The S&P/TSX composite index is closed unchanged at 25,151.26

- S&P 40 Latin America closed -0.92% to 2,386.34

- US 10-year Treasury Rate dropped 6 bps to 4.35%

- E-Mini S&P 500 futures dropped 0.78% to 5,981.75

- E-Mini Nasdaq-100 Futures dropped 0.53% to 21,306.25

- E-Mini Dow Jones Industrial Average Index Futures dropped 0.13% to 43,479.00

Bitcoin Stats:

- BTC Dominance: 61.81% (-0.15%)

- Ethereum in Bitcoin Ratio: 0.02720 (-0.95%)

- Hashrate (seven-day average move): 745 eh/s

- HASHPRICE (spot): $ 56.8

- Total fees: 7.5 BTC / $ 1.3 million

- CME Futures Open Interest: 166,510 BTC

- BTC is priced in gold: 29.7 oz

- BTC vs Gold Market Cap: 8.42%

Technical analysis

- The BTC’s sunny chart shows the cryptocurrency that has triggered a double top bearish reversal pattern.

- The transfer of the trend supports the case for a devastated weakness in the 200-day simple transfer of the average, currently placed below $ 82,000.

Crypto equities

- Microstrategy (MSTR): Closed on Monday at $ 282.76 (-5.65%), down 6.35% to $ 264.81 to pre-market

- Coinbase Global (coin): closed at $ 227.07 (-3.53%), down 5.6% to $ 214.14

- Galaxy Digital Holdings (GLXY): Closed to C $ 21.80 (-4.22%)

- Mara Holdings (Mara): closed at $ 13.25 (-4.68%), down 5.76% to $ 13.09

- Riot Platform (Riot): closed to $ 9.99 (-4.49%), down 5.01% to $ 9.49

- Core Scientific (Corz): closed to $ 9.86 (-8.7%), down 5.58% to $ 9.31

- Cleanspark (CLSK): closed to $ 8.90 (-3.78%), down 5.39% to $ 8.42

- Coinshares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $ 19.20 (-6.43%), down 5.21% to $ 18.20

- Semler Scientific (SMLR): closed to $ 44.38 (-7.04%), down 1.8% to $ 43.58

- Exodus Movement (EXOD): Closed to $ 41.16 (-13.91%), unchanged with pre-market

ETF is flowing

Spot btc etfs:

- Net -Net Flow: -$ 516.4 Million

- Cumulative Net Flow: $ 39.05 Billion

- Total handling of BTC ~ 1,105 million.

Spot etfs

- Net -Net Flow Net Flow: -$ 78 Million

- Cumulative Net Flow: $ 3.07 Billion

- Total Eth Holdings ~ 3.331 million.

Source: Farside Investor

Overnight flowing

Chart of the day

- Raydium registered a combined -combination of trade $ 1.9 billion on Monday, the lowest since November 29, according to Artemis.

- The slowing down slightly explains the recent decline of the value of the Ray token and Sola’s Sol token.

While you are sleeping

- Bitcoin slides below $ 89k to 3-month low as Nasdaq Futures Dip, Yen Sparks risk-off fear .

- US Bitcoin ETFS Post of the 2nd-boost of the year as the trading basis drops below 5% .

- Incorporated by USDE ISSUER ETHENA LABS .

- Forget the Maga, Mega Investors Want: Make Europe Reconnect .

- China has learned to embrace what the US forgets: the virtues of creative destruction .

- Asian shares a slide as US Curbs China Investment, Euro Gain Fades . MSCI’s Asia-Pacific index dropped 1% and Japan’s Nikkei fell 1.3%.

In ether