Crypto ETFs gained massive fame with US advisers as risk ‘reputation’

Las Vegas-Fincial Advisors in the US are focused on funds that have been exchanged by the Crypto Exchange (ETF) and are ready to increase their holdings this year.

During a presentation at the Exchange Conference in Las Vegas, TMX Vettafi leader Todd Rosenbluth and Senior Investment Strategist Cinthia Murphy showed the results of a survey sent to thousands of US -financial advisers in the US, pointing out that the Crypto is “part of the conversation.”

The results showed that 57% of advisers plan to increase their allocations to crypto ETFs, while 42% are likely to maintain their position. Only 1%, almost no one, wants to reduce their position.

“I think last year the message was a risk to reputation. Now, there is no counselor who can’t even have a major crypto communication,” Murphy said.

Even the US Securities and Exchange Commission (SEC) Approved spot bitcoin ETFS in January 2024One year before President Donald Trump’s role, the enthusiastic embrace of the new crypto industry administration was likely to strengthen the broader institutional adoption. Regulators, including the SEC and the Commodity Futures Trading Commission (CFTC), have returned to the Crypto course since the Trump presidency began, which has signed a more lovely and clearer regulation approach.

Respondents said they were especially interested in ETF equity equity, which funds invested in companies that have been publicly exchanged with exposure to the crypto industry, such as approach (former microstrategy) or Tesla.

“You can’t maintain the space that I think explains why crypto equity has become popular because it’s probably quite easy to understand and put your fingers around it,” Murphy added.

Since Trump took the Oval Office, Michael Saylor’s stock has seen more than 100% rally, making crypto-related equivalent to both investors and institutional investors. MSTR shares have paved some of their gains from hitting all time highs; However, the results of the survey seem to suggest that it still draws interest from all parts of the market.

Spots and Multi-Token ETF

Crypto equity-linked ETF is not the only momentum of financial counselors. About 22% of survey respondents said they were looking to provide capital to see crypto ETFs, such as spot bitcoin (BTC) or Ether (ETH) ETF spot.

The third largest group, with about 19% of respondents said they were interested, was the crypto asset funds holding many tokens.

