The bias for XRP shorts continues beyond the rally, the heads of the ‘death cross’; BTC Dominance Surge

The crypto market appears napatabaya However entrepreneurs continue to be careful while talking to Altcoins, such as XRP, while continuing to rotate money to the Bitcoin (BTC) market leader.

XRP focus focuss on Ripple to facilitate cross-border payments, increased by more than 3% to $ 2.24 in the past 24 hours especially in the hope that the legal battle between the Blockchain company Ripple and the Securities and Exchange Commission (SEC) could end soon.

In the midst of price increases, the combined -integrated interests of the ongoing futures listed in the major exchanges are stabilized near 1.35 billion XRP, with annual funding rates and combined -with the amount of negative printing, according to data resource Velo.

Negative funding rates mean shorts pay fees to counterparts to keep their bearish bets open. It shows the dominance of short bearish positions in the market. The negative combined -joint volume of Delta, which measures net capital inflows in the market, indicates that the sale of volume accumulates more than the purchase of volume, potential signing of a bearish trend.

Both indicators, therefore, doubt whether the increase in XRP prices has legs. At the time of press, many other large tokens such as Doge, Sol, SUI, HBar, LTC, BTC, TRX and HYPE have a negative CVD on a 24 -hour basis.

Speaking of Doge, the 50-day simple transfer of average (SMA) token price is about to cross the 200-day SMA, confirming the so-called death. The pointless sound pattern indicates that the short -term price momentum is now underperforming the long -term momentum, with the potential to change to a major bearish trend.

These SMA crossovers are widely followed by trend entrepreneurs, which means that cross cross confirmation can bring greater sale of pressure to the market. That is Halo -The note of predicting moving prices in BTC and ETH markets.

Note that, the DOGE has dropped 65% from the availability of more than 48 cents in December.

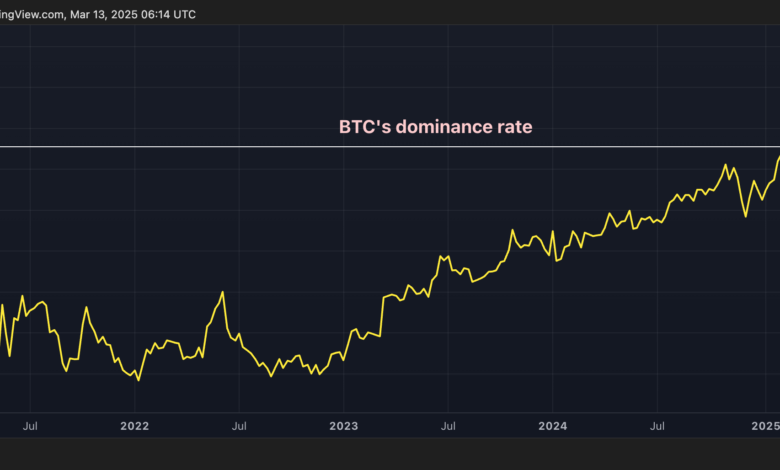

The BTC most dominant in four years

The rate of Bitcoin dominance, or the cryptocurrency component in the total market capitalization, has risen to 62.5%, the highest since March 2021, according to Data Source TradingView.

Noteworthy, the scale increased from 55% to more than 62% due to the total capitalization of the crypto market that sank above $ 3.6 trillion in December.

This implies an ongoing preference for the BTC, especially in the broader market collapse.