BTC Bull Run Ahead? Main markets indicate Trump’s tariffs can overthrow inflation, challenging fears of Fed stagflation

The ongoing US-China trade war is likely to overthrow inflation in the US economy, the major sections of the financial market, which offer bullish cues to risk properties, including Bitcoin (BTC).

At his inaugural address on January 20, President Donald Trump promised “tariffs and taxes to foreign countries to enrich our citizens,” and then fired the first shooting against China, Canada and Mexico in February.

Tariffs increase the cost of imported goods, which is passed to the consumer and may lead to a higher level of overall price in an economy driven by consumption such as the US

As a result since the trade war exploded, markets have been concerned about the resurrection of US-led tariffs on US inflation, with the Fed adding to concerns through stagflationary economic projections last month. Stagflation, which represents a combination of low growth, high inflation and unemployment, is seen as the worst outcome for risk -owned.

Therefore, Bitcoin has dropped nearly 20% since early February, in conjunction with the widespread risk of Wall Street risk that saw investors simultaneously throwing US stocks, bonds and dollars.

Breakevens suggest disinflation

However, inflation -based market -based measures, such as breakevens, suggest tariffs may be disinflationary in the long run. In other words, the Fed may be wrong with the fear of stagflation and is about to have a leeway to cute the rates.

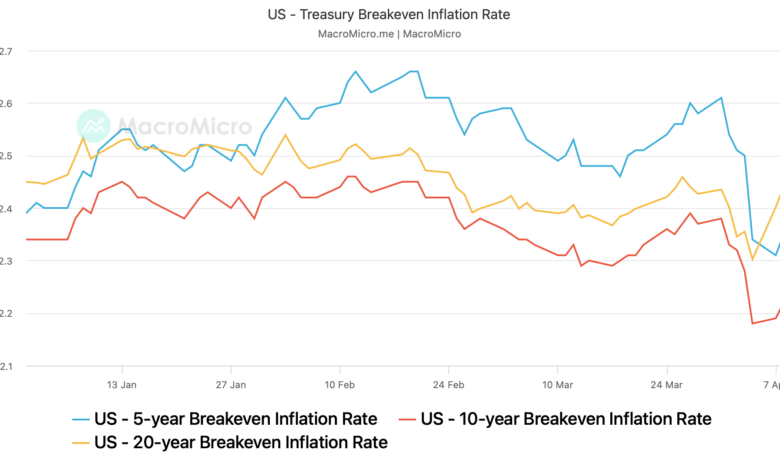

Inflation breaks result in traditional treasury bonds with yields in security -protected security (TIP) security. Breakeven’s five -year inflation rate sank above 2.6% in early February and since dropped to 2.32%, According to The data monitored by the Federal Reserve Bank of St. Louis.

Breakeven’s 10-year rate Get off from 2.5% to 2.19%. Meanwhile, the Federal Reserve Bank of Cleveland’s Expected two -year inflation was held around 2.6%.

One hour cost

According to observers, the impact of tariffs, viewed as a one -time cost adjustment, depends on the reactions of other macroeconomic variables and tend to be disinflationary in the long run.

When producers pass the tariff increase to consumers, inflation levels increase. However, if there is no corresponding income increase, consumers are forced to reduce their consumption. This reduction can lead to the build-up of the inventory and eventually contribute to a collapse in the prices of goods and services.

“Since Smoot-Hawley days, tariffs have not been inflationary yet. Instead they are deflationary and” stimulative itself “. Moreover, the disinflation shown in these charts will help encourage the Fed to be easy as well. said X..

A paper published by American economist Ravi Batra in 2001 made a similar observation, saying“

All of the things that are considered, the recent financial market disturbance is likely to result from fears of growth rather than inflation. The bull can re -imagine in hoping a slippery bearing from the federal reserve.