How Formation Funding Prevents Ethereum

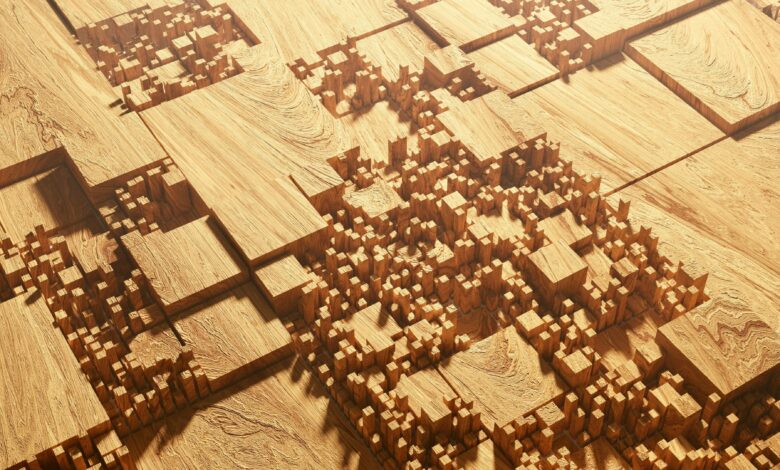

The Ethereum underwent a major change in the last four years, starting as a network capable of administering only 15 transactions per second, and emerging with a thousandth powerhouse processing of thousands, with transaction costs decreasing from $ 50 per replacement to cents. L2 and rollups helped the Scale Ethereum without compromising its decentralized ethos. But this success leads to a new problem, one of fragmentation.

Today, Ethereum is one of the most widely adopted blockchains, consisting of an over 50 l2sEach operating as its own siled ecosystem. What this means for end-users will have to juggle multiple networks, bridge assets, and navigate a maze of processes just to perform basic actions.

The destruction of the technological scene fragment, Ethereum funding made it difficult to navigate for builders throughout the lifecycle, surprisingly as projects that struggle to secure sustainable funding.

To create a better ecosystemEthereum needs to begin the adoption of blockchain-based funding mechanisms that are better aligned with complex, community and experimental nature.

Traditional funding programs often focus on early stage projects, neglecting the long -term needs of web3 builders. It can be misleading to look at narratives in the crypto market that leads the investment landscape and assumes an emerging activity. Financial returns for many of those projects may not come short-term, leaving builders that struggle to navigate sustainable growth. Funding mechanisms need to support builders throughout the trip of the product lifecycle.

Reward effect, not speculation -haaka

One of the most promising funding models powered by blockchain is Retropgf. This model is particularly suited to Ethereum’s fragment ecosystem, where public goods such as open-source software, developer tools, and interoperability solutions often struggle to attract upward investment.

The retropgf focuses on the measured results of a project. These are the funds from the DAOs or those contributing the ecosystem and distributing them retroactively on projects that have shown value. This process ensures that the critical infrastructure-like cross-chain bridges or developer frameworks-receive the support it needs at the right time.

This funding mechanism is preferred as it helps in the alignment of incentives. Instead of competing for speculation -awarely investment, projects may focus on delivering real value, knowing that their contributions will be recognized and rewarded. For a fragment ecosystem like Ethereum, the retropgf offers a way to unite funding efforts and ensure that resources flow to the most affecting initiatives.

Boosting community support

Another powerful tool in the Blockchain funding toolkit is quadratic funding, a model that distributes capital based on the width of community support rather than the size of individual contributions. This approach is a level of playing field for smaller projects and indigenous initiatives, which often struggles to compete with competitors who are well funded with traditional funding models.

Quadratic funds Works by matching small donations from a large number of supporters with a larger fund pool, reflecting the collective intelligence of the community and ensuring that projects with extensive support of indigenous people receive most funding.

By facilitating the value of public commodity projects, such as management rights or income streams, founders can open their projects to a broader pool of supporters with the help of investment mechanisms. It creates a diverse and passionate investor base, democracy of access to capital and reducing reliance on traditional funding sources.

For example, developers who are building a cross-chain interoperability solution can token their project management rights, allowing supporters to contribute micro-investments in exchange for a stake to its success. Not only does it provide the project with the necessary funds but also promotes a sense of ownership and alignment with its supporters.

In a fragment ecosystem such as the Ethereum, fractional investment will help bridge the gaps between the chains by being insecure in collaboration and shared as owner. Projects that may otherwise operate on isolation can tap into a single capital pool, creating a more relevant and resilient ecosystem.

Own on-chain

Amid the funding models powered by this blockchain is the concept of on-chain ownership. By cultivating their work and seizing blockchain transparency, creators and builders can establish direct relationships with their supporters, removes mediators and ensures that the value flows to those who believe them from the beginning.

On-chain transactions also produce funding flows that are visible and heard, reducing fraud and strengthening trust. This transparency is particularly important in a fragment ecosystem such as Ethereum, where users and developers often struggle to navigate complex and fuzzy funding structures.

An important question to meet is how resources funding for these X-L2 initiatives.

One approach is to make the funding of common goods of Ethereum a condition of being a stage 1 or stage 2 rollup. These rollups, once they reach the level of decentralization, rely on a shared community and tools for management. Funding common goods and tools is not only justified but necessary for their continued growth.

An alternative is the redirecting of the Ethereum Foundation Grants program towards resolving this issue. The EF needs to better support Cross-L2 experience and funding common goods to solve these challenges are key to doing so.

Ethereum destruction is beyond technical challenges, it is a challenge to funding mainly. By adopting funding models enabled by blockchain such as retropgf, quadratic funding, and fractional investment, ecosystem offers a way to align incentives, strengthen community support, and democratize access to capital, ensuring that resources are flowing in their projects.