A 20% BTC correction on the table: Glassnode

Glassnode Weekly Report highlighted growing concern for Bitcoin While struggling to recover the $113,000 short-term cost basis, which represents the average purchase price of investors who bought within the last 155 days.

This level serves as a Key threshold for maintenance A Bull Market. Despite numerous attempts to recover it, Bitcoin’s repeated failures suggest weakening momentum.

Glassnode warns that if the price continues to weaken, it could fall towards $88,000, which is the next significant support level. Investors’ active price realization, a measure that reflects the cost basis of actively moving supply and a level that often marks deeper corrective phases. This same metric was mostly at play during the April 2025 “Tariff Tantrum” correction.

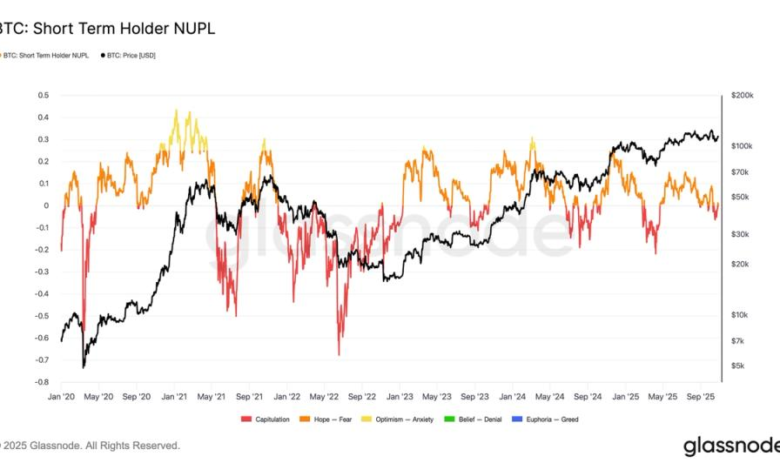

The report suggests investor sentiment is showing signs of strain. Short-term holders are now selling at a loss. Short-term holding net unrealized profit/loss (STH-NUPL) sits at –0.05 with bitcoin around $107,000, signaling mild losses. While not at the full level of capitulation (around –0.2), it reflects a breakdown in confidence.

Long term holder also contributes to selling pressure. The net long-term position change declined by 104,000 BTC this month, marking the largest wave of distribution since July. Glassnode notes that until long-term holders return from selling to accumulation, the price recovery will likely remain constrained.

Meanwhile, the derivatives market appears calm following the October liquidation crisis. Realized volatility dropped to around 43%, and traders scaled back hedges. One-week options skew, which spiked above 20% in the October turmoil, has now normalized near neutral, according to Glassnode.

Overall, Glassnode sees the Bitcoin market moving into a consolidation phase after the October turmoil. However, sentiment and demand structures remain fragile, suggesting that while the worst of the panic may be over, recovery will depend on renewed investor confidence.