Stellar’s XLM token fell 6% as the institutional sale intensified

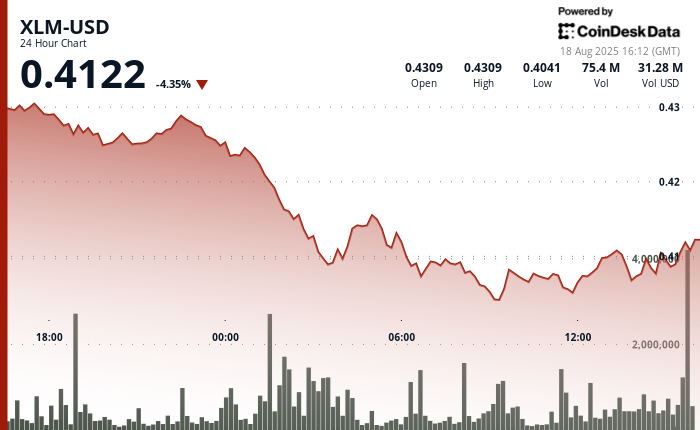

Stellar’s XLM token underwent heavy pressure sale of the institution between August 17 to 3:00 pm and August 18 and 2:00 pm, slipping from $ 0.43 to $ 0.41 to a 6% decline.

Trade volumes over a 24-hour period lead to $ 30 million, representing about 7% of daily shifts.

The most prominent extermination event occurred between 1:00 am and 3:00 am on August 18, when institutional sellers loaded more than 60 million tokens. This sale forced XLM from $ 0.42 to $ 0.41, creating a strong resistance to the level of $ 0.42 and determining the new support near $ 0.41.

Despite recovery attempts, the owner continued to fail to break the resist zone, which signed a continuous institutional bearness and left the XLM vulnerable to further fall.

The final trading time on August 18 added fresh pressure, as XLM registered a 1% collapse between 1:21 PM and 2:20 PM. The institutional sale was accelerated between 1:31 pm and 1:42 pm, with liquid corporates pushing prices from $ 0.41 to $ 0.41 to volumes of over 2.7 million units.

This fuzzy activity confirmed a resistance to $ 0.41 and set a short -term support floor at the same level. Multiple recovery attempts throughout the time have been addressed by the updated sale pressure, ending with a motion near around $ 0.41 with a small amount of volume in the last 20 minutes.

Lack of interest purchase features the possibility of additional weakness that sellers should recover momentum.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.