Aptos’ apt has fallen by 4% while crypto markets retreat

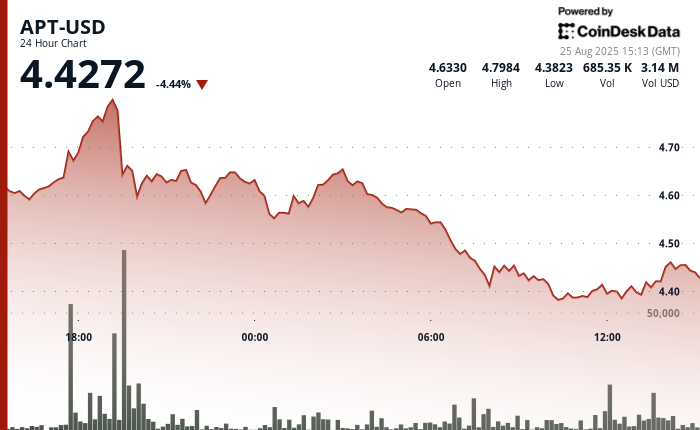

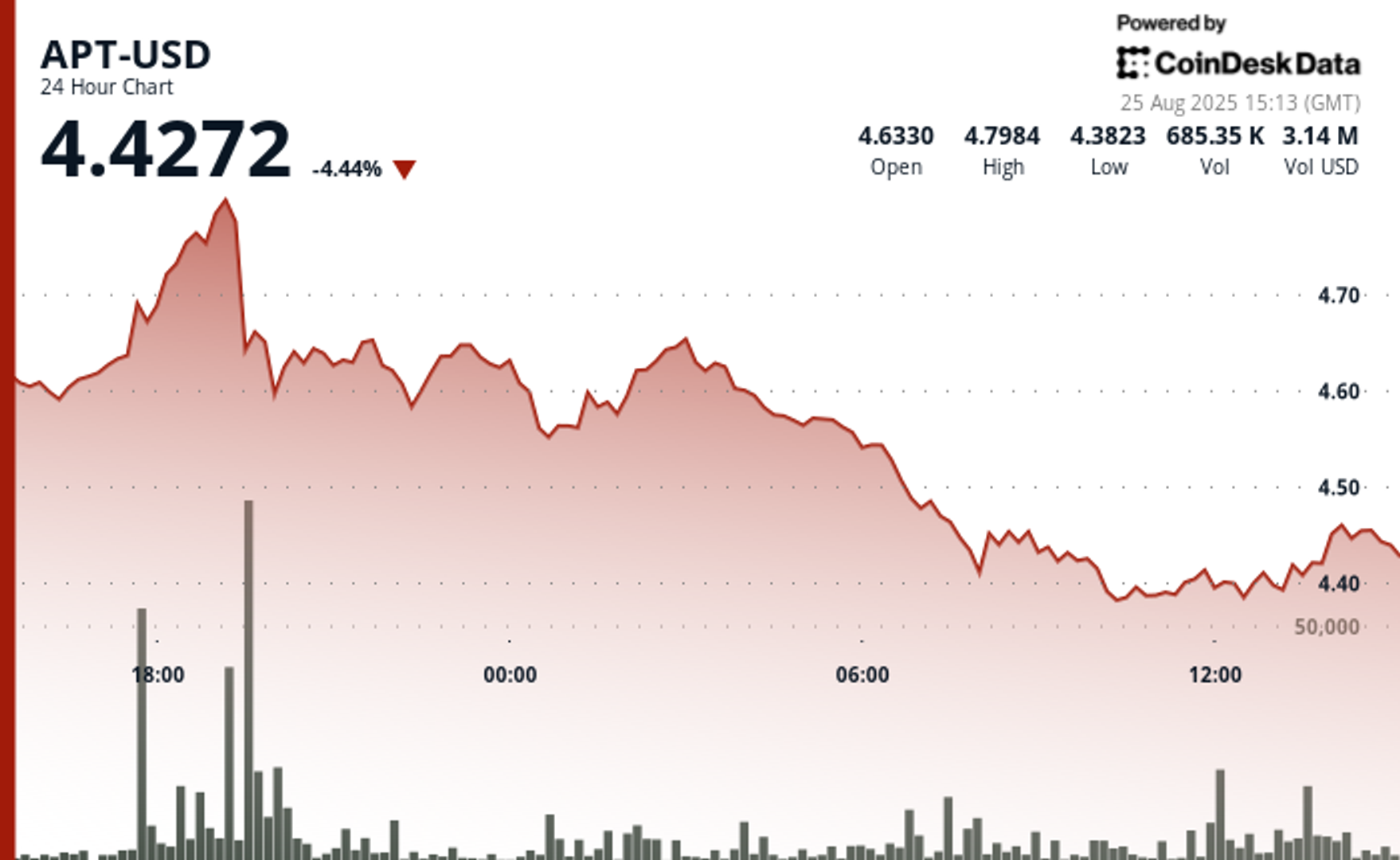

Aptos’ APT fell 4% over a 24 -hour trading period, changing within a 10% range, according to the CoinDesk Research’s technical review model.

The token made a session of $ 4.80 and a low $ 4.38, initially moved to $ 4.80 before refusing to $ 4.43 in the morning, then integrate -with around $ 4.45 with moderate indicators of recovery at the final trading time, the model showed.

Significant support supports around the $ 4.38- $ 4.41 price of the zone, where institutional purchase appeared, with the final time showing the recovery momentum towards $ 4.45, suggesting potential market stabilization following 9% decline from ravine to trunk, according to model.

Falling to the APT came as the broader crypto market also fell, along with the broader size of the market, CoinDesk 20, down 3.2%.

In recent trade, Aptos is 3.7% less than 24 hours, trading around $ 4.43.

In front of the news, Expo2025’s digital purse, reinforced by Aptos, has half a million new accounts and 4.4 million transactions, according to a recent -just Post on x. Meanwhile, defi lending protocol aave rEcently launched on Aptos. This has marked the first-ever expanding AAVE to a Hindi EVM (Ethereum Virtual Machine) Compatible blockchain.

Technical assessment:

- The extraordinary trading volume of 6.6 million within 19:00 hours supported the initial rally, followed by prolonged volume support around the $ 4.38- $ 4.41 price of the zone.

- Clearly upward channel formation with sequences of higher lows at $ 4.39, $ 4.42, and $ 4.45 levels at the recovery phase.

- Three unique rallies driven volume at the last breakout time above the $ 4.41 resistance level.

- Strong interest in the institution’s purchase appeared in the $ 4.38- $ 4.41 zone, which established basic support following 9% decline from the climax.

- The next level of psychological resistance was identified at $ 4.50 following a successful breakout above $ 4.41.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.