Bitcoin’s Bitcoin’s nox Pain

Bitcoin (BTC) options contracts were set approximately $ 5 billion on Deribit this Friday at 08:00 UTC, adding to a volatile coding market.

Bitcoin’s lengthy unification of the DEIBIT (DVOT) fluctuations in a declining direction throughout 2025. However, after a sharp Bitcoin’s sharp decrease, DVOL rose to 52 before declining below 50 – sign a temporary increase in uncertainty in the market.

The last price decrease has left less than $ 90,000, the majority of options outside the money (OTM) and merchants who are facing significantly achieved losses.

The option allows the pregnant woman to the right, but not commitment, to buy or sell a basic asset at a specific price during a specific period of time.

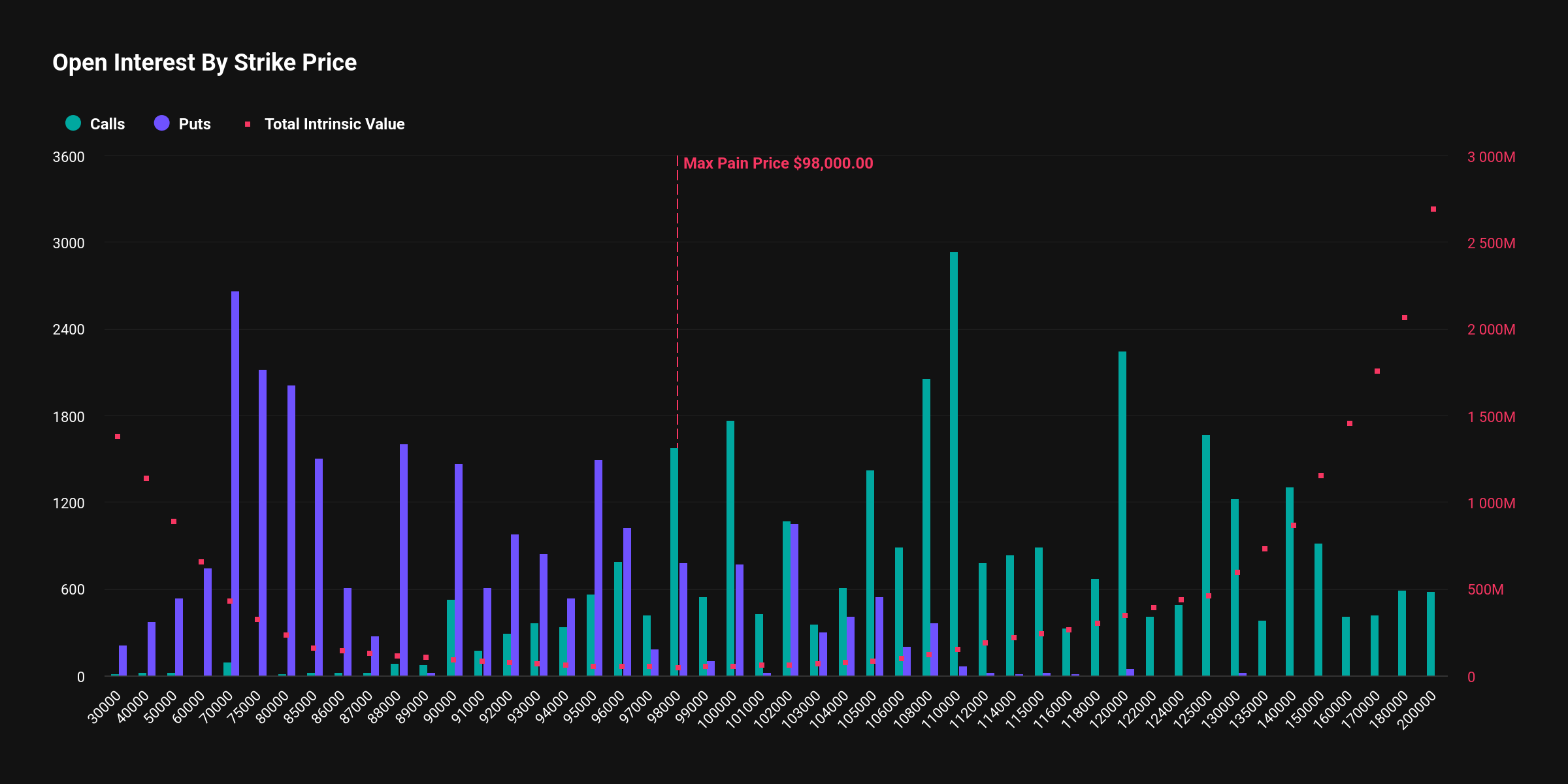

According to Deribit dataOf the 5 billion dollars of the default value that is scheduled to expire, 3.9 billion dollars (78 %) of this is due to the expiration of the validity of the money (OTM), which means that these contracts will expire.

Nearly 100 % of the calls are otm, which are upscale bets, as Bitcoin price has decreased dramatically over the past few days, leaving investors a large amount of unreasonable losses.

Whereas, the remaining amount was $ 1.1 billion (22 %), in money (ITM) where it was dominated. ITM puts the investors who have a hunger strike higher than the immediate price, which means that they hold value.

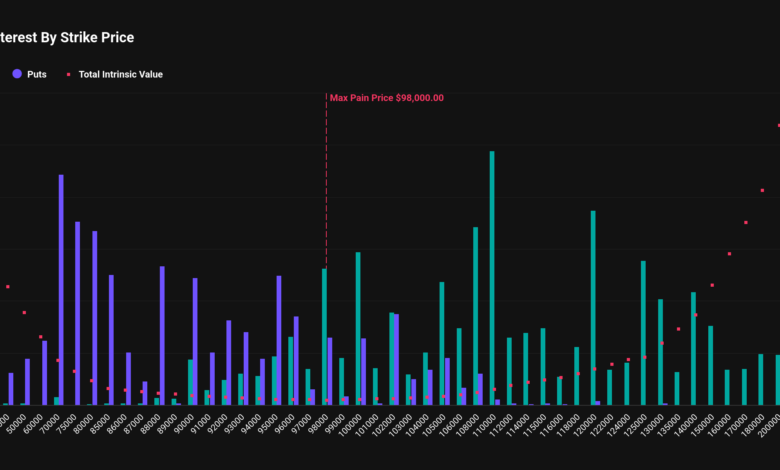

However, Max Pain is 98,000 dollars, or $ 10,000 is higher than the current instant price. Max Pain is the price in which options sellers achieve, and institutions usually make the maximum profit, while buyers suffer from the largest loss of losses.

Since the price of maximum pain is much higher than the instant price, this may motivate options sellers to pay bitcoin to the highest level of pain, according to PowerTrade.

“With the end of the month, merchants should solve Bitcoin options. Near this price.

Let’s see whether the alleged Max pain theory applies.

publish_date