Blog

A ripple buildout near $2.40 could precede a sharp relief rally

Heavy institutional sales wipe $10B in market value as market grabs in derivatives markets.

News background

- XRP endured one of the sharpest single-day declines this month, falling 6% from $2.49 to $2.41 between October 14 and 15. The fall followed a prolonged whale distribution, with 2.23B tokens—worth nearly $5.5B—moving on exchanges since October 10.

- Futures open interest collapsed 50% to $4.22B, signaling forced exits as market makers cut risk exposure amid continued macro and regulatory uncertainty.

Summary of Price Action

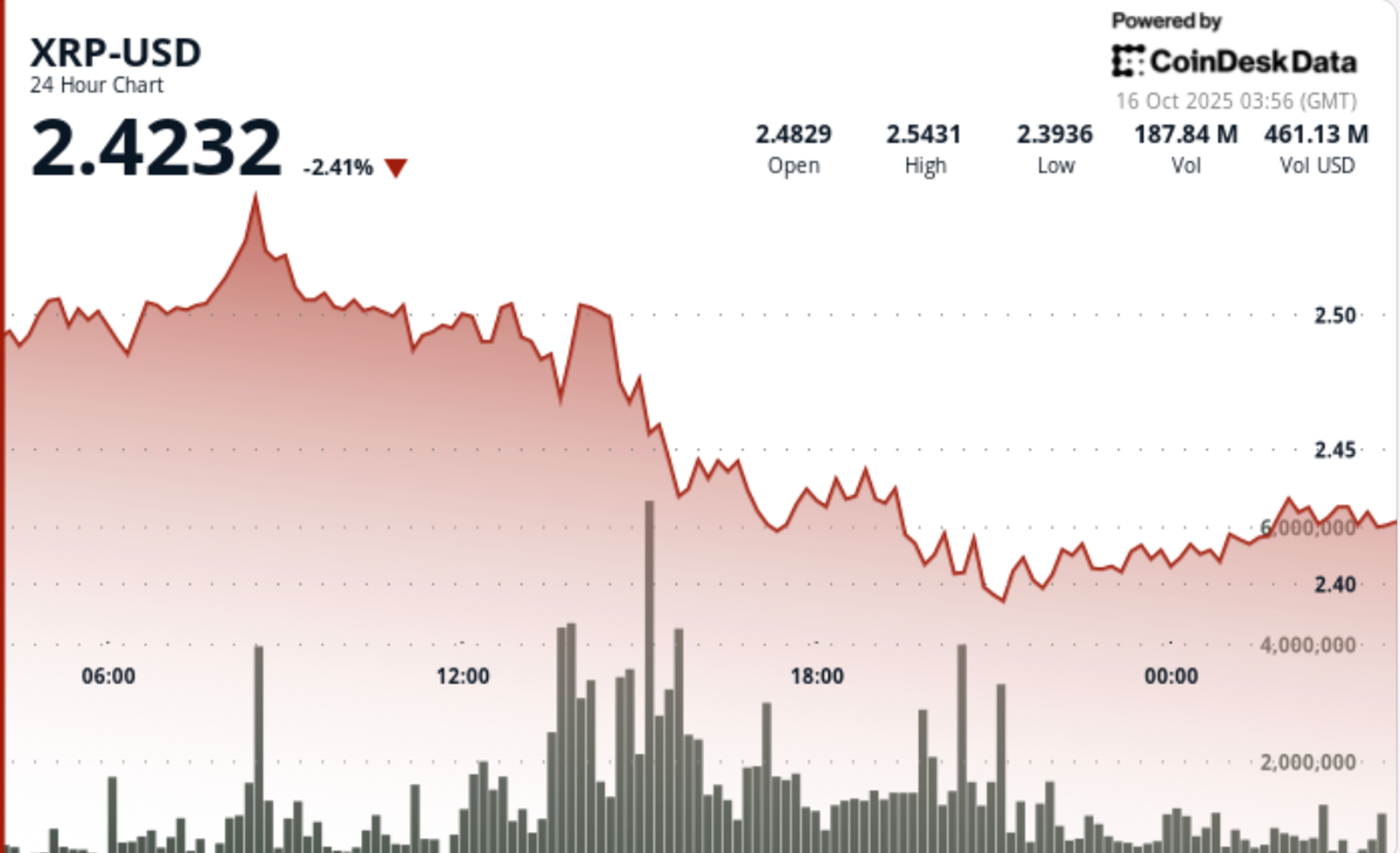

- XRP collapsed from $2.56 to $2.41 during the 24-hour window ending October 15 20:00, marking a 6% downside and a $0.15 trading range (6.3% intraday volatility).

- Intense selling pressure hit from 13:00-15:00 as volumes spiked from 119m to 154m.

- Support failed at $2.48-$2.50, triggering liquid cascades that pushed the price to $2.40.

- A brief recovery attempt at $2.44 around 19:27 was rejected; The price closed near the lows at $2.41.

- Late-hours volumes dipped near 4.5m, confirming capitulation before activity faded.

Technical Analysis

- The breakdown below $2.48 confirms the short-term trend reversal. Today’s support lies at $2.40-$2.42, with temporary resistance at $2.55-$2.56 and wider supply overhead at $2.65.

- Volume-weighted metrics point to institutional exodus rather than retail panic. If $2.40 holds, expect the range to chop until normalization; A clean pullback above $2.55 would allow for re-accumulation.

- Momentum oscillators remain oversold, but buyers have yet to step up to size. Funding rates on major derivatives platforms turned negative, reinforcing a bearish bias through midweek.

What entrepreneurs are watching

- Could $2.40 support withstand further selling from whales or funds?

- If the open interest rebuilds after a 50% fall – signal of stabilization or fresh shorts.

- Spot inflows versus Exchange Outflows to gauge whether accumulation will continue.

- Reaction near $2.65 resistance for any credible bounce confirmation.