Employed by riddles of tokenized securities

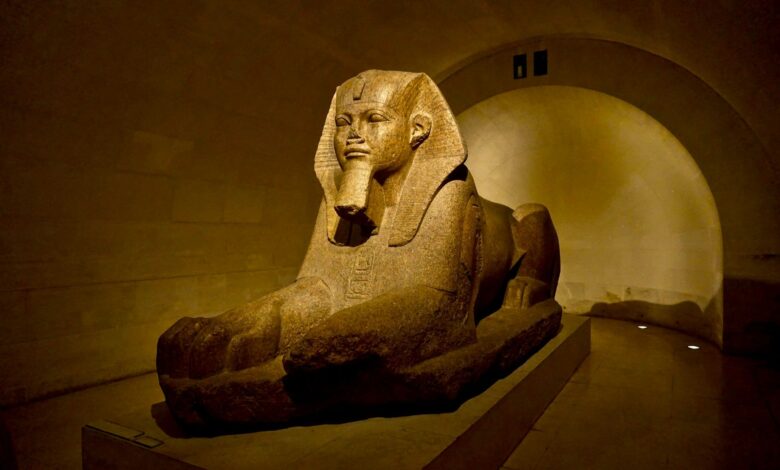

In the ancient Greek story of the Oedipus, good rewards wait for travelers to solve poor riddles, but a strong Sphinx posted riddles and ate those who did not fail to resolve them. Similarly, in the ancient Crypto Times, circa 2017, blockchain technology has stood to change finances and other fields. But the two challenges stand in the way of this technology enjoying its full potential: (1) security laws that are not easy to map in decentralized systems, and (2) a security regulator in the digital ownership, which often brings serious risks to those who have tried to solve the first challenge.

Today, the Sphinx has decided to be more useful, but riddles remain. The Securities and Exchange Commission’s (“Sec”) Crypto Task Force said the agency’s previous regime has created “a hostile environmental change” and focused on working with industry participants to create reasonable regulations. While promising, significant challenges will remain. US security laws are a mix of laws passed by Congress and policies adopted by Sec. The work force has signed the SEC’s willingness to make the latter more possible through new policies and exclusion. The laws, however, show most challenges and only Congress, not the SEC, can change them.

Below is a primer in the more common riddles that are currently facing the developers of tokenized securities.

CONSIDERATIONS

For tokenized securities, the developer creates on-chain tokens that each represents a component of equity to a company or other security, or another property that offers the right cashflows. This tokenization can open up possibilities -such as immediate negotiation, distribution of fractionalization, and sun -day -to -day payment of dividend -which makes the product better or functionally diverse than its counterparts.

Although the SEC may be more attractive -attracting ideas for tokenized security, it has no authority to change the laws. Therefore, tokenized security projects, will still need to resolve or prevent riddles present.

The law of the investment company

If a token provides with the owner of economic exposure to the developer -pool -pool, the token project can be an investment company covered by the Investment Company Act, which controls companies, such as each other’s funds, which invested in security and let investors have exposure to investments through their investors.

This riddle exists properly before crypto, and most decided to navigate it by avoiding being classified as an investment company in the first place. That’s because the requirements imposed by the investment company law do not work well with business models that include more than buying and selling security. There are huge restrictions on increasing debt and equity, borrowing, and even business with affiliates. For those who are inevitably reproducing these requirements, there are exceptions that can be used.

Broker-Dealers under the Securities Exchange Act

Anyone buying and selling security for others or willing to buy and sell security for their own account can be a broker or dealer. There is no apparent line rules for qualifying as a broker-dealer, but the SEC and Courts will be considered as indicia if you provide liquidity, charge a fee related to trade prices, actively find investors, or play a role in handling funds or customer security.

While there is no practical way to exchange digital assets as a broker-dealer at present, the SEC can use its existing authority to tart a realistic path for doing so. In the best case, it will take time and will still come with some obligations to compliance.

Replace under the Securities Exchange Act

While this does not look like a traditional security exchange, a platform that uses smart contracts to combine orders for tokenized security from many buyers and many sellers for matching and implementation can qualify as one, depending on its structure.

Currently, only broker-dealers can trade in exchanges, and exchanges cannot hold customer accounts or customer security security accounts. Although the SEC will be able to rework these policies, some requirements will undoubtedly continue.

Security -based swaps under the Securities Exchange Act

If a tokenized security provides the holding exposure to the economic performance of one or more security, it may cross the complex world of security-based swaps. Generally, tokens that provide for the exchange of future payments based on the value of a security (or events relating to that security) without Delivery of ownership rights is likely to swap. Security -based swaps are under the joint jurisdiction of the SEC and the Commodity Futures Trading Commission. The requirements for them are many, with the most known policies that prohibit retail investors from buying swaps.

Aml and KYC

Companies involved in trading or transferring tokenized security also need to consider the availability of anti-money laundering and knowledgeable universal laws. Compliance requirements depend on the role of transactions but may include collecting and verification of the name, birth, and address of customers.

Riddles should work, not around

Resolving these riddles is not a self -end. When designing any tokenized security project, developers make options based on economic, technology, and regulation framework. These areas are interrelated, as technology can make the economy possible and decide where a project is falling within the regulation framework. But since these considerations are interrelated, developers should study them from the beginning. Leaving regulations on regulations for finishing can be a Jenga game where problematic parts are only removed to overthrow the benefits of and goals for economy and technology. Today’s riddles are not only obstacles to the many benefits of blockchain technology, but the important parts of the answer.

The opinions expressed in this article are the (s) of the set and not necessarily reflect the views of Skadden or its clients.