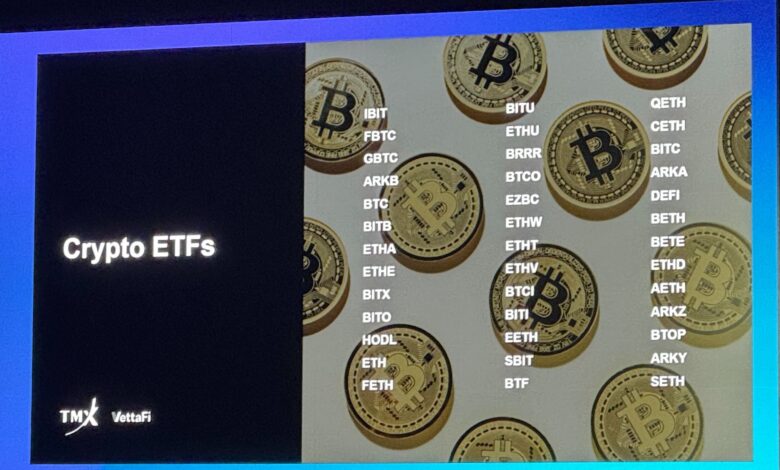

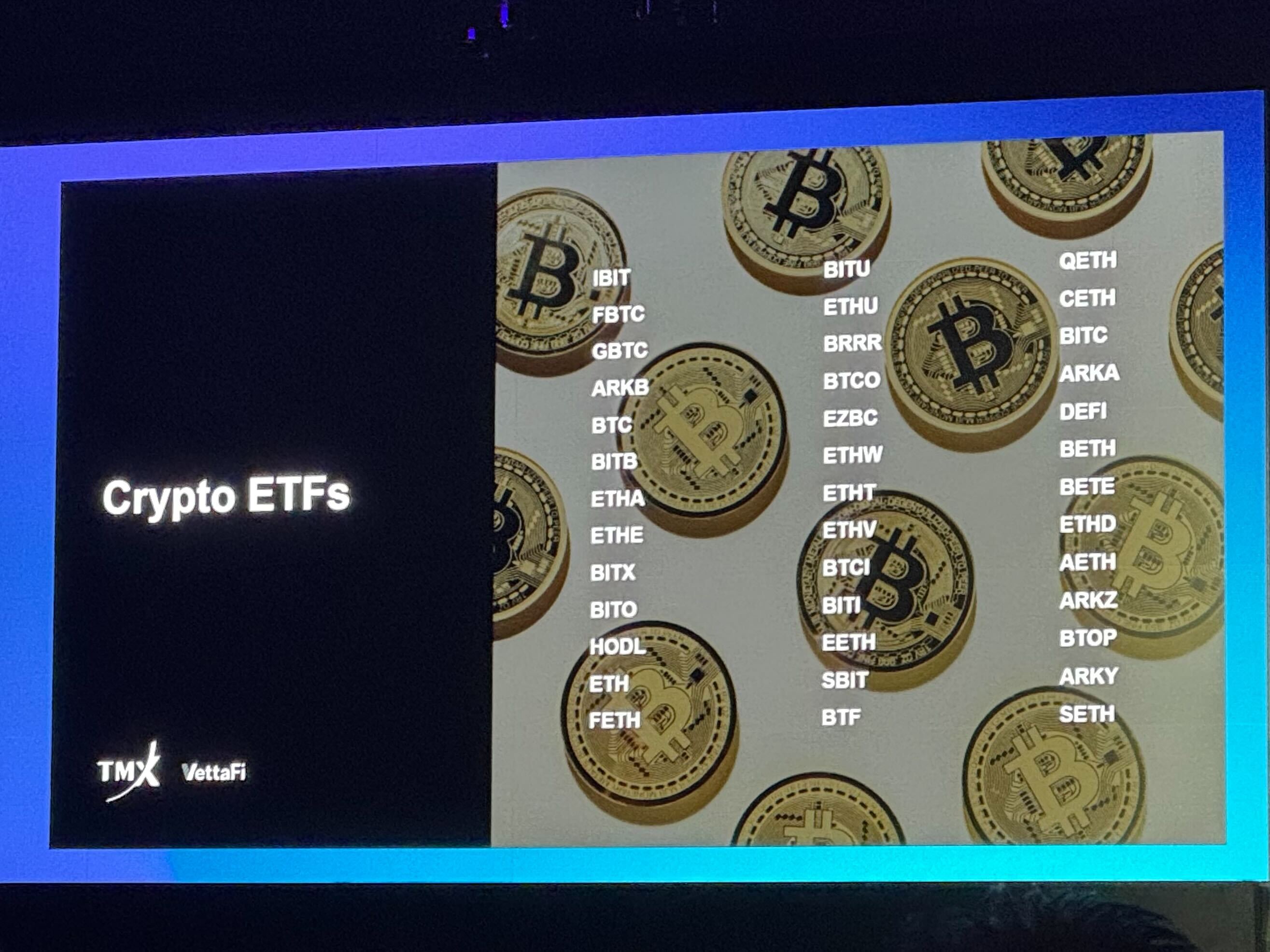

There are many crypto ETFs trading in exchanges, with much more in the process of receiving approval from the SEC listed in the future.

The past months have seen a particularly large number of index -based ETFs, which means they hold a basket of crypto assets behind Bitcoin and Ether. Other launch includes managed funds that provide downside protection for price volatility by allocating the percentage to US wealth, for example.

Many issued the filed to bring additional areas of Crypto ETFs, including Solana (Sol), XRP and Litecoin (LTC), to the market, but the SEC has not yet evaluated them.

“It’s a space that just grows, and I highly recommend that you get to know space experts … because it’s moving fast, and a lot to learn,” Murphy said.

Cheyenne Ligon contributed to the story.

Read more: Crypto Regulatory Clarity Top Catalyst for Industry Growth: Coinbase & EyP Survey