Bitfinex Margin Longs, positions funded by borrowed cash, increase by 60k BTC

As bitcoin’s (Btc) Price wilts, merchants in the Crypto Exchange Bitfinex live until their reputation of being a dip consumer, which offers hope to bathe the crypto bulls provided by their track record of predicting market peaks and troughs.

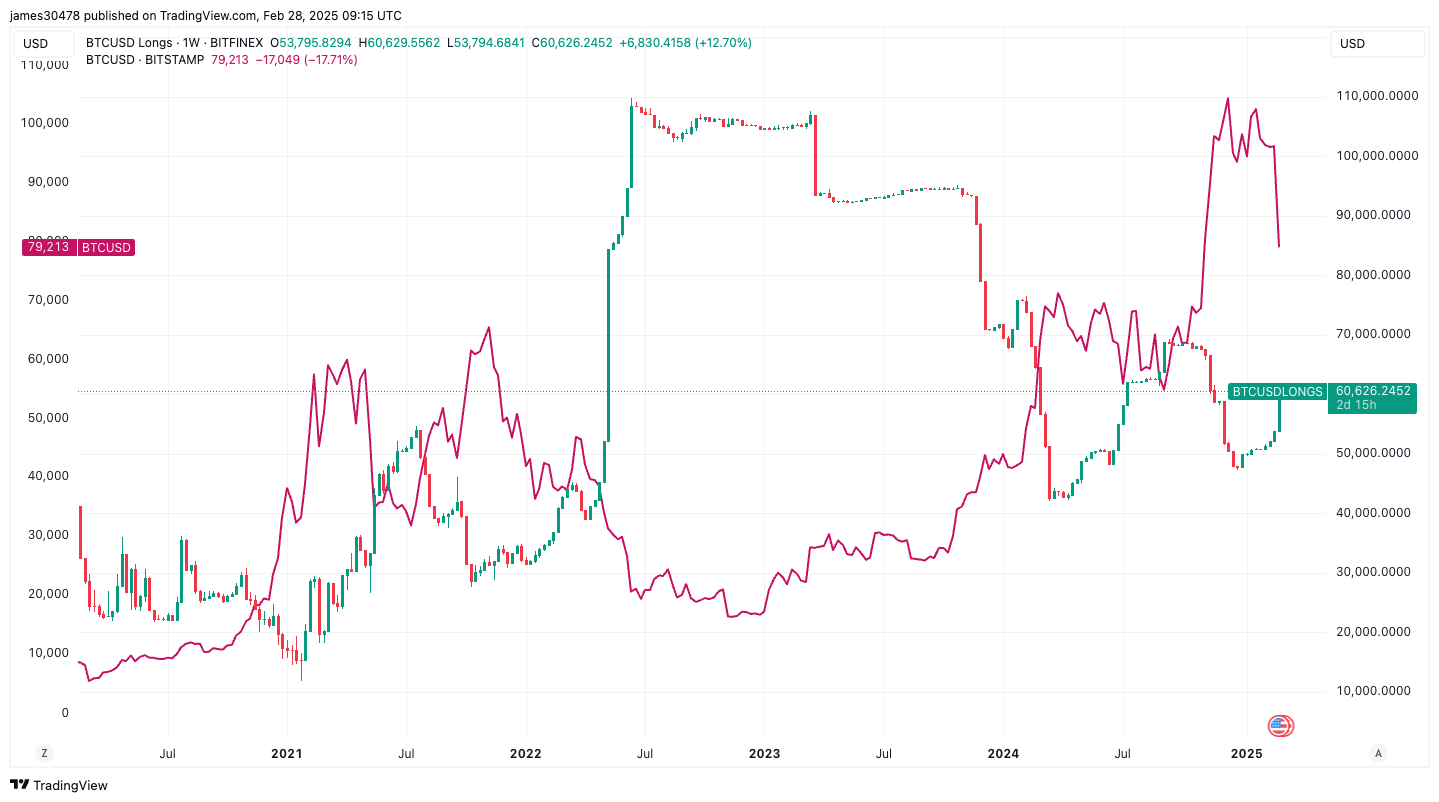

The number of Bitcoin purchased at Bitfinex with borrowed cash, a stake that the BTC price will rise and leave the investor with revenue once they pay off the debt, will rise to more than 60,000 BTCs from 50,773 this month. It jumped 2% in the past 24 hours, according to data from coinglass and tradingview.

Increasing the so -called margin long position is a vote of trust in the greatest cryptocurrency, which has lost more than 20% this month and is on track for its worst monthly performance Since June 2022.

Bitfinex entrepreneurs are major whales – or holders of large amounts of bitcoin – which dabble with margin longs. They are known for accurately signing the top and bottom of Bitcoin and tend to accumulate in downtrends or rangebound markets, as they did in the middle of last year.

Looking at a five -year timeframe, margins continued to increase handling during price swoons and reduced exposure near market peaks. This pattern was apparent during the 2021 and 2024 top top.

As the crypto market collapse, the sentiment in the crypto market is in a state of extreme fear, according to Coinglass’ Crypto Fear & Greed Index. Last year, the market saw only four days of intense fear. It has been dominated by greed and greed for more than 230 days.